As the concept of a central bank digital currency—CBDC—digs for traction in the United States amid a fractured political climate, the idea is finding purchase south of the border.

A February publication of the International Monetary Fund, pulling together research in progress, highlighted the progress being made with CBDCs. The publication, titled “Crypto Assets and CBDCs in Latin America and the Caribbean,” focuses on opportunities and risks carried by the introduction of digital currencies.

Latin America doesn’t move as a monolith on the question of CBDCs. As the report notes, “policy responses have varied substantially, ranging from the introduction of bitcoin as legal tender in El Salvador to their prohibition in many other countries worried about their impact on financial stability, currency/asset substitution, tax evasion, corruption, and money laundering.”

How CBDC Development Is Progressing

Only two countries in the Latin America/Caribbean region—the Bahamas and Jamaica—have fully launched CBDCs. The Bahamas went first, with its Sand Dollar in 2020. That currency is for local use only, with international transactions still taking place under the auspices of commercial banks and using the standard Bahamian dollar.

Jamaica’s currency, called JAM-DEX, took flight in July 2022, after several delays. Among the incentives to encourage use of the digital currency was a program that awarded a bonus of $2,500 in JAM-DEX to the first 100,000 customers who signed up for the CBDC via the digital wallet and transaction platform Lynk.

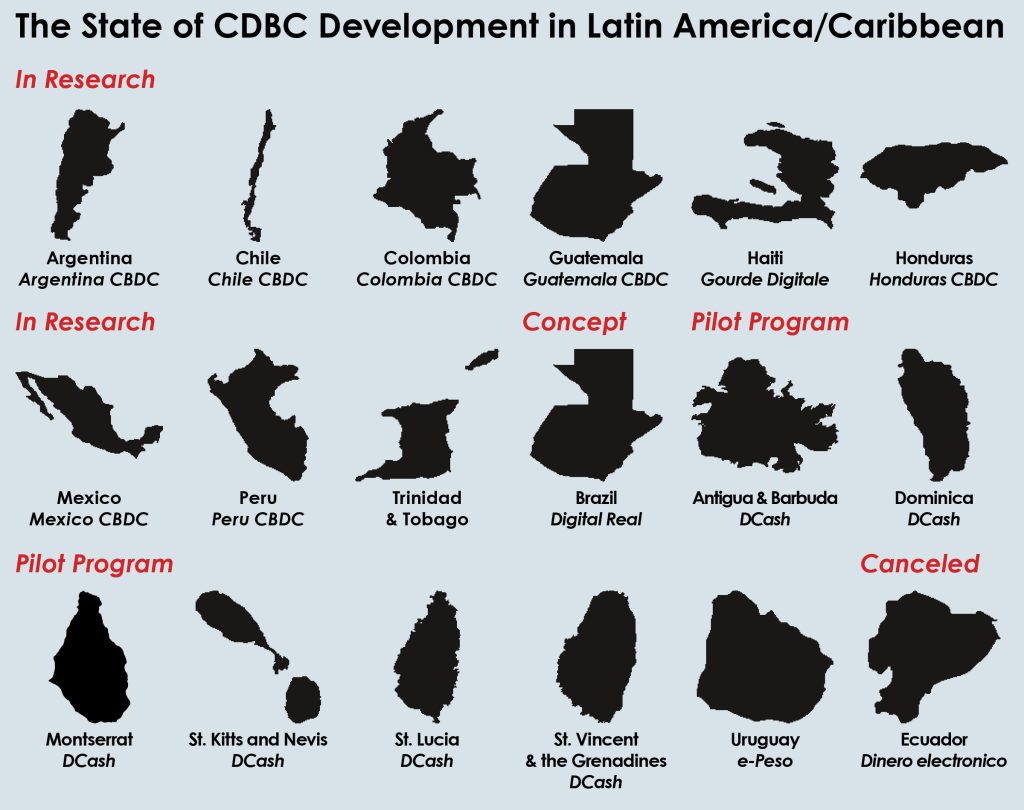

More than a dozen other countries are in various stages of development, as seen in the graphic below.

Opportunities and Challenges

Much of the interest in crypto assets in Latin America and the Caribbean lies in how much of the population lacks financial inclusion and banking services. Further, cross-border transactions such as remittances can be costly, representing a real problem that has a potential solution in crypto assets and their attendant technology.

The potential drawbacks of crypto assets—cast by the IMF paper as “challenges”—are considerable, too. In the IMF’s view, they include big-picture economic vulnerabilities, historic economic instability, low institutional credibility, and corruption. Among the fears is that crypto assets could lead to currency substitution, spur illegal transactions, hamstring tax collection, and other issues.

These opportunities and challenges, taken together, are prompting central banks in the region to explore the issuance of CBDCs.

“A CBDC could help central banks to take advance of technological innovations underpinning the development of crypto assets while continuing to provide a safe means of payment and secure store of value that also serves as a common (and stable) unit of account,” the IMF paper notes.

An Analyst’s View

Joel Hugentobler, an analyst in the Javelin Strategy & Research Cryptocurrency practice, highlighted the tough sledding some countries have faced in driving the adoption of CBDCs.

“These programs are aimed to incentivize users to transition to the digital economy. There’s a lot of nuances, though, throughout the processes,” he said. “The actual rollouts of the projects have shown poor adoption—having less than 8% of the population use the new e-currency is rather abysmal. That’s not to mention the number of incentives the Jamaican government has offered and still has poor adoption, which shows that many still aren’t willing to use it.”

As for any movement toward a CBDC in the United States, Hugentobler pointed to how controversial the idea is in some quarters and the need for moving deliberately—and in the right direction.

“I don’t see the U.S. rolling a CBDC out for at least another year or two, maybe more,” he said. “With roughly 70% of global trade settled in dollars and being the ‘lender of last resort,’ it’s more important to get it right than to be first.”