JP Morgan has been offering real-time payment processing opportunities to its customers in the U.S. for over a year. Computer Business Review had this quote regarding the volume of JP Morgan’s real-time business thus far in the U.S.:

“Since we launched Real-time Payments in the US about a year ago, we are approaching one million transactions per month,” Art Brieske, Head of Faster Payments for J.P. Morgan Treasury Services said.

They announced today the launch of SEPA Instant payments in the EU:

Investment bank J.P. Morgan has become the latest financial services institution to join Europe’s SEPA (Single Europe Payments Area) instant payments scheme; a completely new payments rail on a pan-European level first launched in 2017.

The move makes J.P. Morgan the first bank to offer instant payment capabilities in USD, GBP and EUR. Users can transfer up to €15,000, which will arrive in a beneficiary’s account within a maximum of 10 seconds; typically much faster.

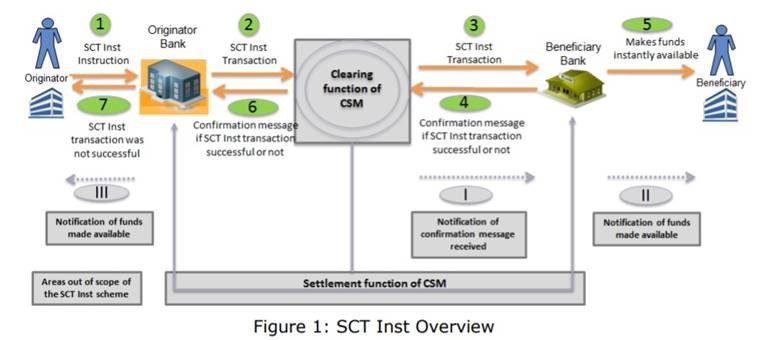

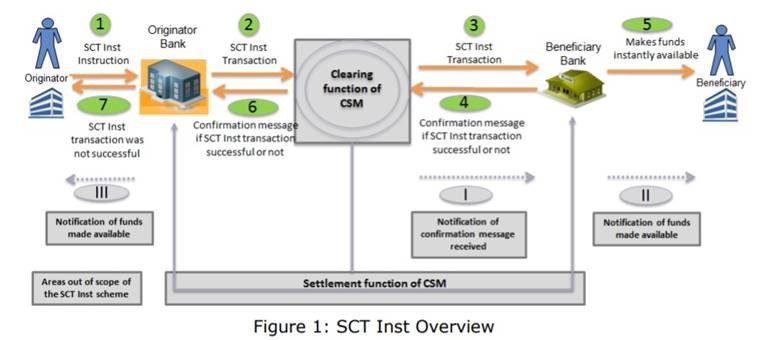

SEPA Instant is a set of rules and requirements, (not a platform) for conducting real-time payments across the EU. Like most real-time payments systems, these transactions are credit push only. At this fairly early stage of SEP Instant’s development, transactions are currently limited to 15,000 €. The following provides a transaction overview of process and functionality:

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group