Podcast: Play in new window | Download

The impact of the coronavirus disease (COVID-19) global pandemic is forcing businesses to modify their behaviors and look for innovative ways to streamline and automate processes that often require a physical presence. For example, many businesses still process invoices and payments manually through checks, wire, and ACH, but since most of the country’s workforce is now working remotely, no one is in offices to manage them.

Beyond that, the complete lack of clarity with respect to the duration of the global business shutdown has caused many businesses to explore alternative sources of working capital to build up cash reserves. For these reasons, the time is right for businesses to transition to commercial card payments and acceptance.

To speak in more detail about how businesses can benefit by digitizing and shifting to commercial card acceptance, PaymentsJournal sat down with Dean M. Leavitt, Founder & CEO of Boost Payment Solutions, Inc., and Steve Murphy, Director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group.

COVID-19 Highlights the Need for Digitized Processes

Businesses have been forced to change their organizations to accommodate a virtual workforce, which has highlighted problems in outdated accounts receivable processes. According to Leavitt, Boost has been inundated with a strong spike in interest from its existing and prospective customers looking to digitize their payments.

This makes sense. After all, the simple logistics of companies not being able to go into the office to write and mail checks or receive mail and deposit incoming checks, has created “a bit of a nightmare.” “For companies that have not digitized their payments—and there are a lot of companies that are not fully or at all optimized—it’s a big wake up call for them to realize they need to be able to both send and receive checks in the digital environment,” noted Leavitt.

As a solution, businesses can transition their accounts payable spend from check, wire, and ACH to a commercial card product to enable a completely automated process.

Commercial Cards Aid Working Capital for Businesses

Beyond eliminating the need for a physical presence to initiate payments, the use of commercial card products over check, wire, and ACH gives buyers and suppliers the opportunity to have greater and faster access to cash on hand.

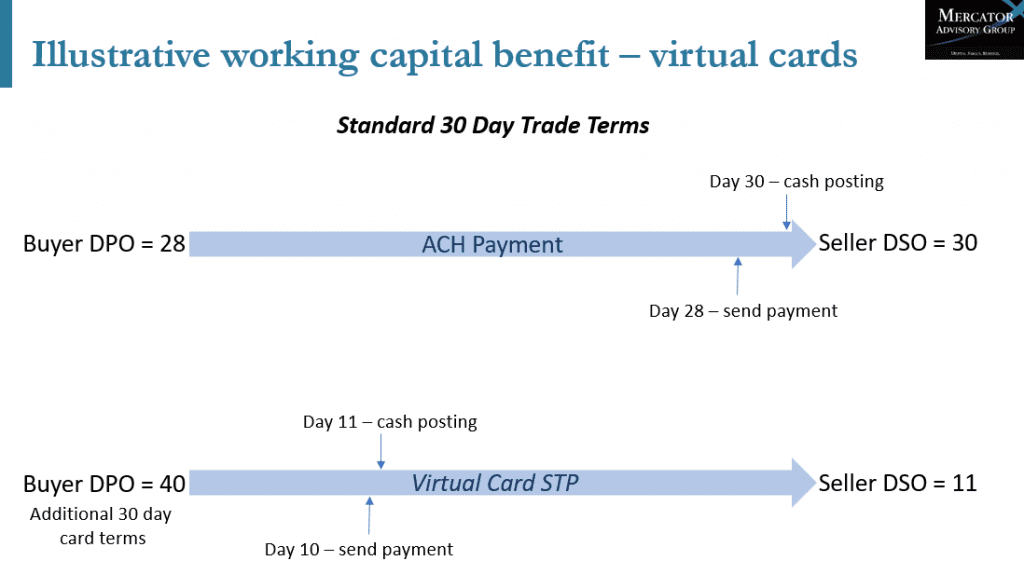

The chart below explores the dual benefit of using the payables process to aid working capital. As Illustrated, switching from an ACH to virtual commercial card payment increases buyer days payables outstanding (DPO) while simultaneously decreasing seller days sales outstanding (DSO):

Some businesses already have a need for increased working capital due to COVD-19, while others are worried about future cash flow as uncertainty regarding the COVID-19 timeline lingers. Credit card products extend DPO, offering buyers working capital benefits and ensuring that their suppliers are being paid in short order.

A typical ACH payment takes two days to process and end up in the seller’s bank account. On the other hand, “straight through processing using a virtual commercial card allows the seller to receive that payment in their bank account without having to do any processing,” explained Murphy. Further, businesses with efficient processes in place will be able to post the payment to their general ledger the next day.

In the scenario presented in the chart, the buyer uses a virtual card to make the payment on day 10. Because of the card credit period of 30 days, an additional 10 days is added to the DPO, giving the buyer an expanded 40 net days. Meanwhile, the seller’s DSO drops from 30 to 11 days, providing them with better cash flow management.

Certain segments, like healthcare, have a greater need to address a lack of capital or concern about upcoming lack of capital directly caused by COVID-19. “This could be particularly important in healthcare institutions and hospitals that are capped out on their traditional lines of credit yet underutilized on cards, which could help them avoid breaching debt or bond covenants,” said Leavitt.

Businesses that Digitize During COVID-19 are Unlikely to Revert to Old Processes

A key reason some businesses have yet to digitize their financial cash processes is inertia; they haven’t come up with a good enough reason to make the change. But COVID-19 is shining a light on the issues surrounding manual processing, revealing that digitization must be done quickly to keep moving forward in the modern world.

While the global pandemic may serve as the catalyst for businesses to make the change, this inertia will pick up quickly once these better processes are established. In Leavitt’s words, “once businesses realize that the manual, non-digital process of making and receiving payments does not work in crisis environments, they will quickly learn how much more efficient and easier it is for staff to make, receive, and process payments digitally.” In other words, don’t expect to see many businesses reverting back to the old ways on the other side of the COVID-19 pandemic.

Establishing Card Acceptance Capabilities Isn’t as Time Consuming—or Costly—As Many Think

Historically, there has been a widespread misconception that getting up to speed with credit card processing capabilities is a time-consuming hassle, but that’s not the case. Boost’s platform is able to get suppliers up and running, transaction-ready, and receiving payments and remittance reports, within a day or two. In emergent situations, it can be up in a matter of just hours.

Another common misconception is that payment methods like check, wire, and ACH minimize costs, and that commercial card acceptance is comparatively very expensive. In reality, there are many cases where costs can be migrated from things like early pay discounts to enable card acceptance, ultimately resulting in businesses saving money—while processing payments just as quickly.

There are other perks of card acceptance, too, including data exchange benefits not present in check, wire, or ACH scenarios. When transactions are up and running, it eliminates the need for businesses to dedicate any meaningful amount of human resources to the process. Further, virtual cards are considered an extremely safe payments vehicle that are nearly 100% chargeback-proof.

The Takeaway

The COVID-19 pandemic has highlighted inefficiencies and problems caused by manual payments processes. At the same time, it has presented an opportunity for business to digitize by establishing card acceptance capabilities that will streamline these processes and aid working capital.

While there are many misconceptions about establishing card acceptance capabilities as time-consuming and costly, the reality is that it reduces costs for businesses in a number of ways. Now is the time to take the plunge.

It’s important to note that the above analysis is based on the assumption that buyers can secure credit for their card program from their issuing bank. But even is credit is not available, whether on a temporary or permanent basis, many benefits can be derived from the use of a prepaid card product.