In a few short weeks, COVID-19, also known as the coronavirus, has permeated every aspect of our lives and completely changed how (and which) businesses operate. Business travel and entertainment have come to a standstill. Many companies have switched almost entirely to working from home to enforce social distancing or comply with mandatory shelter-in-place mandates. As the economic landscape becomes increasingly uncertain, many companies have been forced to take difficult actions to cut spending as they endure a severe downturn of unknown length.

As the crisis progressed, the scale and nature of expense claims have changed drastically. As expected, trip cancellations and work-from-home expenses increased dramatically, while business travel expenses dropped.

AppZen wanted to dig even deeper into the data to find out how employee expenses have changed in comparison to this period last year: Which industries’ expenses have been most and least affected by the current environment? What kinds of expenses are changing the most?

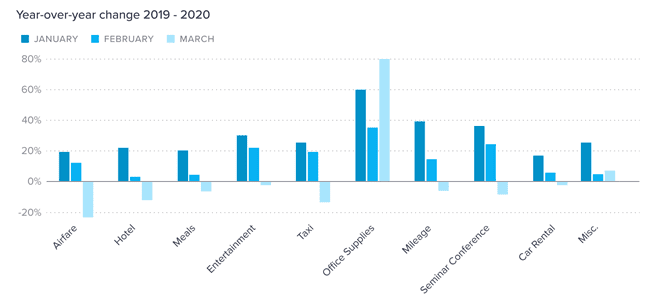

The baseline: Strong year over year growth before COVID-19

To contextualize the changes wrought by the current COVID-19 health crisis, let’s first look at what happened before it began. Between January 2019 and January 2020, expenses in the top 10 largest categories grew by 24%. While COVID-19 was causing significant disruptions in Asia and Europe in early February of this year, overall expenses still rose by 8% compared to last year. By March, that percentage had declined to about 7%.

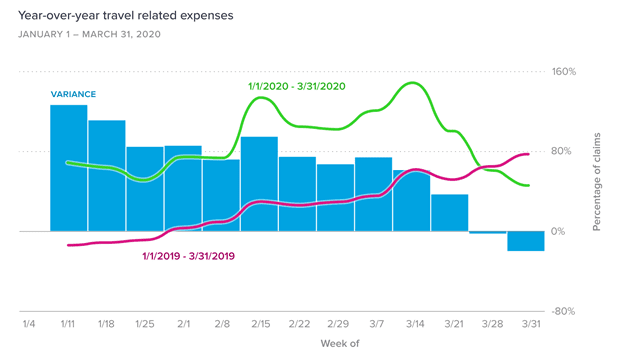

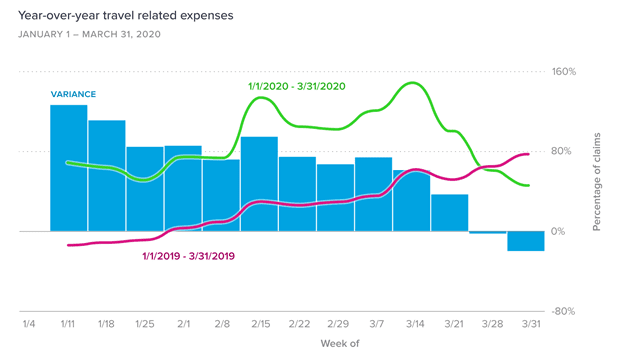

In March, travel expenses began to drop

Unsurprisingly, travel-related expenses such as airfare, hotels, baggage fees, taxis, and trains dropped 9% between March 2019 and 2020. Looking at weekly data shows just how precipitously travel expenses have dropped. Expenses in early March were higher than in 2019, but as the month progressed, expense claims fell dramatically. By the last week of March, travel expense claims were down by 40% compared to the previous year.

