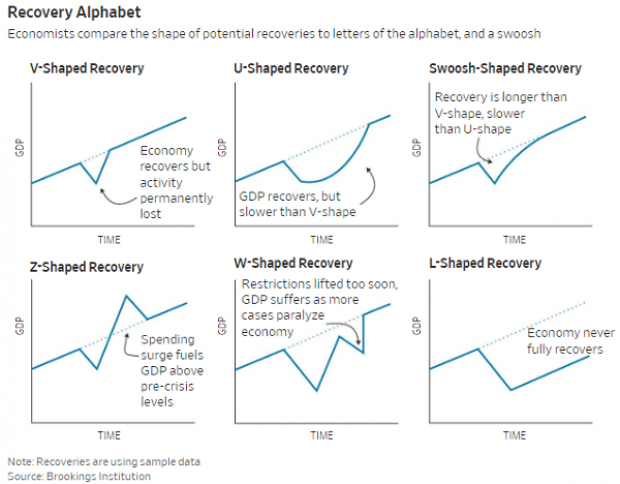

For weeks economists have been trying to determine what letter in the alphabet will best describe the economic recovery coming off the heels of the COVID-19 pandemic. The global economy has taken a gut punch because of the pandemic and, as it seems like the worst is behind us, people are starting to talk about recovery. Recovery parlance often turns to the shape of the GDP graph. Will it look like the letter “V”, or perhaps a “W” or “U”?

Over the weekend an article in the Wall Street Journal, Signs of a V-Shaped Early-Stage Economic Recovery Emerge, cites rebounding retail sales and new hires numbers as reasons to believe that our rebound will be a “V” (as you probably figured out from the title). Specific mentions include:

The strongest evidence comes from consumer spending. In April, retail sales collapsed by 16%, the biggest one-month drop on record.

The government reports May sales data on Tuesday, and economists expect a 7.9% jump, recouping 40% of April’s drop.

And:

The labor market remains the biggest wild card. Economists thought employment would fall sharply in May because millions more workers had filed claims for unemployment insurance, but by focusing on job losers, they missed millions more job gainers, with the result that net employment rose. In a report Friday, the Federal Reserve, citing private payroll-processing data, predicted employment would rise again in June.

The article does mention that a there are still some factors that could change the “V’ to another letter or other graph shape. We are not completely over the pandemic and the question remains regarding severity of its resurgence after the states open up. Furthermore, if the surge in consumer spending is largely driven by the federal stimulus, that money will run out in short order, raising the question of what happens after that.

For what it’s worth, I’ll get behind the optimistic letter “V” graph, for now. That said, I wouldn’t be surprised if some of the unknowns come to change the shape of the graphs. The only thing certain about the economy right now is that nothing is certain.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group