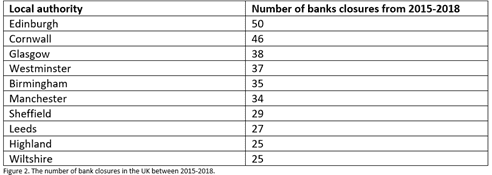

- Edinburgh hit the hardest with over 50 local bank branches closing between 2015-18

- Remote areas such as Cornwall and Wiltshire hit hard with over 46 banks branches closing in the past three years

- June marked the first-time debit card payments overtook cash as the most popular payment method in the UK

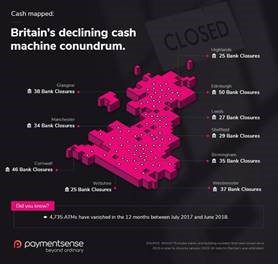

Research by card payment solution’s provider Paymentsense reveals that ATM’s are closing at an alarming rate across Britain.

Data from Statista shows that across the UK no less than 4,735 ATM’s have vanished in the past 12 months, which averages out at 394 cash machines closing every single month.

Paymentsense have created an infographic that visualises the number of cash machines that have been closed over the past year, which can be seen here.

Figure 1. Paymentsense Infographic to visualise the number of cash machines and bank branches closed between 2015-2018.

Luke Sam Sowden, a visually impaired lifestyle blogger based in Leeds, has faced a number of challenges recently and said: ‘’My local branch closed down due to a spate of burglaries and being visually impaired, I need a local bank with a physical location instead of just an ATM, like a lot of banks seem to be heading towards nowadays.

‘’In the end, I had to change banks, which despite being fairly easy to do thanks to the fast-track switch service, still took a lot of messing around as I had to memorise new account information and passwords, many of which hadn’t been changed for several years.’’

Research reveals that many banks around the UK have been closing their local branches over the past two years. Edinburgh and Cornwall have been the most affected with just over 50 closures:

But for the many that have embraced the cashless society and digital revolution, the prospect of more bank and ATM closures simply isn’t a concern.

Freelance copywriter Ellen Holcombe said: “I have seen a lot of cash machines and branches of banks close in my area, however, this hasn’t really impacted me. Most of the stores and services I use accept cards. I think we’re living in a world that’s going to be cashless very soon and I’m okay with that”.

With demand for cash machines falling and pressure on companies such as Link to keep specific ATMs running, it will be interesting to see how this plays out in the near future. If there’s one thing we can be sure of, however, it’s that cashless payments are going nowhere fast and will most likely only increase in popularity.

Guy Moreve, Chief Marketing Officer at https://www.paymentsense.co.uk said: “ Our research earlier this year highlighted that as a society, we’re now close to becoming cashless with contactless making up over 42% of all transactions. As you can see from our latest study ATM’s and bank branches are closing at an alarming rate’’.