This article in FXStreet provides a quick and reasonable assessment of the multiple issues that make crypto a poor replacement for cards or cash at retail locations. The article begins by explaining how card networks operate, but instead let’s jump to the issues that impact crypto adoption at retail:

“The transaction costs in many blockchains are lower than in the fiat world, so the coffee can be cheaper. The merchant gets their funds within minutes. And there are no chargebacks!

If it is that simple, what is the problem?

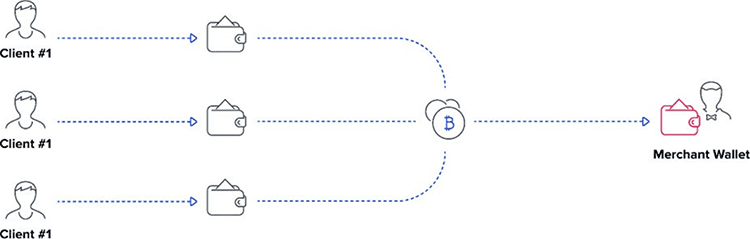

When it’s a business and there are many crypto payments, the merchant needs to identify each transaction. If you and the guy next in line say you both have sent your payments for a coffee to the merchant’s wallet and he/she sees just one payment, the merchant won’t be able to tell which one of you is cheating. To allow him to proceed, in addition to the schema above intermediary wallets for each payment appear. Generating new wallet addresses for each purchase, the merchant can see whose coffee is already paid. No problem, then?

Well, the merchant now has to pay the blockchain commission twice: once to receive payments to intermediary wallets and then again to send the funds from those wallets to his/her wallet. But the merchant can trust creation of intermediary crypto wallets to an exchange or a payment system. Doing this, he/she won’t pay extra commission but will pay only for the services. Not a big deal.

What else? If merchant’s business expenses are in crypto, no problem – then he can pay those expenses with crypto from his wallet. But it’s a rare case and most merchants want to exchange crypto to fiat. Such a merchant could collect crypto for a period of time and then exchange it to fiat saving on transaction costs. The problem is the merchant never knows how much fiat money he will receive in the end. The high volatility of crypto brings with it arguably the biggest issue!

The merchant has some planned expenses: salaries, rent, purchase of goods and in the fiat world the prices won’t change that much. That is why most merchants, whose major expenses are in fiat prefer to exchange crypto to fiat immediately after they receive it. A crypto to fiat exchange rate can change dramatically within a couple of hours, so even exchanging it daily may not help.

To protect his/her business from high volatility of crypto, the merchant has to add a percentage to the coffee price. As a result, when you pay for your coffee in crypto, very often it’s not cheaper for you at all as you cover the merchant’s risks!

Let’s take an example. A merchant has a 100-dollar product that has cost him/her 80 dollars. He/she gets about 90 dollars in the end when he/she sells it, having paid all the intermediaries’ and bank’s commissions. On the blockchain like Ethereum even if he has to cover a payment system’s costs, he/she can get about 98 dollars to his account. The merchant could split the benefit of crypto payment (8 dollars) with a client and reduce the price to 96 dollars, and the client will be happy to pay in crypto. But volatility may eat up his gain.

Now you know the true enemy.

What can give crypto payments a boost?

- Stablecoins (cryptocurrency pegged to a stable asset, such as gold or fiat currencies) could make your coffee paid with crypto cheaper. When the merchant is not afraid of receiving less fiat than planned, he/she can take advantage of the stable environment to make the price more attractive.

- The blockchain technology is still immature. All the existing blockchains have flaws. Some are slow and expensive but reliable and open. Others are fast but too new and with a limited number of nodes, and thus not open. The more blockchains and new algorithms we have, the better. In no time at all, there will be a faster, cheaper and more reliable blockchain supported by banks and that can be a breakthrough. Banks could be the blockchain nodes and they could process payments while being truly transparent.

- Then the number of crypto adepts will grow considerably, which will also contribute to the improvement of crypto payment services.

So, if were you a merchant knowing all the above, would you offer crypto payments to your clients today?”

It is interesting to note that the card networks have also recently recognized that too many options for eCommerce payments confuses consumers and annoys merchants. The card networks, EMVCo, and the W3C have all introduced solutions that create a single buy button that will work for all card networks, or in the case of W3C, will work with any payment method including crypto.