Voice-powered devices like Amazon Echo and Google Home are quickly changing consumer behavior. Google says more than 20 percent of searches now happen by voice and estimates that figure will reach 50 percent by 2020. And it’s not just search that’s changing—we’re entering a new era of customer communication as voice impacts the customer experience from discovery through purchase.

Invoca recently surveyed more than 1,000 U.S. adults who own voice assistants and found 58 percent of respondents are using voice to accomplish tasks they once performed by typing or swiping. Sixty-four percent say they use their voice assistant more than when they first bought it, and for one-third of respondents, that’s more than five times per day.

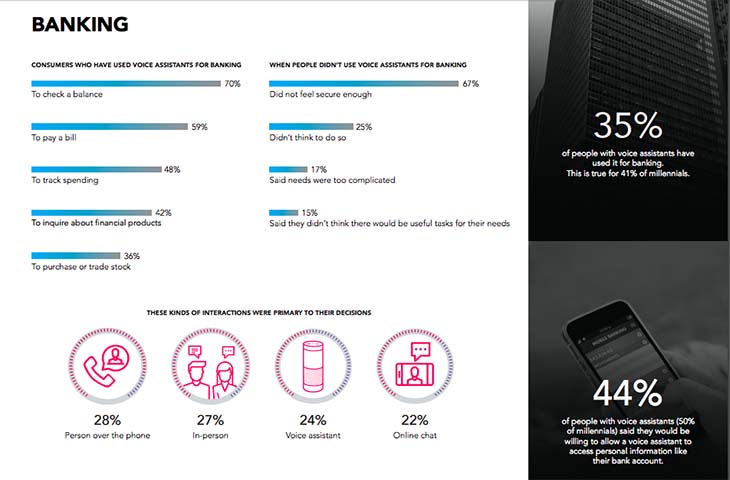

So, voice assistant use is on the rise—but will consumers trust voice-controlled AI to access sensitive financial information? Invoca’s survey found that for a significant number of consumers, the answer is yes: 35 percent of people have used their voice assistant for banking. Half of millennials, and 44 percent of respondents overall, said they would be willing to allow a voice assistant to access personal information associated with their bank account.

Financial institutions are investing in voice-centric solutions. A 2017 study by Accenture found that 76 percent of banks plan to improve customer experiences using AI, and voice will factor into this development. U.S. Bank has an Alexa Skill, launched last September, through which customers can check balances on their checking, savings or credit card accounts; hear payment due dates and the amount due; obtain account transaction history; and make payments to U.S. Bank credit cards. Bank of America has Erica, the voice assistant for its mobile app, which uses artificial intelligence, predictive analytics and cognitive messaging to help customers do things like make payments, check balances and track their savings.

According to a recent study from CapGemini, voice assistants from companies like Google, Amazon and Apple represent much more than a new marketing channel. The voice interface “…promises to be a curator of services and experiences that intelligently meet needs and engage consumers emotionally—anytime, anywhere.”

This emotional connection is key, and it’s worth underscoring that voice-controlled AI is not quite there. (Interestingly, 78 percent of people in Invoca’s survey said they’d use their voice assistant more often if it could better understand their tone of voice.) While voice assistants can automate any number of simple interactions, human conversations—namely, phone calls—will continue to dominate high-stakes customer interactions, such as taking out a mortgage or resolving a complex issue with an account.

Financial institutions are in the business of relationship-building, and conversations between people are central to building trust and loyalty. So while it’s smart for banks to invest in ways to connect with customers via voice assistants, they must be ready to pick up the conversation where voice assistants leave off. It would be wise to architect AI-powered voice systems, for now, to handle routine requests and transfer more complex or sensitive questions to live agents.

AI-enabled voice recognition is becoming a normal part of how we interact with technology. But these advancements don’t change the fact that people want to talk to each other. Voice, even as it evolves, remains at the center of how people communicate. My advice for financial institutions is two-fold:

- Don’t build a custom voice assistant or an Alexa Skill just to keep up with the latest in technology. Build it because you understand your customer and how voice can enhance your relationship with them.

- Think of voice beyond voice assistant interactions. Consider the other voice-centric ways consumers will connect with your brand—for instance, through phone conversations. What data can you glean from these conversations? AI-powered systems can automatically mine these conversations for insights that help marketers understand customer intent and craft better customer experiences.

The modern customer experience is no longer just about clicks and swipes on desktops on smartphones. The impact of this change for businesses, and particularly for marketers, is vast and yet to be fully realized. It’s time for financial institutions to get ready for this voice-first world.