As online retailers kick into high gear this holiday season, they may want to pay special attention to one element of their customer experience— fraud prevention.

With fraud on the rise, most retailers have put complex and challenging fraud prevention solutions into play. Unfortunately, some of these tools get in the way of the seamless experience that shoppers are looking for. In fact, it may even drive them away.

That’s the upshot of an October Holiday Retail Shopping survey of 2,634 adults. Some 80 percent of those respondents said they plan to conduct at least half their holiday shopping online this year. More than 40 percent of shoppers said they plan to do most of their holiday shopping online.

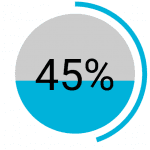

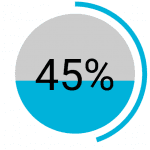

But 45 percent of respondents weighed in to say that additional validation requirements during checkout could be detrimental. Six percent said an overly complex identity verification process would cause them to have a negative view of the retailer. That’s why retailers need to employ processes that are both stringent and frictionless.

Fraud is on the rise

Retailers know they need to make fraud prevention a top priority. The e-commerce industry lost about $7 billion to chargebacks caused by fraud in 2016. That figure is expected to hit $31 billion by 2020.

U.S.-based merchants are a prime global target, drawing 52 percent of attacks worldwide. A recent National Retail Federation study found that the loss of inventory related to theft, shoplifting, error or fraud had a total impact on the overall U.S. retail economy of $46.8 billion in 2017.

Validation of credit card information is a major fraud prevention technique. TransUnion’s survey shows 50 percent of shoppers expect to use personal credit cards for their purchases. Another 5 percent plan on using retail-branded cards.

The popularity of e-commerce, credit cards and new digital touch points have prompted an array of fraud techniques. Those include card-not-present fraud in which criminals use stolen credit card information for online and phone-based sales, identity fraud and pagejacking, in which hackers direct consumers to an illegitimate website that asks for log-in info. The advent of artificial intelligence has upped the ante for both fraudsters and fraud preventers.

Cumbersome fraud prevention processes slow things down

Retailers need to go further though. If they don’t provide a seamless experience, then consumers will go elsewhere. A long and obtrusive identity verification process will cause them to flee.

Studies show that the majority of consumers abandon their online shopping carts. Often the cause is an overly complex checkout process.

False positives that turn legitimate customers away are another hazard for retailers. Such mistakes can reflect a rules-based process that can flag innocent attributes (like a new address for a shopper that has recently moved) as suspicious due to limited information. Even larger-than-expected purchases can trigger alerts. Imagine how the shopper feels at that point.

Aim for seamless identity verification

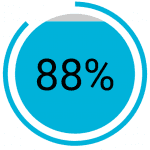

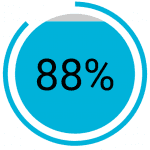

Retailers, your customers have spoken: Some 88 percent are willing to go through additional steps at checkout to ensure their safety. Sixty percent want retailers to protect both their account information and payment info. Forty-four percent will not shop with a retailer who has had a data breach.

When more than 77 percent of shoppers plan to purchase items online this holiday shopping season, retailers have a responsibility to protect their customers.

What’s clear from all the data is that retailers need strong fraud prevention, but, the kind that doesn’t get in the way. The way to achieve that is better data. Just as advertisers can size up a consumer based on their online behavior, effective fraud prevention solutions employ both historic and real-time data in a dynamic fashion. A comprehensive system can also look at attributes of the device itself like location and reputation.

For retailers finding that balance is a realistic goal. That’s why retailers need to put a user-friendly identity verification process on their wish lists this year.