Following the footsteps of WorthFM, SheCapital and Owners Advisory, New York-based avant-garde robo advisor Hedgeable has finally called it quits on 9 August 2018, just short of its 10-year anniversary. Even though there is mounting evidence that standalone robo-advice alone will not attract affluent investors, leading data and analytics company GlobalData, says that it will offer competitive advantage to traditional wealth managers over competitors.

Robo-advisors by themselves do not attract assets under management (AUM). In addition, high-net-worth (HNW) investors are not flocking to transfer their assets to standalone challenger platforms. GlobalData’s 2018 survey of wealth managers found that just 10% of private wealth managers feared they would lose market share to robo-advisors over the next 12 months. Indeed, as can be seen from the reports of many robo-advisors, their clients are entrusting only small portfolios to the digital-only platforms.

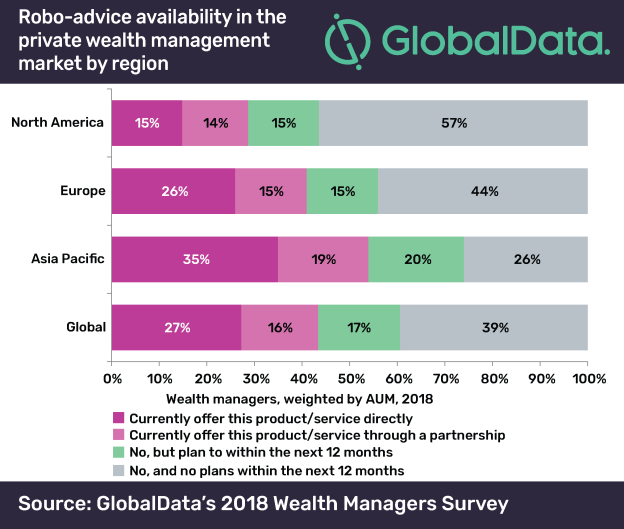

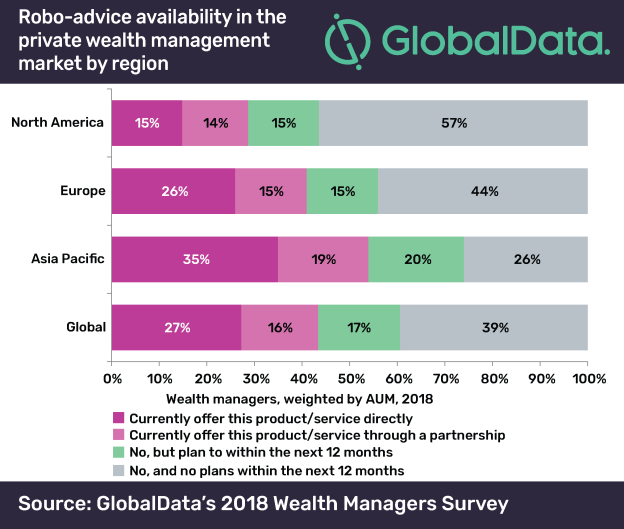

IMAGE FOR PUBLICATION – Please click here for a high resolution image

ElleVest’s investors are giving it just $7,400 on average. Hedgeable ended with $47,000 per account on average, despite marketing its offering as HNW-ready. Either platforms’ users are not HNW individuals, or they are not comfortable handing over the bulk of their assets to be managed by algorithm.

Andrew Haslip, Financial Services Analyst at GlobalData, says: “When a key selling point of the service is its low costs, you have to have a mass market strategy. In other words, in order for any robo-advisor to be successful, it must be attracting AUM in the billions of dollars.

“Robo-advice is a volume play, not a margin play, so the boutique specialist angle is not practical. Wealthfront, Betterment and a few other major brands such as Acorns are strong enough and broad enough to attract enough clients. Start-ups with little brand awareness and targeted addressable markets are not.”

However, the survey found an enduring and growing demand for robo-advice, with 40% of private wealth managers noting strong demand for the technology from their clients, more in the fast-growing Asia-Pacific region. Investors are increasingly looking at it as a tool that every wealth manager should be deploying on their behalf.

Haslip concludes: “Despite some drawbacks robo-advice is a competitive advantage that all traditional wealth managers must acquire. They are not about to lose their best HNW clients to a start-up robo-advisor, no matter how slick the digital interface. But they might just lose out to a competitor that has adopted the technology and integrated it into its overall private wealth management proposition. Although ultimately the human element will remain prominent in the world of financial advice, the industry will continue its technological advancement.”