Cindy is the proud owner of an interior design business. She and her six employees spend their days picking out fabrics and edgy accent pieces for commercial spaces. Cindy and her small yet dedicated team recently remodeled a large, beachfront restaurant, and it couldn’t look any better. But there’s one problem: the business owner hasn’t paid Cindy yet.

Cindy now finds herself sitting at her kitchen table, staring down the barrel of her expenses. How will I pay my employees for their labor? she worries, as the cash flow has momentarily halted. Surely they won’t, or perhaps can’t, wait to get paid until she receives payment from the client.

This is a challenge that SMBs face on a daily basis. The bills continue to roll in while they wait to receive the money to cover their expenses. According to a recent Mastercard sponsored Mercator study titled The Cash Flow Conundrum, “of 2,000 small businesses in the U.S., cash flow is one of the primary concerns that a small business has.” About half (48%) of small businesses surveyed are either concerned or very concerned about cash flow.

Top 3 concerns for SMBs and the rising focus on cash flow

Among the 2,000 SMB owners surveyed, the top three concerns are:

- Customer retention

- Cash flow

- Employee retention

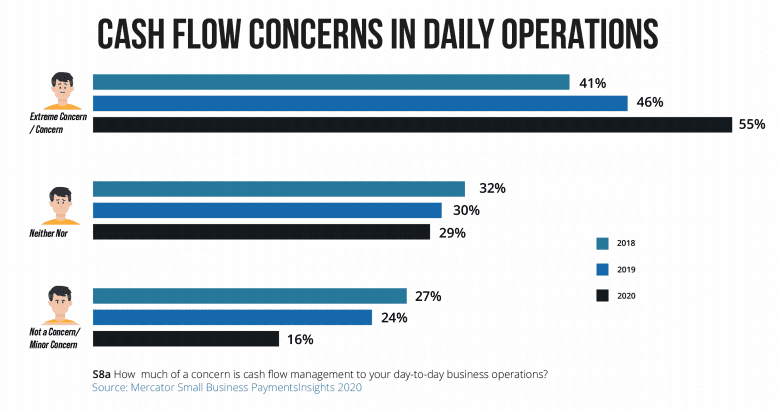

Forty-nine percent said they were either very concerned or concerned about customer retention, followed closely by cash flow (48%) and employee retention (47%). In 2018, approximately 4 in 10 SMBs reported cash flow specifically to be an extreme concern or concern. That number increased to 55% in 2020. Only 16% of those surveyed in 2020 said cash flow was not a concern or only a minor concern.

Sarah Grotta, Director of Mercator Advisory Group, knows that cash flow concerns keep SMB owners up at night. She believes that products and solutions are needed to help to solve issues around accurately projecting sales and revenue, understanding the timing of revenue and expenses, and putting the right cash flow controls in place while also developing a savings cushion for unexpected events.

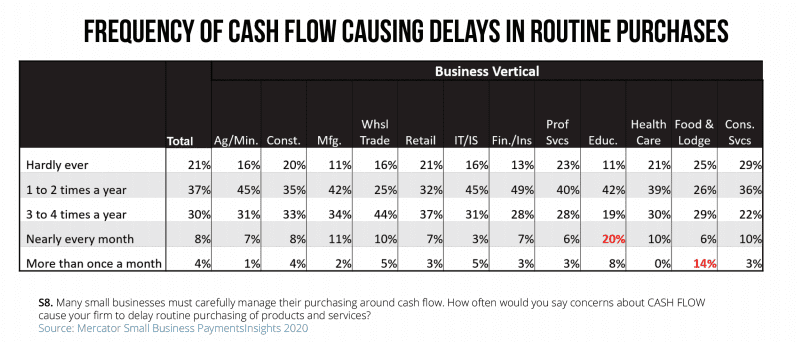

Frequency of cash flow causing delays in routine purchases

Almost all small businesses have concerns over cash flow, but it must be noted that a relatively small number of these businesses are actually prevented from making purchases. Of all SMB owners surveyed, 21% said their daily routine purchases were hardly ever impacted. Thirty-seven percent said their routine purchases were impacted 1-2 times per year, 30% were impacted 3-4 times a year, and 8% were impacted nearly every month. Only 4% stated they experienced delays in routine purchases due to cash flow concerns more than once a month.

