Imagine a world where skinny jeans are one-size-fits-all…it would never work out. If retail consumers are given a choice between leggings and joggers, then why are banks still using the same set of tools across a diverse range of customers?

According to a recent Brighterion report titled How to Put AI in Your 2021 FI Business Plan, American consumers had nearly $14 trillion dollars in combined debt at the start of 2020. With the pandemic striking shortly thereafter, the global economy was sent into a recession in a matter of weeks.

While banks turned to familiar tools such as forbearances on loan and mortgage payments to help customers cope with the sudden economic deficiencies, subsequent economic data revealed a series of shortcomings in the linear way in which financial institutions handled this crisis. Banks certainly could not have anticipated the pandemic, but it did help to expose why they need better AI for forecasting and managing credit risk.

Credit application and origination scoring

Financial institutions (FIs) have always used credit scores to decide if they should issue a loan or extend a line of credit to a customer. Once these customers developed a consistent history of paid-in-full on-time payments, FIs would then offer easier credit access. Customers with funds in their bank accounts were more likely to be approved.

However, pandemic-induced challenges have shone a light on the insufficiencies of these dated methods. For example, it is more likely that banks might withhold credit lines from consumers who are only temporarily going through a rough time financially than those with higher account balances.

FIs that take advantage of AI to assess credit risk have a greater ability to analyze their customers using “alternative data.” This data might include things like bank records, transaction histories, usage of other products, and additional permitted data feeds. These types of information can help FIs improve their customer assessment models, leading to more accurate risk predictions and an extended list of eligible, lower risk consumers.

Managing credit delinquency risk

FIs’ approach to managing credit delinquency has always been similar to that of a mother in dealing with her toddler: let them make the mess and clean it up afterward. Banks don’t normally focus on preventing the mess from happening in the first place. Only after accounts fall into delinquency do loan managers work with their customers to bring them back into good standing. FIs might even resort to suspending or closing accounts that remain delinquent.

There are two huge problems with this approach: 1) FIs can’t predict whether or not customers are likely to miss payments and offer alternative payment solutions that may enhance their ability to pay, and 2) customers’ credit scores will most likely decrease because of the reported missed payments. In this scenario, both parties are at a loss because FIs are jeopardizing potential revenue, and customers may lose their credit worthiness.

AI-driven credit monitoring is capable of analyzing massive amounts of data at quick speeds. This allows banks to scan for larger patterns in each account holder’s banking and payment history over an extended period of time. With a sufficient amount of data, AI can detect “early warning signals” and predict delinquency with impressive accuracy before a consumer ever misses a single payment. Some AI systems can even detect potential problems up to one year before they occur.

Collections optimization

There are three key business aspects that FIs must manage in order to increase their consumer credit portfolios’ returns and enhance the value for customers: business profitability, customer experience, and global applicability determined by countries’ privacy policies and regulations. AI has the capability to perform all of these functions.

Business profitability: If FIs can manage to prevent customers from ever missing a payment in the first place, then they can help to ensure the account holders’ financial stability. Providing this service can be as simple as sending monthly reminders via text or email. AI can help banks tailor their outreach strategies and customer engagement approach to maximize the likelihood of on-time payments.

AI systems can also analyze customers’ payment histories and available funds to decide how much they might be willing to spend on their monthly bills. FIs that use AI to inform their decisions regarding methods of collections extract more return on investment (ROI) from their accounts than those that don’t.

Customer experience: In recent times, especially since the onslaught of COVID-19, customers have come to expect an enhanced, digital-first experience. Access to an online banking platform is one of these expectations, and AI enables such banking capabilities.

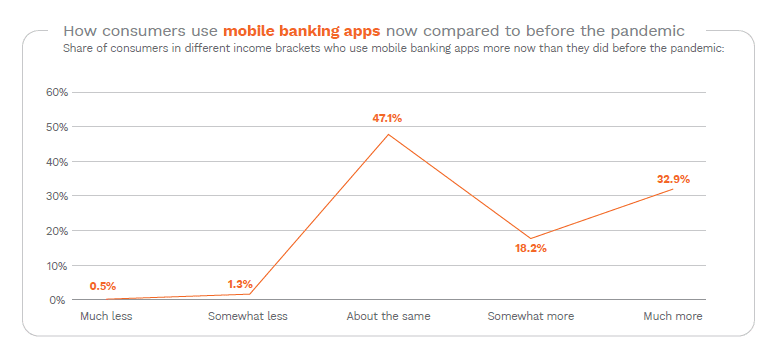

Fifty-one percent of mobile banking app users are interacting with these apps more than they did when the pandemic began. They are using these apps to perform nearly every transaction and account maintenance activity, mostly because they want to avoid COVID-19 exposure. Sixty-one percent now use digital channels, and 80% of their transactions are online. AI has predictive capabilities and can use this to personalize the digital banking experience for customers, as well as increase digital engagement across banking channels.

Global applicability: The ability to incorporate these AI systems into FI banking programs varies from country to country. For example, some countries have data protection laws in place that are stricter than others and thus prevent the usage of personal data. FIs must adhere to these regulations in order to comply with the laws set by their governments.

Takeaway

Banks are smart, but COVID-19 made them smarter. The pandemic has highlighted points of weakness—managing credit risks and optimization of services for current and prospective customers—and the necessity of artificial intelligence.

With AI assistance, FIs can improve their return on investment from consumer credit portfolios and provide a personalized banking experience for each of their customers. AIs systems also provide the digital-first experiences that many customers have come to prefer. These systems can help to maintain financial stability in an unstable economic environment and can lead to more seamless banking experiences.

To learn more you can access Brighterion’s How to Put AI in Your 2021 FI Business Plan