Set it and forget it.

Over the past few years, a new “way to pay” has blossomed and thrived. The growth of subscription services has generated a new form of bill payment that is virtually invisible to the subscriber. One signs up for a subscription service, such as Netflix, Spotify, or a “box of the month” club, enters all their payment information and that’s it. No bills, no account statements, nothing. The charge just appears on your statement.

A recent article in the New York Times highlights the growing popularity of these services and the drawbacks of not staying on top of subscriptions. Further, this article makes some very sound suggestions on how to manage subscriptions.

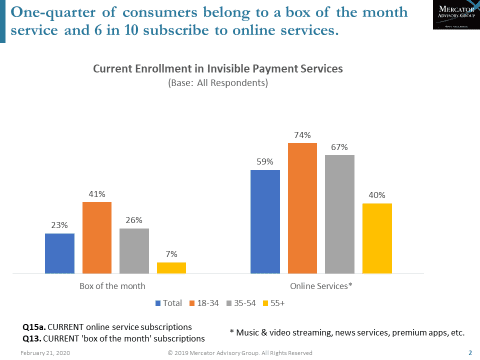

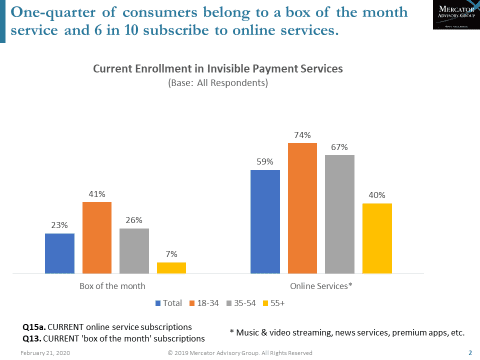

Recent data from Mercator’s PaymentsInsights survey shows that one-quarter of American adults have a subscription to a “box of the month club” and six in 10 have a subscription to an online service like streaming music, video streaming, and premium apps.

As the graph points out, membership to these services is heavily skewed by age – which is to be expected.

When it comes to payments, virtually all of these services bill in the background. In other words, set it and forget it. Every month, a subscriber’s credit card, debit card, or bank account via ACH is hit with a request for payment without any notification. Then, there are the 30-day free trials that service providers hope will automatically convert to invisible payments.

These subscriptions start to add up. As my colleague, Rachel Gore, points out in a recent PaymentsJournal article:

This has consequences. A survey of 2,500 Americans found that 84% of people underestimate what they’re actually spending on digital subscriptions per month. The same survey found that around 10% of millennial consumers spend over $200 every month on recurring subscriptions.

Both the articles I reference identify situations where customers can get themselves caught up in too many subscriptions and become overwhelmed managing all of them. Not long ago, Visa and Mastercard introduced the Mandate for Subscription Transactions which, among other things, makes it easier for consumers to manage invisible payment subscription.

There’s the old phrase “death by a thousand knives.” Paraphrasing it in this context might be something like “Going broke at the low cost of $9.99 a month.”

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group