A few weeks ago I was in a meeting with several employees of a major payments player and the subject of smart speakers came up. Even among these people who are in the business and “should know better”, there was a noticeable air of skepticism around conversational commerce and interfaces like Siri and Alexa. One mentioned that he didn’t like the idea of having a smart speaker in his home. Another mentioned that it was “creepy.”

A recent article I read in Retail Wire on voice commerce reminded me of this conversation, and many others I’ve had, about the pros and cons of conversational interfaces.

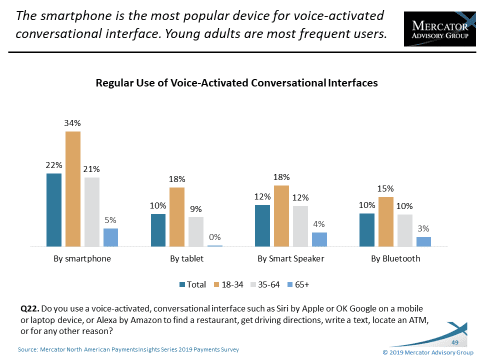

Let’s first get some of the numbers out of the way. As the chart from our U.S. PaymentsInsights survey below describes, the use of these interfaces currently stands at about one-fifth of the U.S. adult population via smartphones. That number is nearly halved when we ask about smart speakers.

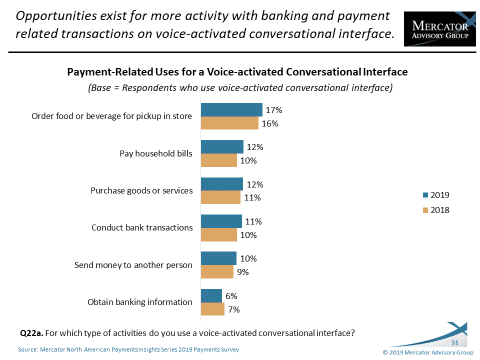

The next chart from the same study shows that even among regular users of conversational interfaces, using them to pay for things is quite low.

The article does a pretty good job of explaining some of the reasons for this low usage: trust and comfort in the technology, the desire for many to see what they are buying, and a “typical” technology adoption curve.

I’d like to add my own thoughts on some other issues that may be slowing the adoption of conversational commerce.

For a product to gain wide acceptance, it needs to solve a problem that other products have not. Is buying something using your voice significantly better than the current method you have for buying things? In other words, is conversational commerce the solution for a problem that needs solving? At this point in time, the data says that it probably isn’t in most Americans’ minds.

Give me a second to stand up on my soapbox for the next one.

There are so many “new” payment options available to consumers right now, Is this just another one? The POS payment has gone from a simple swipe to dip, tap, phone, watch, and more. There are P2P payments, in app purchases, ACH/e-check. Is it all too much for a consumer to process?

As the article points out, payment methods require a higher level of trust than, let’s say, a Bluetooth speaker – it involves people’s money. As an industry we’ve asked consumers to gain trust in all these new ways to pay. When does it get to be too much?

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group