Podcast: Play in new window | Download

Payment modernization was once a nice-to-have feature for corporate banks that wanted to set themselves apart. That’s no longer the case. Rather, it is absolutely crucial for corporate banks to shift away from legacy banking systems in favor of digitization.

To learn more about why digitalization in corporate banking is a necessity, PaymentsJournal sat down with John Farrell, SVP of Global Product Management at Volante Technologies, and Steve Murphy, Director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group.

The Factors Driving Corporate Banking Modernization

There are multiple factors contributing to the modernization push in corporate banking.

First is record-low net interest margins. “Last time we saw anything near 4% across all asset classes was back in 2010, and we don’t see this trend changing much anytime soon,” said Murphy. This places added pressure on non-lending bank businesses to increase their contributions while also creating institutional pressure to improve efficiency ratios to expand margins.

There’s also the rise of non-bank competitors that have their sights set on business banking expansion using modern experiences. “A lot of banks actually still struggle with the legacy environments, [which] is not only more expensive to maintain, but not flexible enough to adapt quickly to new products and servicing needs,” Murphy added.

The third factor is the palpable shift in customer demand to move toward more integrated and end-to-end digital corporate banking experiences and away from traditional siloed transactions services.

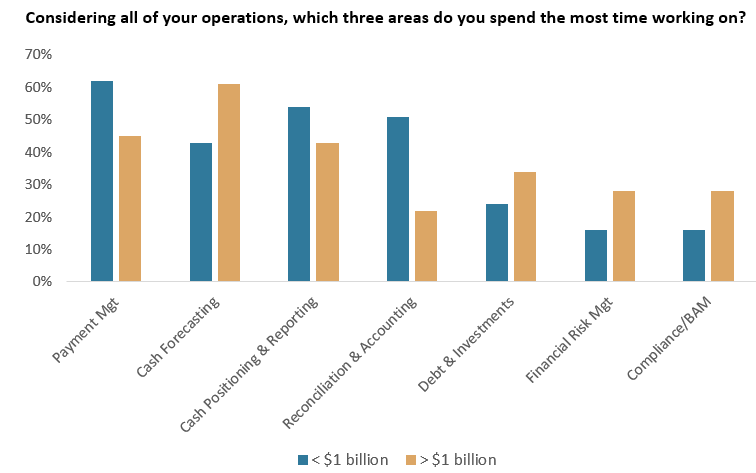

The chart below, provided by Mercator Advisory Group, displays the results of a treasury survey of companies below and above $1 billion in revenue.” You can see payments management is a very big concern. You can see cash forecasting is a very big concern… and to some extent, reconciliation and accounting,” said Murphy.

When payments infrastructure is digitized, payments management, cash forecasting and other payments operations improve. “As you improve the payments management and further digitize your infrastructure, you start to get more data, and you start to get that data faster, even in real time. That improves your cash forecasting, and that includes your ability to move funds around and make liquidity decisions,” explained Murphy.

In other words, the solutions to the problems seen in the chart lie in payments modernization.

To Meet Business Needs, Legacy Banking Systems Need an Upgrade

While some corporate banks dove head first into digitization efforts, others are falling behind. “Some of these new market entrants are really kind of taking the market by storm with their capabilities and their new platforms and their fully digital approach to financial services,” said Farrell. “That’s what is happening around payments, but [it’s] not happening when it comes to corporate payments.”

Using legacy systems, treasurers choosing a bank are often forced to become experts in payments to understand how to navigate dated drop-down menus and multiple options. “In a digital world, [they] should only have to make one or two decisions: I want it there fast or I want it there cheap,” Farrell added. However, without payments modernization, that is not what’s occurring.

The prioritization of real-time payments should not be forgotten when thinking about upgrades. “One of the things that I’ve seen that’s been successful is taking a problem and not just trying to make it more efficient, but starting from the principle of [whether] we [can] solve this in real time,” explained Farrell. “I feel really strong [that] with this amount of data … it can be real time or near real time.”

It’s easy to say that banks should replace legacy systems, but what should that actually look like? The good news is that it doesn’t have to be a massive overhaul of the entire legacy system all at once. Instead, organizations can take the practical first step of integrating a payment rail that enables future expansion into digitization.

“One of the good things that is happening… are all these new payment rails that are coming on board,” said Farrell. “Bringing on board that one new rail is a great way to start the process.”

Corporate banks upgrading legacy infrastructure should also use their ability to leverage rich data to automate and streamline payments. “That should be the goal. You’ve got to design your processes around that, not design your processes around how you do [things] today,” he added.

Embracing Real Change Is Key to Successful Payments Modernization

Another thing to keep in mind when it comes to modernizing corporate banking is to avoid rebuilding what is already in place. “Be very cognizant of… not rebuilding what [you] have today just so [you] can say it’s not on a mainframe,” advised Farrell.

Without authentic commitment to real change, businesses risk losing out on the maximum benefit of upgrading legacy infrastructure.

“That’s probably the number one thing that extends or causes a project to go sideways. You’ve got to be working from a principle of… embracing change, [and leveraging] new technology to affect that change,” he concluded.