How much can spending affect couples?

Valentine’s Day is just days away. Some will ring in the holiday single, others will enjoy multiple course feasts at a fancy restaurant, and a number will end the evening with a diamond ring—Valentine’s Day consistently ranks as one of the most popular days of the year to get engaged.

But not every couple is thriving. And for unhappy couples, the approach of Valentine’s Day can force them to answer some tough questions about the future. Breakups can stem from offenses as serious as cheating to things like toxic behaviors, unsupportiveness, or plain old lack of compatibility.

All in all, relationships are hard to navigate on their own. For many couples, things become even more complicated when another factor is added into the mix: money.

Nearly three in four young adults have been angry at their partner over a financial decision they made.

According to findings from a recent MagnifyMoney survey, a whopping 74% of partnered millennials and Gen Zers have been angry at their partner for a financial decision that they made. Out of 953 surveyed consumers ages 18 to 40 who were in a relationship, engaged, or married, 50% reported being mad at their partner for a financial decision once or twice; roughly a quarter reported being mad at their partner over finances multiple times.

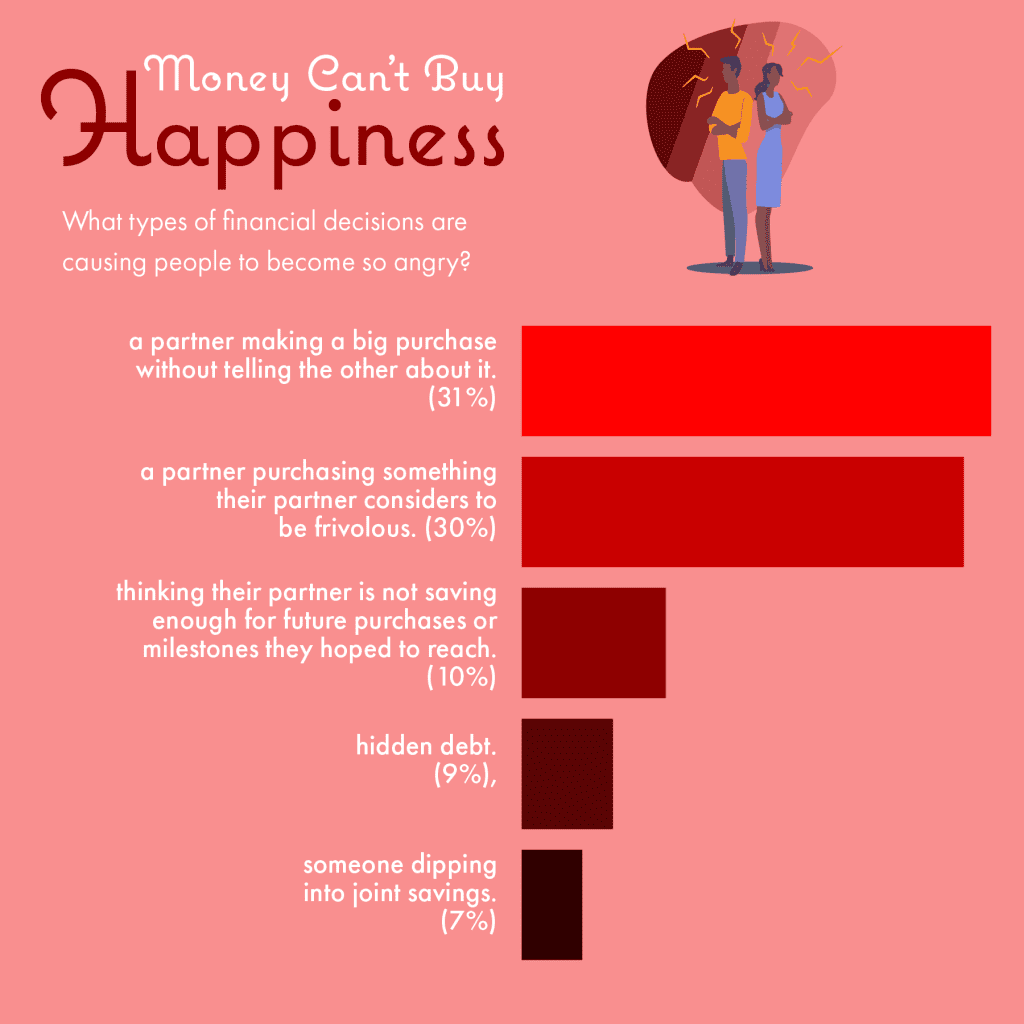

What types of financial decisions and spending are causing people to become so angry? The top two culprits are a partner making a big purchase without telling the other about it (31%) and a partner purchasing something their partner considers to be frivolous (30%). Other reasons couples are fuming are not thinking their partner is saving enough for future purchases or milestones they hoped to reach (10%), hidden debt (9%), and someone dipping into joint savings (7%).

Fortunately, most couples have talked about the amount of debt they have. This is especially true for married couples, 92% of which either know all about each other’s debt or know about it but haven’t delved into the specifics. 82% of couples living with each other fall into those two categories and 68% of those not living together do.

Income level makes a difference too. Respondents earning between $50,000 and $74,999 were the most likely of any income bracket to have been mad at their partner for a financial decision (84%).

So does gender. Seventy-eight percent of men surveyed reported that their partner has been angry at them for a financial decision, while only 58% of women said the same.

These are the biggest challenges couples face when it comes to finances and spending.

Why, exactly, are couples having problems with money and spending? For a lot of couples, the strife stems from being raised with completely different views on money. In fact, 30% of survey respondents listed different views on money as the hardest part of their relationship money-wise.

