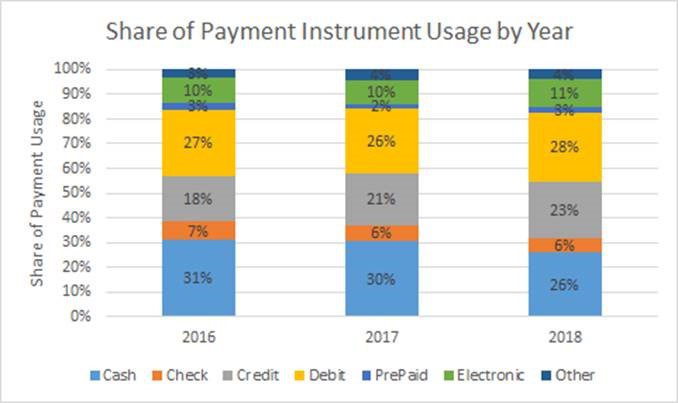

The Cash Product Office of the Federal Reserve Bank has published its 2019 Findings from the Diary of Consumer Payment Choice. This annual report tracks U.S. consumers’ payment preferences and found this year that debit cards are used most frequently, followed by, you guessed it, cash. Although, there was a decline in the number of cash transactions from 2017 to 2018, its dominance in small value transactions and its preference with younger and older generations continues to hold true. From the report:

Of all the cash payments reported, 80 percent were for payments below $25. The combination of these two factors illustrates why cash continues to be a popular payment instrument. However, the share of cash payments has been declining. The 2018 Diary represents the first year cash was not used for the majority of transactions under $10. In 2017, 56 percent of payments under $10 were conducted using cash while data from the 2018 Diary show that share declined to 49 percent, through cash was used more than twice as often as debit cards at 23%.

There are a lot of other interesting payment trends which you can find in the full report here.

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group