Cash is no longer king in Canada. It’s been demoted to prince or maybe duke.

Canada continues to evolve into a sophisticated payments market. An article in Mobile Payments Today cites a Payments Canada report that says cash payments have decreased 40% in the past five years. I can’t say that I am all that surprised. The article states:

Electronic payments accounted for 73% of total payments volume and 59% of total payments value. The report also revealed that contactless payments grew 30% year-over-year in 2018 with a total of 4.1 billion contactless payments (card and mobile) worth C$129.9 billion at point-of-sale.

Debit, often viewed as a convenient substitute for cash, represented almost 60% of volume of these contactless payments. In fact, debit card use overtook cash for the first time in recent years, the report said.

Meanwhile, credit card use has accelerated dramatically with a 52% increase in transaction volume over the last five years. Canada currently ranks second with highest volume use of credit cards per capita in the world after South Korea, according to the research.

Our recent PaymentsInsights Canada report supports many of the findings in the article.

As the graph below demonstrates, about seven in 10 currently use a credit card and six in 10 use a debit card, which is about 10 percentage points higher than what was reported for the same time period in the U.S.

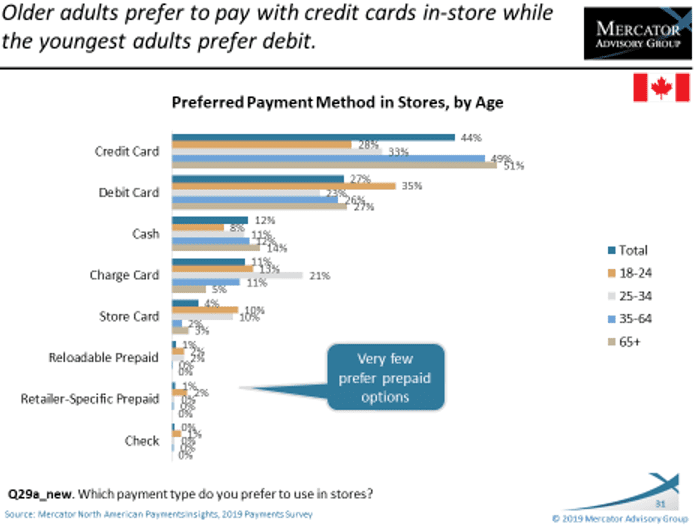

The differences between credit and debit mentioned in the report may be generational. The graph below shows that younger Canadian consumers prefer debit when shopping in-store, while credit preference increases with age.

One question comes to mind as I look at these data: is Canada a harbinger for the U.S.? They were much faster to embrace payment technologies like chip and NFC. Will the U.S. adoption rate of these solutions increase digital transactions overall at the expense of cash? Many think so, but it remains to be seen.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group