There is little doubt that 2020 will go down as a landmark year in the history and economics books as the COVID-19 crisis continues to significantly disrupt (and reset) economies and communities. While performance will see impacts across the board, resiliency measures and their efficacy in the current environment will determine the ‘winners’ of the next decade.

Financial Institutions (FIs) must strike a balance between resiliency and growth. The day-to-day operations of financial services firms are adversely affected by social distancing norms and lockdowns in many countries. They are challenged with trying to keep their distribution channels working, complying with supervisory and regulatory duties, and managing customers’ and investors’ expectations. At the same time, they will need to stay conscious about their brand, reputation, and strategy with regard to potentially changed customer behavior once the crisis subsides.

A strong case for utilities, more than ever before

While many organizations will turn to aggressive cost management as the default priority in the next couple of quarters (and rightfully so, for the most part), some will look to offer enhanced value to customers as their strategy to recover from the crisis. Business Process as a Service (BPaaS) cloud-based utilities will be one of the options to consider. Utility is an entity that performs one or more common, non-differentiating functions, in a standardized and efficient manner, which were previously carried out by the industry players themselves, or by vendors, but in ‘silos.’

A prime and early example is in 2015 when three big US banks came together to create a data utility company. It was set up to clean reams of reference data more efficiently. Over the years, utilities have taken on varied dimensions and forms, from a few players collaborating to industry-wide entities like SWIFT. Multiple models are running across many countries ranging from:

- An ecosystem model: Financial institutions working with market infrastructure firms to develop utilities.

- A leader backed model: Leading individual institution could take up the task of developing such an entity, then offering it to their ecosystem.

- A technology vendor model: The vendor provides a technical backbone to several clients to collaborate.

Regulators around the world have also been generally supportive of utilities and allowed compliance functions like KYC to be carried out by them. However, apart from KYC and regulatory compliance, there are other wide-ranging areas where the application of utility models has been tested. A few such domains are trading and execution, anti-money laundering solutions, information exchanges to ward off cyber threats, etc.

To date, most firms have looked at utilities only from a cost perspective. However, by ridding financial institutions of routine tasks, utilities can prove to be a much more value-enhancing proposition. Merits of deploying utilities include:

- faster time to market

- standardized service quality

- significantly lower capital requirements

- improved response to regulatory changes

- Undeniably better cost leverage

However, financial institutions need to carefully analyze their process and workflows to identify areas most amenable to the utility model. Some key parameters of such identification are differentiating vs. non-differentiating capabilities, the repetitiveness of tasks, and whether it is a front-office or back-office function.

How can ‘Utility’ models steer FS firms through such crisis periods?

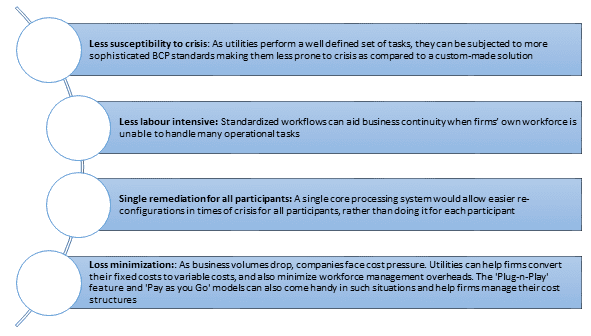

Utilities can enable financial institutions (FIs) to achieve simplified architecture, streamlined processes, and standardized and mutualized workflows aided by rapid advancements in cloud technology. These abilities can prove crucial for companies in implementing advanced business continuity/contingency plans in numerous ways such as:

Engaging with utility service providers is one of the necessary actions in response to massive structural changes expected on multiple fronts — regulatory, macroeconomic, behavioral, etc. Companies can navigate such sweeping changes more efficiently if they work together with providers, who can leverage their experiences from working with other FIs, thus ensuring a more robust presence.

However, before engaging vendors, firms should also have clear visibility regarding their long-term business case and implementation roadmap.

The best time to act is now

The COVID-19 crisis will surely reset the fundamental ways business is conducted. FIs ought to strengthen their operational resilience in the face of pandemics of such (or perhaps bigger) magnitude and also need to accelerate the adoption of digital channels and remote working. To survive and grow in this ‘new normal,’ firms need to start planning and executing on the industry utilities opportunity now and strive to enhance value delivery to customers and other stakeholders.

Written by Harpreet Arora, VP & Head BFSI Consulting, Kapil Kohli, Partner, and Dishank Jain, Senior Analyst – Wipro Insights