This New York Times article indicates several economists have discovered direct links between the deployment of automation and the rising income inequality. The economists identify what they term “so-so” automation as the most damaging. So-so automation is defined as automation that displaces workers with little or no productivity gain. It offers self-checkout kiosks as an example.

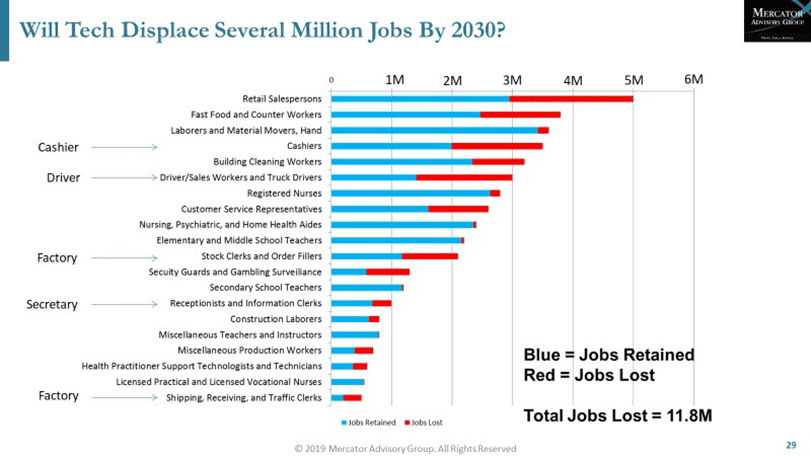

Interestingly, in 2019 Mercator delivered the following charts to several of our members. The first chart identifies our projections for the number of jobs most likely to be displaced by 2030 – and cashiers were close to the top of the list:

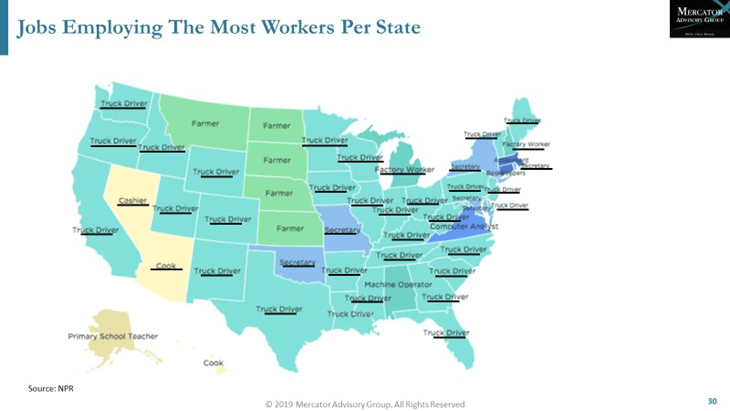

The second graphic matched several of the jobs identified as suffering losses to the states that have the greatest number of workers in those very same jobs:

High tech companies deploying AI have argued that AI will be used to augment existing workers, not displace them. But employees are not as reliable as a machine, so without some form of protection, those that can be displaced by automation likely will over time.

“Mr. Acemoglu is no enemy of technology. Its innovations, he notes, are needed to address society’s biggest challenges, like climate change, and to deliver economic growth and rising living standards. His wife, Asuman Ozdaglar, is the head of the electrical engineering and computer science department at M.I.T.

But as Mr. Acemoglu dug deeply into economic and demographic data, the displacement effects of technology became increasingly apparent. “They were greater than I assumed,” he said. “It’s made me less optimistic about the future.”

Mr. Acemoglu’s estimate that half or more of the increasing gap in wages in recent decades stemmed from technology was published last year with his frequent collaborator, Pascual Restrepo, an economist at Boston University. The conclusion was based on an analysis of demographic and business data that details the declining share of economic output that goes to workers as wages and the increased spending on machinery and software.

Mr. Acemoglu and Mr. Restrepo have published papers on the impact of robots and the adoption of “so-so technologies,” as well as the recent analysis of technology and inequality.

So-so technologies replace workers but do not yield big gains in productivity. As examples, Mr. Acemoglu cites self-checkout kiosks in grocery stores and automated customer service over the phone.

Today, he sees too much investment in such so-so technologies, which helps explain the sluggish productivity growth in the economy. By contrast, truly significant technologies create new jobs elsewhere, lifting employment and wages.”

Overview by Tim Sloane, VP, Payments Innovation at Mercator Advisory Group