Several interesting points here. This chatbot was designed specifically for Direct to Consumer companies and to engage customers using WhatsApp, Facebook Messenger, and Instagram.

It claims to steer the shopper to the most qualified products using sentiment and intent models and can complete the sale by using the same channel for checkout. Because it retains the history of the transaction it also uses the same channel to automate order tracking, returns, and complaints:

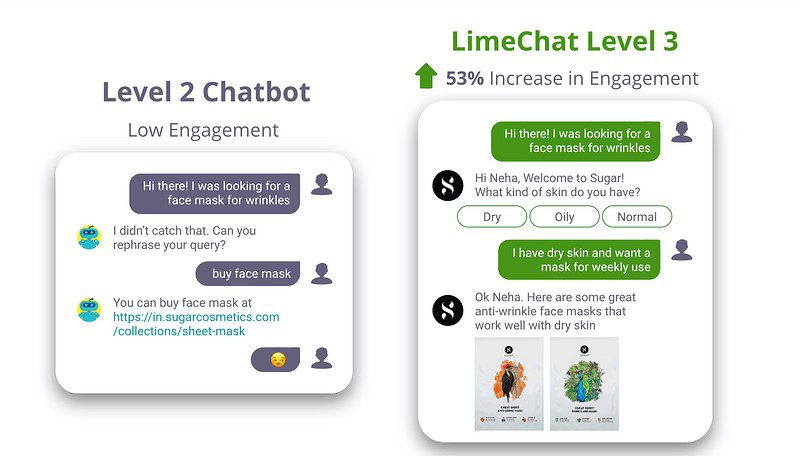

“Claims to provide a human-like shopping experience on chat mediums, Nikhil says, ‘This is because of our first-of-its-kind Level 3 AI chatbot technology, which can identify language, sentiment, and intent to deliver personalised and natural conversational experiences to customers.’

Most chatbots can only take in fixed predefined responses and are unable to answer questions that have not already been programmed.

The sales chatbot can provide a holistic buying experience on a website chat, WhatsApp, and Facebook Messenger.

Nikhil adds that LimeChat’s Level 3 bot can give a 53 percent higher engagement rate than a Level 2 bot.

‘We have launched several other offerings, such as remarketing campaigns on WhatsApp, customer support automation, granular analytics and an agent dashboard. To provide an end-to-end seamless experience to our customers, we have deep integrations across CRMs, store management platforms, payments networks, and logistics platforms,’ he adds.

How it works

LimeChat’s bot starts by engaging the users when they visit a client’s website to capture the buying intent.

Thereafter, it asks focused questions on the customer preferences to showcase the best products thereby giving a hyper-personalised shopping experience and reducing the time and effort required by the customer to research and make the decision.”

Overview by Tim Sloane, VP, Payments Innovation at Mercator Advisory Group