The world has officially reached a state of digitization. With devices in nearly every hand, purse, or pocket in the U.S. and most other countries, access to the e-commerce world has never been easier or more convenient. Now, with most consumers making purchases online, cyberspace is in an extremely vulnerable position and the internet is a shiny new playground for all types of fraudsters.

To further discuss the growing world of e-commerce and the importance of the underwriting process in preventing cybercrime, PaymentsJournal sat down with Ron Teicher, Founder and President at EverC, and Raymond Pucci, Director of Merchant Services at Mercator Advisory Group.

COVID-19 impacts e-commerce

Not many people are aware of the enormous changes that have happened in commerce, particularly concerning payment risks, over the past few years. The payments system used to be a relatively simple operation where any merchant could be easily identified and verified by a number of attributes, such as country of operation or line of business.

In recent years, with the influx of fintechs, the technological advancements that allow for easier access and greater inclusion also open the doors for bad actors to join the system. There are two main factors driving the increased risk of fraud: the payments system became more complex, and the ability to become a merchant is now open to anybody with an internet connection.

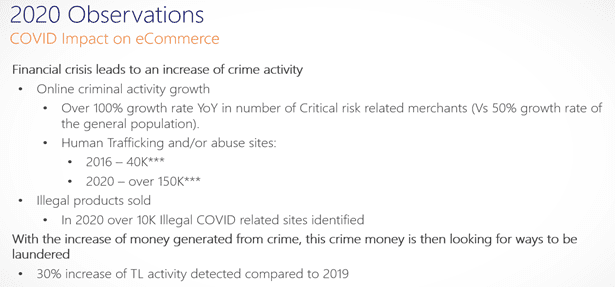

“The combination of a much more complex system with a huge data overload on the underwriting functions really creates the conditions for bad actors to thrive in e-commerce,” explained Teicher. As e-commerce continues to overrun traditional commerce, as shown in the chart below, the new reality means we are exposed to criminal activity at a higher rate than ever before.

“There isn’t as much visibility to merchants as there used to be,” added Pucci. “So that’s why there’s an increasing importance for onboarding and the underwriting system that needs to go into that.”

Why should companies care about underwriting?

Underwriting is where financial institutions and payment organizations meet their Know Your Customer (KYC) requirements. The genesis is a regulation within section 326 of the Patriot Act, defined Teicher. Its main objective is to fight against those financing terrorist organizations, but it is also intended to protect consumers by safeguarding and enabling e-commerce.

Customers will be deterred from purchasing online if it is easy for cybercriminals to attack them. “We want to make sure as society that we’re putting the appropriate controls in place to allow everybody to enjoy the benefits of e-commerce,” assured Teicher.

On January 1, 2021, Congress passed the National Defense Authorization Act to address a number of national security matters, including a considerable set of reforms to the U.S. anti-money laundering and counterterrorism financing laws. One of the reforms was the modernization of the existing Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) laws to account for emerging finance markets and expand the tools and resources needed to control threats.

“We’re talking about increased penalties, we’re talking about enhancement of scope on types of organization…the rules will allow for a more centralized way to be able to identify the people and organizations,” concluded Teicher.

Common gaps in the underwriting process

Every day, our lives are moving more and more online, and there are a lot of new realities that people must adapt to. Underwriting is one of those realities, and it can be a quite difficult concept to understand.

“In today’s day and age…everybody’s looking for frictionless onboarding,” said Teicher. “How do we complete an onboarding process as fast as we can [to] allow maximum business in [while causing] minimal interruption to the merchant?” The answer to this question often results in limited ability to acquire sufficient or accurate data that will allow for proper underwriting.

In the past, people could go to the bank, fill out forms, and provide proof of income to open an account or receive a line of credit. Today, payments organizations can onboard tens of thousands of merchants within minutes. It is important then to have enough information about the merchants that are being granted access to the financial system, otherwise that system is open to fraud and cyberattacks.

EverC was surprised to witness the existing gaps in some of the fundamental KYC requirements in many of the existing e-commerce programs. One of these gaps includes the way data about the new merchant’s line of business is obtained, as an estimated 50% of basic information about their business was misclassified, according to Teicher.

“The need for speed and volume creates a significant data gap around very fundamental requirements for KYC, such as understanding what the merchant is doing, understanding where the merchant operates, very basic and fundamental stuff that creates dramatic risk exposure to the financial institution, the payment industry, and their respective consumers,” concluded Teicher.

The future for KYC

In the current environment, speed and accuracy of merchant underwriting are critical to the continuous and safe growth of merchant portfolios. Companies that rely solely on manual underwriting will risk new merchants leaving them for companies with faster onboarding processes.

“The future of KYC and underwriting lays in systems that can triangulate many of the traditional data sources, along with utilizing new nontraditional data sources like the internet, social media, crowd intelligence, website traffic analysis, and other sources to provide deep, thorough risk analysis that is tailored to today’s new merchant payment system and merchant profile and needs,” explained Teicher.

This is a system that will allow for near real-time onboarding at scale, with a hefty analysis that won’t introduce heightened risk to the payment organization’s portfolio. Frictionless onboarding, little interruption to the merchant, and the utilization of new technological capabilities to compensate for the lack of proper retrieval of data from the merchant—this is the new age of underwriting.

EverC is a global leader in cyber intelligence for merchant risk and compliance. EverC MerchantView Underwriter is a next generation automated solution for merchant onboarding that helps organizations grow their portfolio and keep customers happy. For more information, download the e-book, “Accelerate your underwriting without sacrificing due diligence.”