As the economic impact of the COVID-19 pandemic continues to grow, PSCU, the nation’s premier payments credit union service organization, updated its weekly transaction analysis from its Owner credit union members on a same-store basis to identify the impact of COVID-19 on consumer spending and shopping trends.

To provide relevant updates on market performance, experts from PSCU’s Advisors Plus and Data & Analytics teams today released year-over-year weekly performance data trends. In this week’s installment, PSCU compares the 16th week of the year (the week ending April 19, 2020 compared to the week ending April 21, 2019).

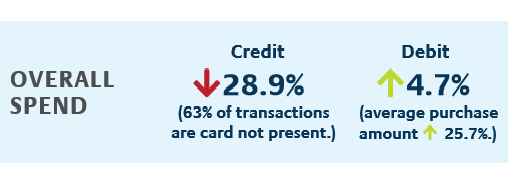

- Overall credit card spend was down 28.9% and overall debit card spend was up 4.7% year over year.

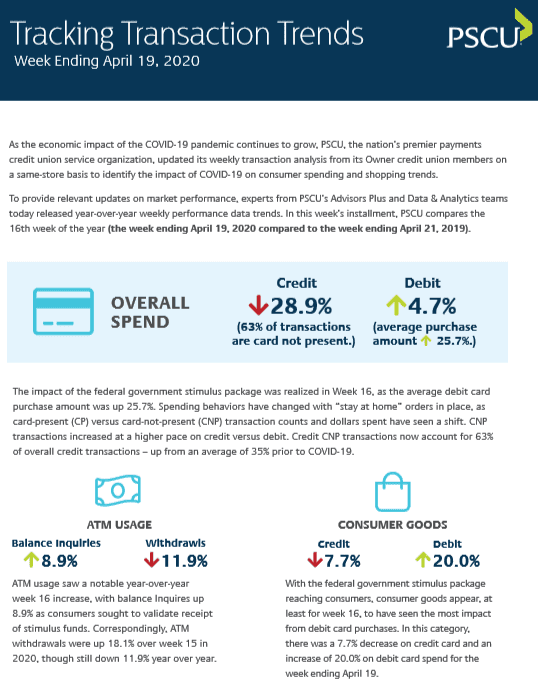

- The impact of the federal government stimulus package was realized, as the average debit card purchase amount was up 25.7%. ATM usage saw a notable year-over-year week 16 increase, with balance inquiries up 8.9% as consumers sought to validate receipt of stimulus funds. Correspondingly, ATM withdrawals were up 18.1% over week 15 in 2020, though still down 11.9% year over year.

- With the federal government stimulus package reaching consumers, consumer goods appear, at least for week 16, to have seen the most impact from debit card purchases. In this category, there was a 7.7% decrease on credit card and an increase of 20.0% on debit card spend for the week ending April 19.

- Spending behaviors have changed with “stay at home” orders in place, as card-present (CP) versus card-not-present (CNP) transaction counts and dollars spent have seen a shift. CNP transactions increased at a higher pace on credit versus debit. Credit CNP transactions now account for 63% of overall credit transactions – up from an average of 35% prior to COVID-19.

- Currently, there are eight states without “stay at home” orders in place. The weekly buying patterns for these states closely mimics the overall U.S. weekly spending trends. For these eight states, credit card spend was down by 29.4% and debit card spend was up by 4.5%.

- For the states/districts hardest hit by the pandemic (“hot zones”), spending was slightly more curtailed than the overall U.S. The credit card spend for CA, CT, DC, IL, LA, MI, NJ, NY was down 33.5% last week. Debit card spend for these same areas was down 2.4%

- Grocery stores/supermarkets have returned to more normal spending. The week ending April 19 finished at an increased rate of 4.1% over the comparable 2019 week for credit card and 15.9% for debit card. Debit card usage remains elevated, but not as high as increases that were realized during the peak March weeks of COVID-19 stockpiling.

- Drug Store/Pharmacy results have dropped below 2019 spending levels. Credit card spend at drug stores dropped by 14.6% and debit card spend dropped by 8.2%.

- Gas purchases remain soft and are hovering near the same rate over the past three weeks. Spend is down 60.1% for credit card and 39.0% for debit card for the week ending April 19, compared to 2019 levels. Lower gasoline prices at the pump, along with decreased transaction activity driven by the substantial increase in remote work and stay-at-home orders, continue to significantly affect the purchase of gas.

“This week’s transaction analysis showed the impact of the federal government’s coronavirus stimulus package,” said Glynn Frechette, SVP, Advisors Plus at PSCU. “Debit card spend and average debit card purchases saw year-over-year increases as money was automatically deposited into checking accounts – and consumers found ways to use it, with debit purchases on consumer goods notably increasing. At the same time, credit card purchase activity continued its negative trend as consumers used their newfound money in checking via debit to transact.”

PSCU will continue to develop and share analysis of transaction trends on a regular basis throughout the COVID-19 crisis.