Like everything else in the payments world, merchant services is a very confusing space. There are so many different types of companies that purport to play in this space, which provide many different options for businesses both large and small.

J.D. Power just released the results from its Merchant Services Satisfaction study. Its results show that big banks are the leaders in satisfaction among small businesses. A review of its results also shows that the specialists, like Square and PayPal, do well in the merchant services arena. As it points out, there is no surprise in these results.

“Traditional banks have a natural advantage in providing merchant services to small businesses by virtue of their existing relationships with business owners,” said Paul McAdam, senior director of banking intelligence at J.D. Power.

“Similarly, payment specialists such as PayPal and Square have built strong brands and satisfaction by providing small businesses with easy, reliable ways to accept a variety of card and digital payment options. They provide the technology and security a small business requires, along with fee structures that are easily understood.”

In digging into these results in a little more detail, it should come to no surprise that the big processors score somewhat lower with smaller businesses. They position themselves for the nuances scale players and are better suited for larger merchants.

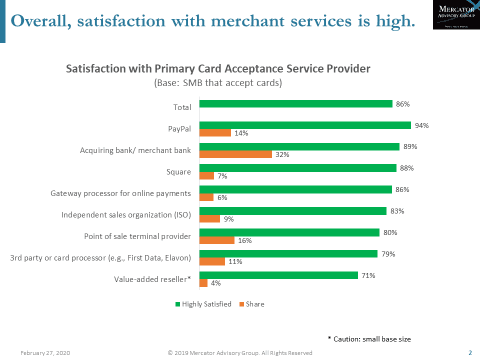

I took a look at our Small Business PaymentsInsights results to see how they aligned with the J.D. Power results. While there are differences in the methodologies and the questions asked, if we compare this graph to the J.D. Power results, I think it is safe to say that the overall findings complement each other.

At the end of the day, the big takeaway for me is that small businesses are, for the most part, very happy with their merchant services providers. Given all the things that small businesses have to worry about, it’s nice to know that merchant services isn’t one of them. They seem to be in good hands, regardless of who they have providing merchant services.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group