I suppose this is a sign of the times. As unemployment benefits have ramped up, both at the federal and state level, fraud has also climbed.

As mentioned in an article from PaymentsSource, the Office of the Inspector General estimated in June that $26 billion in federal supplemental unemployment insurance spent this year will be lost to fraud. That’s just at the federal level; it doesn’t include the billions in unemployment insurance spent by the states.

With all the technology at the payments industry’s fingertips, and the frighteningly large losses, I would think this would be an area deserving review. Not only is this a loss of tax payer funds, those anticipating benefits are sometimes not receiving them:

The claims being filed by fraudsters run the gamut of impersonating real out-of-work consumers, real people actually still employed and synthetic identities created by fraudsters that mix aspects of real, personal identifiable information (PII) with fraudulent data. One key aspect that is making the insurance fraud so costly is the ease and speed with which criminals are able to monetize the theft, through the use of prepaid cards.

Visa reported that it is working with state unemployment agencies to spot potential fraud through spending patterns. However, that may not be enough as the opportunity is too lucrative to keep fraudsters and other “bad actors” out of the game with so many millions of unemployed Americans filing claims.

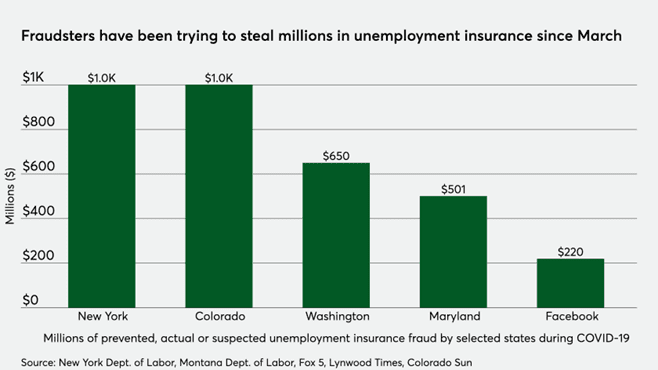

Check out this graph of just a few states and their unemployment fraud losses:

One ruse scammers favor is phishing emails that offer to help potential victims speed up the process of collecting unemployment insurance. All that is needed is for a victim to hand over his or her PII data. As millions of Americans already live paycheck to paycheck and losing a job can be disastrous, the offer of help could appear to be a miracle. Unfortunately, for many, it often leads to fraudsters filing legitimate claims on behalf of someone and then stealing their money.

Tia Ilori, senior director of Fraud and Breach Investigations at Visa, offered up some suggestions to curtail these run-away losses:

Ilori noted that some best practices agencies could follow include limiting how many unemployment accounts can be loaded onto a single card. Other practices include setting limits on weekly spend velocity and maximum transaction size.

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group