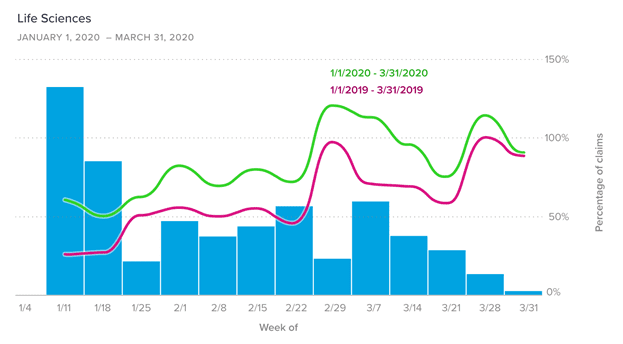

However, not all industries are equally affected. Heavily white-collar, digital businesses that have been deemed “non-essential” have dropped off the most. In finance and insurance, for example, expense claims fell by 47% year over year in the last week of March. In information businesses (mostly software and media), claims fell even more – over 63%.

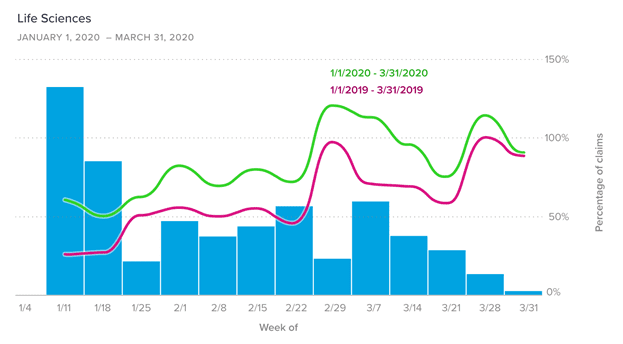

Businesses like construction (whose “essential” status varies by type and location), and life sciences (definitely essential!) were affected to a much lesser extent to date. In the same timeframe, expense claims for construction companies only decreased by 12% compared to last year. Life sciences companies saw an uptick in expenses during this time – a 3% increase from last year, though the trend line in the previous five weeks, if it continues, points toward a decrease in the weeks ahead.

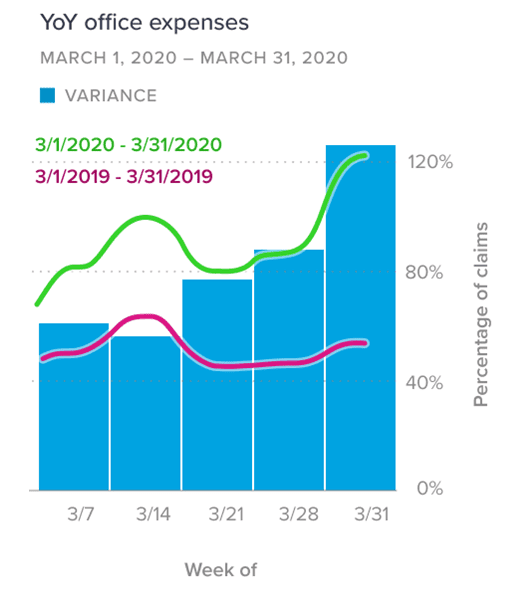

Office expenses have gone up as many employees have shifted to working from home

Expenses in the office supply category have increased across every industry during this timeframe. The most significant spike was during March, where AppZen saw 80% growth in these expenses across sectors.

As companies closed their offices and began encouraging their employees to work from home, many employees needed to expense office supplies such as laptops, monitors, cables, and keyboards. The last week of March was the most significant spike in these expenses, particularly for the construction, information, and professional services industries.

Variations in expense categories by industry

In March, expenses in categories such as subscriptions, training, and internet were 20-25% higher compared to March of last year. Demand for subscription-based services such as video conferencing software rose in March as employees began to work from home. This would explain the additional charges for the internet, as some companies allow remote employees to be reimbursed for internet usage.

AppZen also saw variation by industry. Both life sciences and construction industries show an uptick in transportation mileage during March. This may be because these industries are considered essential, and car travel adheres more strongly to social distancing requirements in the current environment. Finance and insurance companies saw a significant surge in subscription expenses, over seven times higher than 2019. Construction companies saw the most significant rise in office supplies, five times higher than the previous year.