With Pay Pal and Early Warning recently reporting second quarter results, it’s time to take a look at Venmo and Zelle person-to person (P2P) transaction growth rates. These two P2P solutions represent the majority of U.S. digital P2P volumes, but not the total industry. Other bank solutions, Square Cash and Pay Pal also contribute to total volumes.

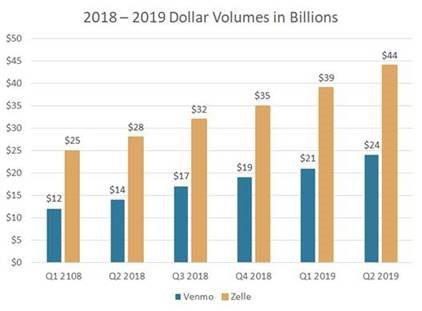

For second quarter, both solutions returned fantastic growth rates. Venmo’s dollar volume reached $24 billion, a 70% year-over-year increase and Zelle reached $44 billion, a 56% year over year increase. These are some great numbers considering how nascent this market was 5 years ago. Here’s how those numbers compare for the last several quarters:

These reported numbers aren’t truly an apples-to-apples comparison. Venmo is also including Pay with Venmo purchases in their volume data. This is where consumers can use their Venmo balance to make purchases, both in digital and physical store locations. This is all a part of the efforts to monetize Venmo transactions.

Bank Innovation had this to say about Pay Pal’s efforts to generate revenue from Venmo’s 40 million customers:

PayPal is continuing along its path to monetize Venmo’s 40 million-strong user base. On Wednesday, the company said 15 million Venmo users engaged in monetizable transactions.

The company is focusing its efforts to generate revenue from Venmo by taking use cases beyond casually paying friends for beer, rent or other peer-to-peer transactions, which aren’t moneymakers for the company. Instead, PayPal’s plans center around e-commerce payments through Venmo to participating merchants and fee revenue generated from those transactions.

To drive up adoption, PayPal is testing incentives to encourage more consumers to use Venmo debit cards. In May, the company offered 5% cash back on all purchases made at a grocery store. The incentive was designed to drive adoption and increase interchange fee revenue

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group