In this Visa announcement today, we see that Visa B2B Connect has been officially launched. We first learned of the proposed cross border platform and network effort back in 2017 through Kevin Phalen, Visa’s Head of Global Business Solutions. We have been awaiting the results of pilots and tracking progress, keeping members up to date in various reports and viewpoints.

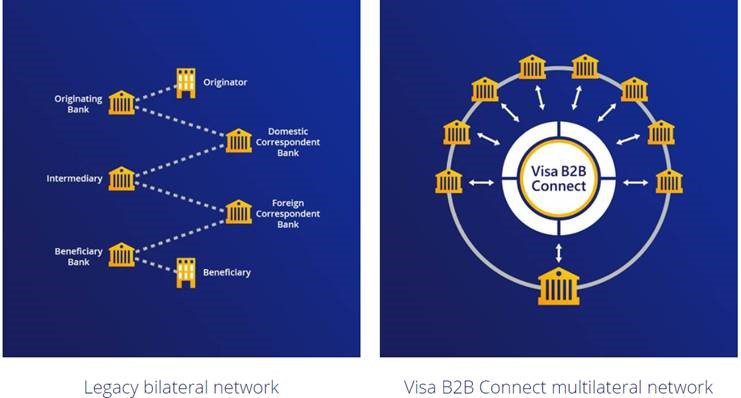

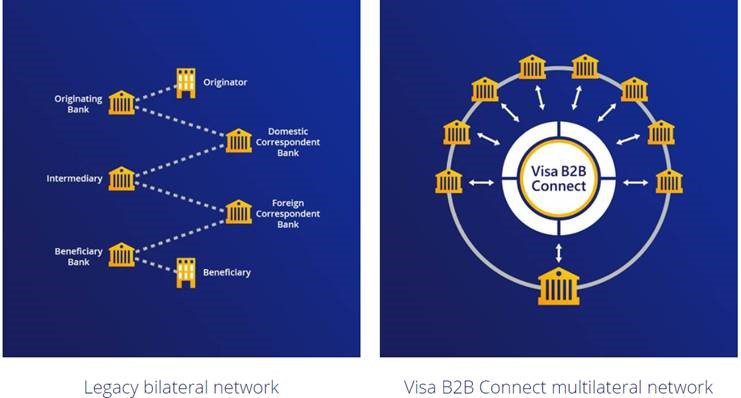

‘Visa Inc. (NYSE:V) today announced the commercial launch of the Visa B2B Connect network, giving financial institutions an ability to quickly and securely process high-value corporate cross-border payments globally. The Visa B2B Connect launch will cover more than 30 global trade corridors, with an aim to expand to as many as 90 markets by end of 2019….“Launching Visa B2B Connect marks an important industry milestone which will accelerate theevolution of how commercial payments move around the world,” said Kevin Phalen, SVP, global head of Visa Business Solutions. “By creating a solution that facilitates direct, bank to bank transactions, we are eliminating friction associated with key industry pain points. With Visa B2B Connect, we are making payments quicker and simpler, while enhancing transparency and consistency of data.” ‘

As readers who follow the commercial payments space know, cross border payments have been traditionally slow and opaque, with a system of correspondent banking relationships going back decades, therefore a number of industry efforts are underway to make this space more friendly and valuable to corporate financial professionals, and the public in general. We are not aware of any efforts to date with the Visa B2B Connect unique combination of technology using a blockchain framework and API development scheme, along with the existing network scale that Visa can bring. Visa has been working with various partners and pilot institutions to bring the network to market with scale. These partners include Bottomline Technologies, FIS and IBM, with pilot institutions including Commerce Bank and Cornèr Bank.

Source: Visa website

“With Visa B2B Connect, we are leveraging Visa’s existing assets and our expertise in cybersecurity, data privacy, the scale of our network – and layering that with new elements of distributed-ledger technology to meet unique needs of this industry,” said Sam Hamilton, SVP, data product development at Visa. “This lays the foundation for a service with the potential to transform cross-border payments.”

Another interesting development in the rapidly changing world of B2B payments. We’ll keep you posted as we learn more.

Overview by Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group