Myanmar, once known as Burma, has a 50 million population wedged in between India, China, and Thailand. Unlike its surrounding neighbors, the country is essentially unbanked, with 74% of citizens lacking an account at financial institutions, and only 5% holding debit cards. And, if you think those numbers are unusual, consider the fact that less than 1% of citizens hold a credit card. Though unemployment is only 4%, one out of four people live below the poverty line.

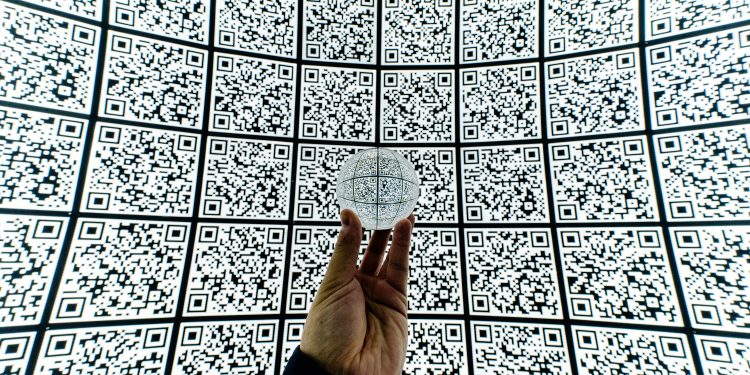

Almost everyone in the country owns a cell phone, with 87% penetration. The mobile device is what will be used to bring the country onboard to electronic payments, and they will do it with QR codes.

This is surely a case study for financial inclusion and increasing electronic payments

The Central Bank of Myanmar reports that the manual reconciliations required to clear debits and credits are burdensome, the long term vision is for an automated clearing system, which will be an add on to the 2011-updated EFT system.

Consumer payments are now a priority and the country plans to use what has become a common business strategy by linking high cell phone penetration with low banking availability with QR codes.

Singapore Business Review announced today that Nets Group, a Nordic tech firm will help the country integrate QR payment acceptance standards similar to those endorsed by the Monetary Authority of Singapore.

- The first project under the programme will see NETS sharing its technical and operational knowledge around the Singapore Quick Response (SGQR) Central Repository platform with MPU, to implement a similar platform in Myanmar.

- Launched in September 2018 by the Monetary Authority of Singapore and the Infocomm Media Development Authority, the SGQR is said to be the world’s first unified payment system for QR codes that combines multiple QR payment codes such as PayNow and NETS QR into a single QR code. With the consolidation of QR codes, merchants only need to display a single SGQR label instead of having multiple QR codes, cutting clutter on the storefront and enabling quicker payments processing.

- Myanmar’s digital payment has gradually developed with the explosive growth of mobile and internet penetration that had a major impact on its financial services sector, according to Zaw Lin Htut, CEO of MPU.

The beauty of QR codes is that they allow consumers to transact cellphone-to-cellphone, no payments terminal required. Instead of data or internet lines required for the standard payment card acceptance device, a consumer can simply engage their phone to the merchant’s device, and once linked, the typical payment card acceptance, authentication, and approval tools engage.

…Welcome to the world of credit and debit.

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group