These are all popular axioms we hear in the payments world. Depending on who you talk to, all of these can be true.

Lowcards.com recently published an article, 82% of Americans Still Carry Cash, which cites a J.D. Power Pulse Survey finding that the majority of consumers still use cash and that stores should be required to accept cash.

When asked if they carry cash, 82% of respondents said they normally have cash on hand, and 25% said they usually have at least $50 in cash. Surprisingly, cash was more popular than card payments: 67% of participants said they had used cash in the last week, while 61% said they had used a debit card and 54% used a credit card. Only 20% of consumers said they used a mobile wallet to make a purchase.

According to the Fed 2018 Findings from the Diary of Consumer Payment Choice, cash makes up roughly one in three transactions in the U.S. This article found that the bulk of cash transactions are for low ticket items.

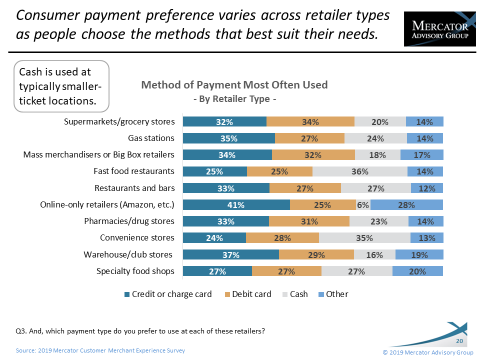

Mercator’s own findings back up this insight. This spring, in our Buyer Insights PaymentsTracker (formerly Customer Merchant Experience Survey) we asked 3,000 U.S. consumers the payment methods they use most often at a variety of merchant locations and, as the graph below indicates, cash is strongest at those locations that traditionally have low dollar volume transactions.

It is important to note that there are still consumers whose primary method of payment is cash. Often, these individuals feel it is the best way for them to manage their money. Further, there are also people who operate outside of the traditional banking system for whom credit and debit may not be an option.

It is important to note that there are still consumers whose primary method of payment is cash. Often, these individuals feel it is the best way for them to manage their money. Further, there are also people who operate outside of the traditional banking system for whom credit and debit may not be an option.

Another factor at play is illustrated in the graph above: Some consumers change their payment choice based upon the type of merchant they are shopping at. For some shoppers, the type of merchant, or even specific store, dictates what they take out of their wallet.

Cashs may be losing popularity, but news of its death is exaggerated.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group