This is where arguments over frivolous spending can come into play. Someone who grew up in a household living paycheck to paycheck might not understand how their partner can invest a lot of money in something like a brand new gaming console.

Differences in pay came in second, with 19% of respondents saying that the hardest part of the relationship money-wise stems from the fact that one person in the couple earns significantly more than the other. Unsurprisingly, the higher earners were typically men; 63% of millennial and Gen Z men in relationships reported making more money than their partner.

These differences aren’t always well-received. Over half (51%) of people in relationships or marriages where one person makes more than the other said that there has been tension because of it. This is particularly true when one partner makes significantly more than the other and in those earning $100,000 or more.

Here’s what young couples are saving for.

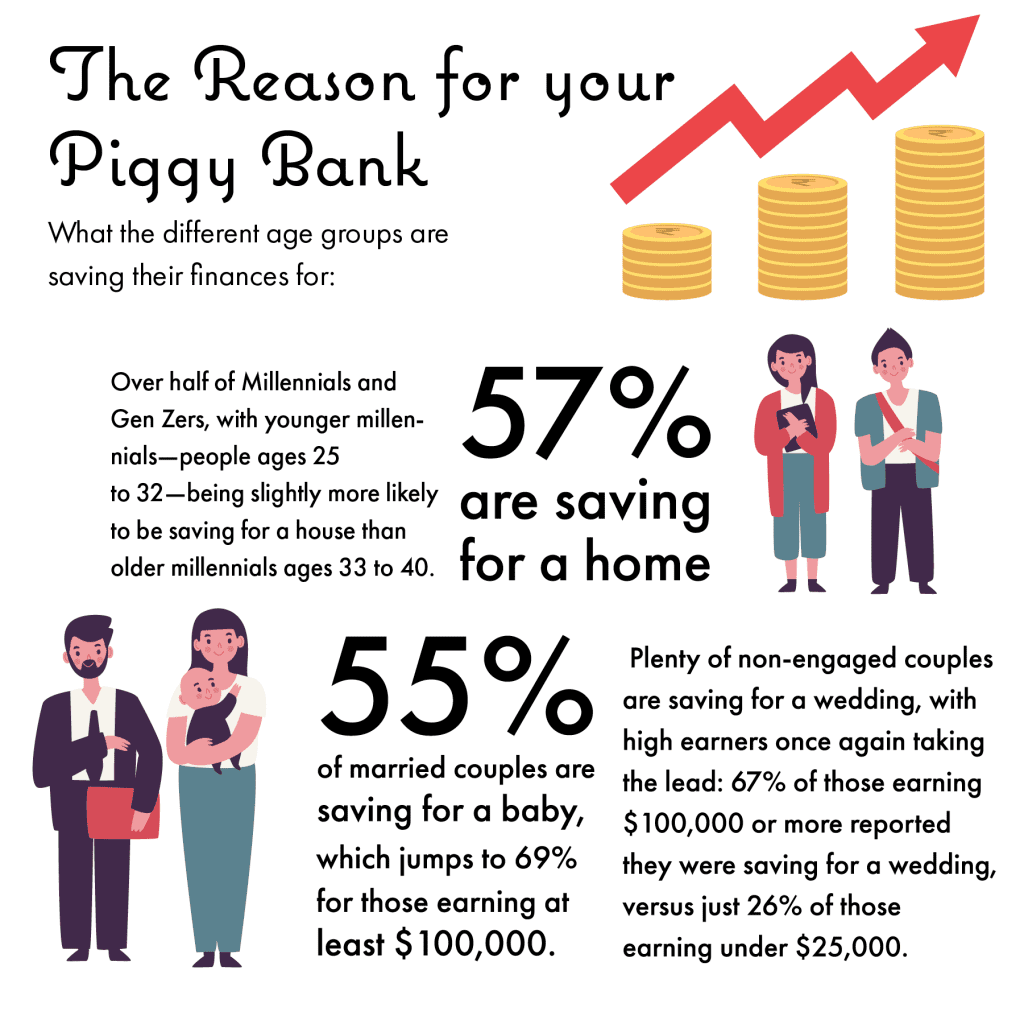

Millennials and Gen Zers are investing in their futures. Over half (57%) are saving for a home, with younger millennials—people ages 25 to 32—being slightly more likely to be saving for a house than older millennials ages 33 to 40.

Fifty-five percent of married couples are saving for a baby, which jumps to 69% for those earning at least $100,000. Plenty of non-engaged couples are saving for a wedding, with high earners once again taking the lead: 67% of those earning $100,000 or more reported they were saving for a wedding, versus just 26% of those earning under $25,000.

The takeaway

MagnifyMoney’s findings echo the sentiments of many others in years past: finances can add significant stress to a relationship. For example, a survey of 2,000 adults in relationships conducted by the insurance site Policygenius found that couples are 10 times more likely to break up if one believes their partner is bad with their finances—a belief that one in five people hold. Meanwhile, Oxygen Banking found that nearly a quarter (22%) of 1,000 surveyed Americans said they would break up with a partner if they didn’t use mobile banking.

Just because money is a point of contention in your relationship doesn’t mean all hope is lost. There are multiple steps couples can take to stop arguing about money, such as having a conversation about sticking to a budget, agreeing on larger purchases before they’re made, and getting on the same page when it comes to future goals and savings.

Lastly, for those hiding things like debt or a bad credit score from their significant other, it may be time to fess up and make a game plan. Romantic relationships are built upon trust, which makes transparency surrounding spending and debt important to sustain a healthy, happy love.