Early Warning Services reported third quarter results setting new records for processed transactions and showing a continued reliance on Zelle, the digital person-to-person (P2P) payment app. Consumers adopted P2P aps in droves, (also including Venmo, Square Cash, and others) as they found the ability to pay others electronically more important as the global pandemic shifted payment habits.

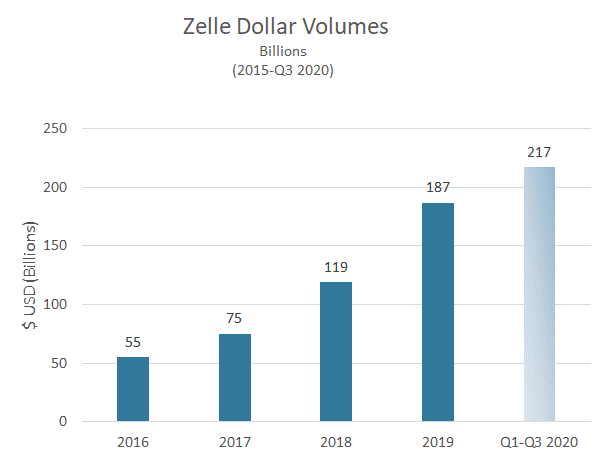

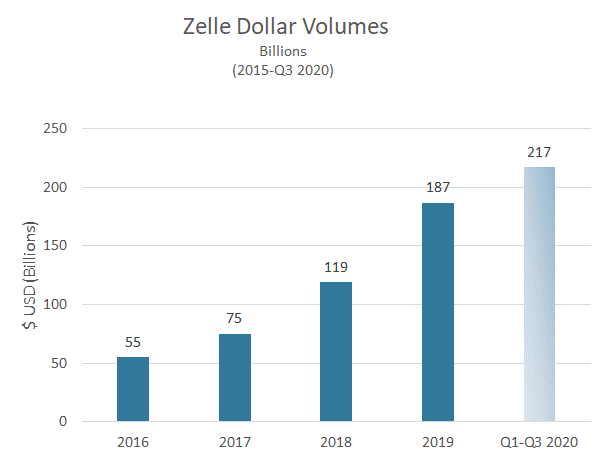

The continued growth suggests that as shopping habits find their new “normal”, P2P apps will continue to thrive. Here’s a graphic representation of Zelle’s growth trajectory:

In addition to the P2P activity, Zelle is starting to be used for small business transactions too. Here’s what the company’s press release had to say about that point:

We continue to grow our network, welcoming financial institutions of all sizes. Today, more than 1,000 banks and credits unions are currently contracted to participate on the Zelle Network, including 731 that are live today and processing transactions,” said Al Ko, CEO of Early Warning Services, LLC. “Zelle is available to more than 140 million consumers in their mobile banking apps or in the Zelle app, and is used for the most important life essentials such as sending contactless payments to local businesses and money to friends and family in need.”

The Zelle Network also saw more than $4.5 billion sent to small businesses and nearly half a billion dollars sent by companies to consumers via the Disbursements with Zelle service.

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group