However, the report points out that there are lasting effects of being short on cash, even one time. This can impact the way a business looks at their cash flow for a long time thereafter.

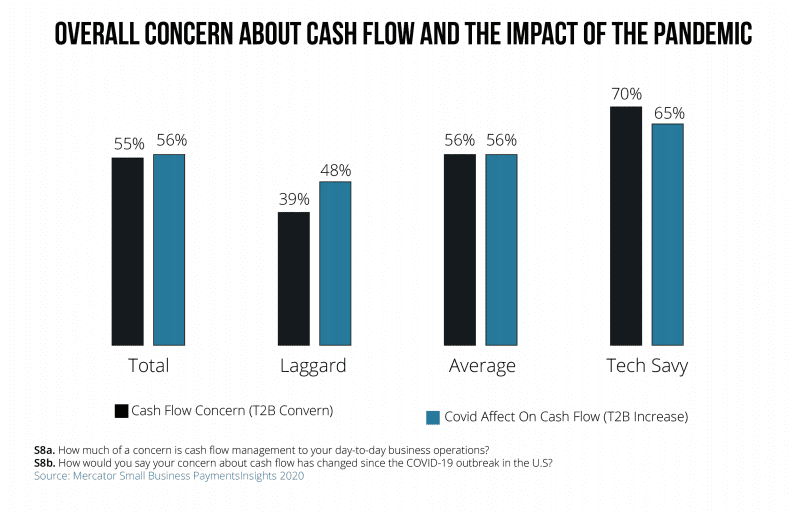

Tech savvy SMBs are most concerned about cash flow and the effects of COVID-19

The pandemic has undoubtedly affected every aspect of the payments industry. While the increasing cash flow unease began years prior, it is clear that the dramatic increase from 2019 to 2020 was due, at least in part, to the unexpected outbreak of COVID-19.

According to the data in the report, 70% of tech savvy SMBs have cash flow concerns and 65% have been impacted by COVID-19’s effect on cash flow. These business owners are more inclined to say their cash flow worries have been intensified by COVID-19 and are more likely to be early adopters of new technologies for their companies.

Furthermore, of SMBs with average knowledge of technology, 56% had both cash flow concerns and were impacted by COVID-19’s effect on cash flow. Laggards, or people with less experience, were less concerned than the other groups (39%) and experienced less COVID-19 related cash flow issues (48%).

The pandemic has increased the number of small businesses who look to outside sources for additional assistance with financial worries. Banks, financial advisors, and accountants are excellent resources to seek out if looking to address these concerns.

When it comes to affecting change at scale, Silvana Hernandez, SVP of Digital Payments and Labs at Mastercard, believes we are at a tipping point, “The need to offer more for individuals and SMBs in the digital economy has long existed, and the emergence of a global pandemic has created the tipping point necessary for businesses and consumers to begin to embrace change. Faster payment options like Mastercard Send allows merchants to have near real-time access to funds transferred like rapid merchant settlement, SMB loan disbursements, and insurance claims payouts.” When funds are instantly available to SMBs, it strengthens their liquidity and cash flow position and performance.

SMBs can also partner with early wage access providers, who are able to ease cash flow problems for their employees. “Instant push payments replace the days of waiting that is common with ACH transfers. The challenge for the financial services ecosystem is to take the technology already developed to bridge these gaps and get it into the hands of those who need it most, when they need it most,” concluded Hernandez.

For more information on how Mastercard Send is solving the cash flow conundrum for SMBs and other recipients, visit www.mastercard.com/send