With many developing use cases and businesses increasingly demanding access to real-time payments, financial institutions risk losing loyal customers if they do not offer real-time payments as soon as possible. This sentiment is reflected in the rapid adoption and connectivity to The Clearing House’s (TCH) RTP® network and interest in the Federal Reserve’s upcoming FedNowTM Service.

However, when it comes to the when and how of real-time payments implementation, there is no standard template or approach. Each financial institution must consider several factors, including their organizational strategy and customer base, when developing an implementation plan.

To offer insight into recent developments in the real-time payments market and what a successful real-time payments implementation strategy looks like, PaymentsJournal recently hosted a webinar panel discussion titled “Real Time Payments: A Practical Guide to Implementation.”

The panel consisted of expert speakers Steve Murphy, Director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group; Keith Gray, VP of RTP Strategic Partnerships at The Clearing House; Carrie Blankenship, Director of Product Management, Instant and Emerging Payments at Fiserv; and Chaula Pandya, SVP and CTO at Community Bank of the Bay.

The U.S. real-time payments market

Real-time, near real-time, and faster payments have been gaining traction in the United States in recent years. Faster payment examples include debit networks’ push payments, which have real-time clearing and next day settlement, as well as Same Day ACH. An example of near real-time payments is Early Warning’s Zelle. While Zelle does have the option for real-time clearing through The Clearing House’s RTP® network, the majority of settlement today is delayed and completed via debit card rails or ACH.

The two main real-time payment rails in the U.S. are The Clearing House RTP® network, which launched in 2017, and the Federal Reserve’s anticipated FedNowTM Service , which is slated to go live in 2023. “Both of these rails are real-time clearing and settlement systems, meaning that within seconds, payments can be sent and received with finality, and the systems are always on 24 hours a day, 365 days a year,” explained Murphy.

Real-time payments deliver real value to banks

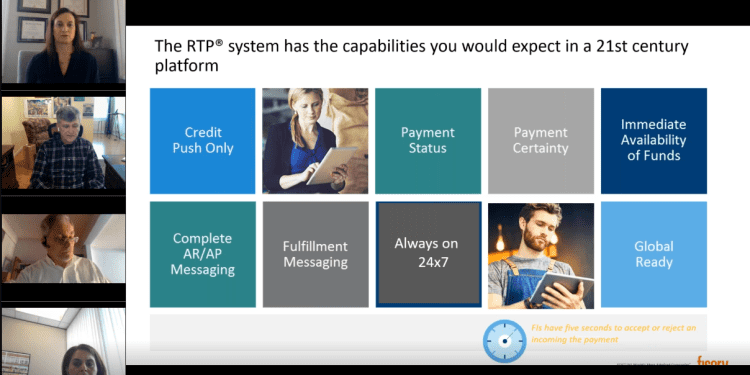

According to Gray, the promise of the RTP® network from the beginning has not only been to make payments faster, but also to make them smarter and safer. “A lot of the capabilities of the RTP® network are not only around the immediate part of it, but also those enhanced capabilities that have to do with smarter and safer payments,” he said.

One of the main differentiators of the network is that it is a push-payment model. This means that the sender needs to push money into the recipient’s account, rather than the recipient being able to pull money out of the sender’s account. This creates complete visibility on both sides of the payment transaction. “The payment is certain and those funds are available immediately. Those capabilities—the immediacy, the certainty, the immediate clearing and settlement—are what I call the base level components of the network,” said Gray.

Enhanced RTP network capabilities include use cases such as account to account (A2A) transfers, loan funding, gig economy, B2B payments, payroll, merchant funding, title companies, wallets, insurance claims, and cash concentration. Additional use cases and applications are added regularly, exemplifying why financial institutions are keen to connect to the RTP network.

“We add banks and credit unions every week onto the network. That number is actually accelerating as we move forward. Companies like Fiserv have different programs and products in place that really make it easy to have them join the RTP network, especially on the receiving side… We’ve really done what we can from a network standpoint to make onboarding onto the RTP network a very straightforward process,” explained Gray.

The importance of implementing real-time payments

Financial institutions of all sizes need to make real-time payments a priority. “The mission that we have at Fiserv is that we enable banks and credit unions to be able to deliver instant payments across their enterprise for all use cases and all networks,” said Carrie Blankenship.

Of course, each financial institution has its own unique set of customers and needs. Recognizing this, Fiserv offers more than one way for financial institutions to incorporate real time payments into their product offerings. For starters, its Enterprise Payments Platform is a full scale and traditional payments hub that delivers high performance, real-time payments processing multiple payment rails, including RTP. For organizations that do not have a strategic intent of deploying a full-fledged payments hub, Fiserv Payments Exchange offers a direct gateway to the RTP® network with faster and more affordable onboarding. Payments Exchange will also connect to the FedNow Service when ready. “Our advice to financial institutions is to start with Receive now on RTP®, familiarize internal resources with solution while volumes are low and get ready for future phases”, said Blankenship.

The California-based Community Bank of the Bay learned the importance of real-time payment capabilities firsthand during the pandemic. “During the COVID-19 pandemic, U.S. banks offered the SBA Paycheck Protection Program [PPP] to businesses in our community, and banks could have used after hours and over the weekend loan funding options. But we were not part of The Clearing House, and we had not joined the RTP network at the time,” said Pandya.

This translated to the bank being unable to fund PPP loans outside of traditional wire transfer hours. “We also learned another lesson during the PPP era, and that was when the state of California decided to fund grants to small businesses. We did not have partnerships with the right fintech company, and what that did is [prevent] our clients from receiving their grants to their accounts here at Community Bank of the Bay,” she added.

This lack of functionality meant that customers had to go through their accounts at other banks that had already chosen the right fintech partners. The takeaway? “It is important to stay on top of what fintechs are innovating, and financial institutions partnering with the right technology partner to stay compatible with product offerings is going to become the standard. Integration with fintechs is totally unavoidable for banks,” concluded Pandya.

To learn more about how banks and credit unions can implement real-time payments functionality, please fill out the form below to access the complimentary PaymentsJournal webinar, “Real Time Payments: A Practical Guide to Implementation.”