Social media isn’t simply making us spend more time online. All those hours spent scrolling through carefully curated posts in which our friends dine on delectable food, down craft cocktails, embark on scenic vacations, and go on luxe shopping sprees are also making us spend more money.

There’s no denying the value of a leisurely night out on the town or a well-deserved weekend getaway. But as social media fuels more impulse purchases, it’s only getting harder for consumers to amass savings and stabilize their personal finances.

But if (some) technology is contributing to a culture of living beyond our means, it can also play a positive role in empowering consumers to make smarter financial decisions and take control of their futures.

To understand how banks can be an ally in our efforts to curb spendthrift impulses in the age of social media, it helps to take a deeper dive into the rise of FOMO culture, the decline of savings, and the new opportunities offered by AI-driven money management tools.

YOLO and FOMO: The Visibility Bias

Once known as “keeping up with the Joneses,” the deep-rooted, competitive peer pressure to boost one’s social standing through conspicuous consumption is now more commonly referred to with catchy acronyms like FOMO (fear of missing out) and YOLO (you only live once).

While the urge to consume based on what we see others consuming is as old as human existence, social media is making things worse by highlighting the excesses in our lives. You don’t see a post sharing “I put $100 into savings”, but you see plenty of people “living their best lives” in exotic locations and nouveau restaurants – creating a bias that makes life look like a series of extravagances – known as the visibility bias. All of this is happening in the context of declining personal savings rates – and while social media isn’t the only culprit, it’s making a bad situation worse. With more than 3 billion people expected to be on social media by 2021 – nearly 40% of the whole world’s projected population that year – the impact is monumental.

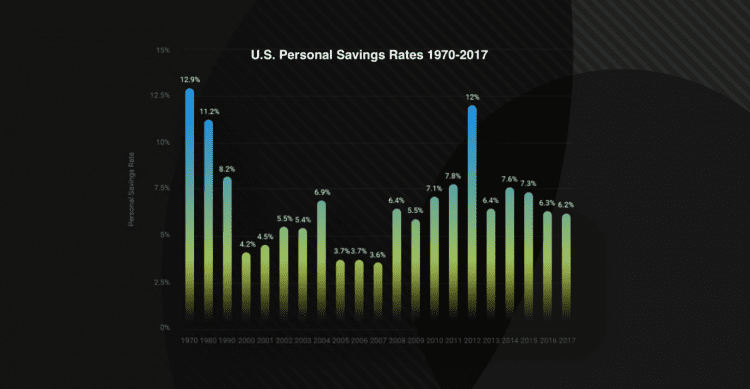

Personal Savings Rates In The U.S. have seen a stark decline in recent decades, plummeting from 12.9% in 1970 to 6.2% in 2017. To some extent, the increased consumer spending from visibility bias that has been siphoning funds away from saving opportunities helps to explain this decline and raises a red flag that current standards of living may not be able to be sustained in retirement if this trend continues.

Turning Visibility into Financial Empowerment

So can we influence this visibility bias by providing an alternative view? Can we offer consumers a lens into the consequences of their financial behavior and encourage healthier choices? Trying to make people feel guilty doesn’t work. The key is to present bite-sized pieces of information that offer small steps towards better day-to-day financial decisions.

Consumers rarely see an accounting of their impulse-purchase costs, and when they do, it is often a wake-up call. The good news is that, while awareness of the consumption taking place around them makes people spend more, awareness of one’s own spending can help break the influence of the visibility bias.

With insight into their own finances, including notable variations in spending trends, consumers can safeguard against over-consumption or, at the very least, be aware of it in order to make informed decisions about whether they wish to proceed with purchases or not.

Yet simple access to transaction data is not enough to affect the spending habits at issue here. This information is already available to customers at multiple touchpoints. For consumers who find themselves in trouble because they’re overspending or just not saving enough, a little extra nudge to take notice of money issues is not only a benefit, but it is also often a prerequisite to taking action.

Utilizing AI to Change Consumer Habits

Forward-thinking banks across the globe, seeking to engage these digitally savvy customers, are implementing AI-based solutions with an eye toward proactively engaging customers with data-driven insights and personalized advice. These tools help customers manage their money in ways that deliver tangible and immediate benefits to their lives, from avoiding overdrafts and the associated fees to preparing for a rainy day.

In the U.K., Metro Bank’s Insights and Nationwide’s MoneyWatch are providing customers with real-time insights into their account activity. In the United States, Huntington Bank has introduced Huntington Heads Up to help customers stay out of trouble with their money and US Bank positioned AI-powered insights front and center in their recently re-launched mobile banking app. In a first-of-its-kind for Canada, RBC launched NOMI Budgets – an AI solution available through its mobile app, that proactively analyzes customers’ spending history, recommends an appropriate budget and sends timely updates to help keep them on track.

What you see influences how you act. That’s the fundamental principle behind the visibility bias, and it’s why a growing number of banks realize that the key to keeping their customers’ finances on track is to offer meaningful insights and full visibility into their spending and consumption behavior. Identifying opportunities to save money helps customers stop themselves from making rash purchasing decisions, meet their financial goals and prepare for emergencies.

Visibility bias will always be with us – but by deploying tools that deliver real value to their customers, banks can offer consumers a much more complete picture that can help put into perspective the excesses they are exposed to on their social platforms.