As something of a Money 20/20 series veteran, having attended the Europe and Vegas editions several times, it was with great curiosity and even greater expectations that I set off to the first Asian event.

Held in Singapore, the event had many of the same faces – the giant Techs, the payment schemes, the big payments vendors and banks. But the varied and nuanced nature of the countries which comprise the ‘Asian market’ was immediately obvious and made for some extremely interesting discussions. So, now back in my own time zone, here’s some of the key talking points that really stood out for me.

It’s all in the detail

A recurring keynote theme was the need to focus on the smaller points. Sure, buzz around transformative technology was rife (if I had a Singapore or Hong Kong dollar for every time I heard about Blockchain…), but it was refreshing to see renewed focus on how technology can be harnessed to remove the small frictions we experience in our daily financial lives, now.

DBS Bank, noted that we should consider what finance and banking enables – the much-needed holiday you want to book, or the loan to start your own business. Payments need to be a means rather than an end.

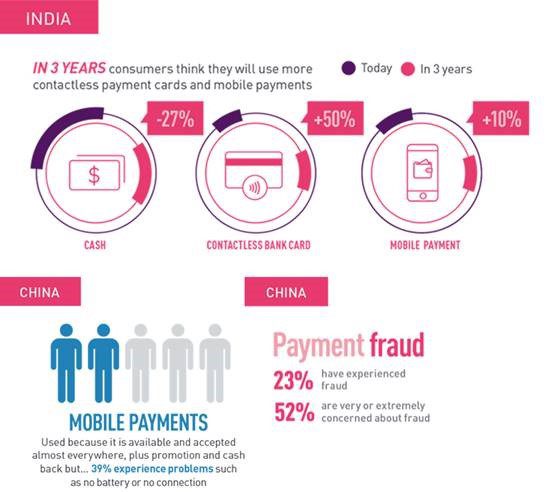

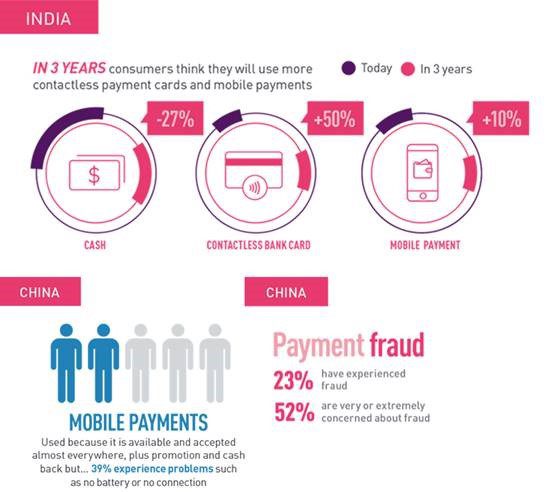

This was reflected in the tailored approach big players were adopting with each country. Whether empowering micro-merchants, supporting India’s rapid demonetization, or looking at the growth of credit in China – the larger payments ecosystem is scrutinizing how it needs to adapt to meet each market’s unique points of friction.

Consumers want more than mobile

Asia has long been the leader of the mobile revolution, but the event raised the importance of not narrowing the strategic vision too far. In fact, in one panel, the question was even asked whether mobile payments were dead, with slow adoption rates outside of China.

Customers like flexibility and options in their financial lives. The number of online giants now opening physical stores, such as Amazon, illustrates that. Not to mention the number of traditionally mobile-centric Fintechs, such as Uber, launching a loyalty-driven payments cards to work in tandem with their app offerings.

There is no one ‘better’ way to pay. Equally, there is no single way consumers want to pay for everything. Offering a multipronged approach must become central for retailers and banks looking to get ahead.

Cards are getting cooler

Cards are in vogue again and issuance figures are continuing to rise across Asia.

Premium, brand-driven payments cards were showcased at the event, with design and luxury at the heart of new offerings. The sleek metal card launched by Monaco was an especially interesting example of how the humble payment card is adapting to the modern age, incorporating its cryptocurrency wallet into a physical card and with a mobile app as companion.

Biometrics still has its finger on the pulse

Biometrics were prolific at the event. From ‘selfie pay’ solutions and voice recognition, to biometric smartcards, initiatives focused on how biometrics can be used to reduce fraud and improve user experience in payments.

Whilst biometrics technology has long been a conference discussion point, it was evident that biometrics have quickly become favored by consumers – a symbol of convenience, cool and security – and they are moving beyond smartphones.

It’s no surprise then that biometric smartcard demos and trials were a big feature at the event. Combining the familiarity and choice provided by the payment card, with the ease of use and security of biometrics, momentum is certainly gathering in the region and our consumer research shows that the demand is there.

To return to ‘the small stuff’, these solutions tackle the minor friction points consumers experience in their daily payments lives. To look at the bigger picture again, the market potential is huge and we look forward to seeing it take off.

What were your key takeaways from the first Money 20/20 Asia? Join the discussion on Twitter.