I don’t think I’m breaking new ground when I say that the success of contactless payments, by phone or by card, will come from a combination of consumers seeing a benefit to using it and merchants seeing a benefit to offering it. The problem with contactless payment technology is that while it sounds so simple, actual execution and usage is another story. Not all contactless forms are accepted equally.

Yesterday RetailDive published some of the findings from a recent National Retail Federations (NRF) research report entitled State of Retail Payments (paywall). One of the interesting findings from the survey was that:

67% of retailer respondents accept some form of no-touch payment. The survey found that 58% accept contactless cards, an increase from 40% last year.

Two-thirds of American merchants say they now accept contactless in one form or another; that’s pretty impressive. However, only 58% accept contactless cards. So there is a disconnect between card acceptance and other contactless methods (smartphones and smartwatches via wallets). This is where my earlier point about not all contactless forms being accepted equally comes into play.

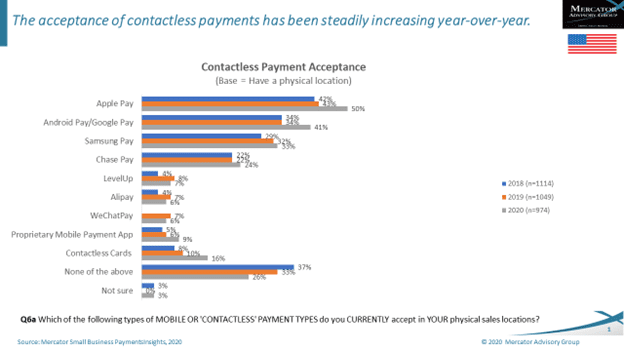

The graph below is from our most recent Mercator Advisory Group’s Small Business PaymentsInsights. It is a perfect example of the issue. We surveyed 2,000 small businesses across the country about the types of contactless payments they accept in their physical location (if they have a physical customer-facing location). The stunning result here is the vast disparity between the brands accepted, not to mention that contactless cards are near the bottom.

One would think that the contactless symbol on the terminal would mean that all contactless payment types are accepted. Are the results in the graph below simply a result of merchant ignorance or confusion, or is it real?

Regardless of the reason, this presents a problem for the consumer who is trying to pay with contactless.

Consumers have been told that contactless means contactless, not that contactless means you need to have the right wallet brand and/or card. Consumers will only put up with being turned down for using contactless and forced to dip or swipe one or two times before abandoning the idea of paying via contactless entirely.

So the current situations appears to be one of total confusion. Merchants think, rightly or wrongly, that they are limited in what contactless options they can accept and that means that consumers won’t know either. What a perfect way to roll out a “new” technology.

For more on this subject, see my blog post We Accept Contactless…Just Not Yours

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group