These days, it seems like credit card processors that offer cash discount programs are popping up left and right. What’s less common is cash discount programs that are card-brand compliant. In fact, many of the current cash discount programs are actually surcharge programs in disguise.

Cash discounting confused enough people that Visa itself issued a bulletin to acquirers in October of 2018 outlining compliant vs. non-compliant cash discount programs.

In this article, I’ll go over cash discounting vs. surcharging and cite Visa’s bulletin to provide clarity on the rules surrounding compliant cash discounts.

Cash Discount or Surcharge?

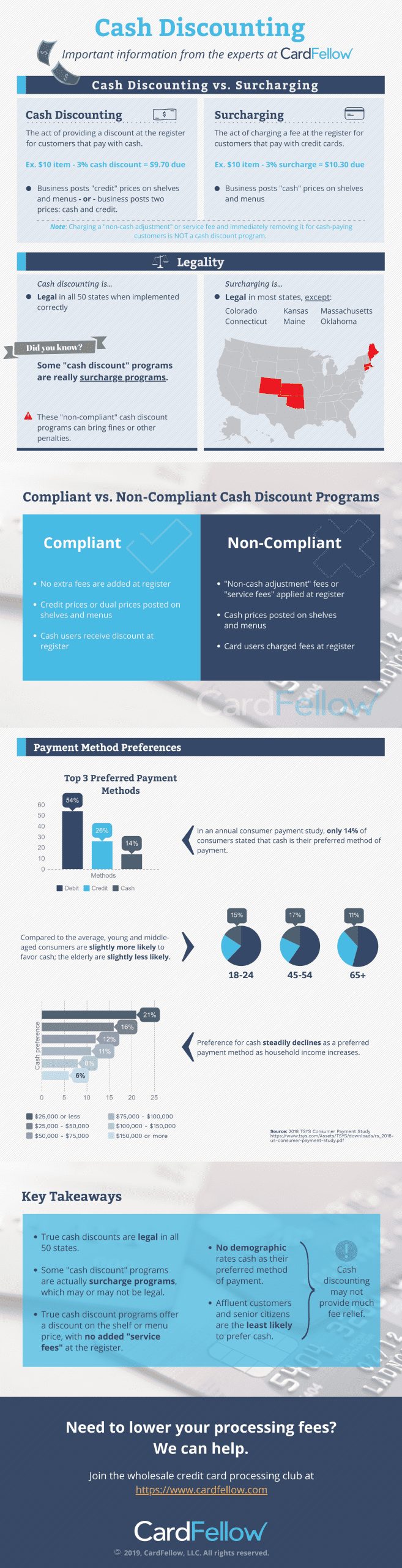

At the most basic, a cash discount is when a customer pays less than the shelf or menu price because they pay with cash. For example, if the shelf price is $10 and a merchant offers a 3% cash discount, the customer will pay $9.70.

A surcharge is when a customer pays more than the shelf or menu price because they pay with a credit card. For that $10 item with a 3% surcharge, the customer will pay $10.30.

Any tinkering with these scenarios doesn’t change the end result. A program in which merchants add a “service fee” or a “non-cash adjustment” that is immediately removed for cash customers is not a discount, as the customer did not pay less than the shelf or menu price. That is, there was no actual discount.

For example, if the shelf price is $10 and the merchant adds a 3% “non-cash adjustment fee,” the price goes to $10.30. The customer chooses to pay with cash, so the merchant removes the fee, dropping the item back to the original $10. No discount on the shelf price occurred. Instead, the customer simply wasn’t surcharged. “Not being surcharged” is not the same thing as “receiving a discount.”

What Visa Said

This issue of customers not receiving a discount is at the heart of the bulletin Visa issued. Visa explicitly stated that, “Models that encourage merchants to add a fee on top of the normal price of the items being purchased then give an immediate discount of that fee at the register if the customer pays with cash or debit card are NOT compliant with the Visa Rules…”

The bulletin goes on to state that posting two prices, one for cash and one for cards, is an acceptable method. The card brand highlights gas stations as an example of merchants than often employ dual price tags.

However, posting cash prices and charging a “service fee” that is immediately removed for cash customers is not a discount and programs that use that model are not compliant.

Does the distinction really matter?

It does, for three reasons.

- Adding a fee makes it a surcharge program. Surcharge programs are prohibited in a handful of states (including Colorado, Connecticut, Kansas, Maine, Massachusetts, and Oklahoma) which means improperly implementing a surcharge in those states could land merchants in legal trouble.

- Debit cards cannot be surcharged, in any state. Merchants that don’t remove the surcharge fee for debit cards can face fines or other repercussions.

- Engaging in a non-compliant cash discount program could bring repercussions from the card brands.

At the time of writing, Visa has not publicly fined or punished acquirers for non-compliant cash discount programs. However, it does have the right to do so. Should Visa decide to take action against non-compliant programs, it could leave processors and merchants facing fines and loss of merchant accounts.

It’s not worth the risk. Instead, merchants can implement compliant cash discount programs or elect to surcharge.

Compliant Cash Discount Programs

Cash discount programs needn’t be complicated. A merchant must post the credit price on shelves and menus (or utilize dual pricing, showing both the cash and credit prices) and then offer a discount from that price for customers that pay with cash.

When considering a cash discount program, merchants should look for programs that require posting credit prices and offering a discount at the register on that price. On the other hand, if merchants want to add a fee at the register, they should look for surcharge programs.

Spotting a Non-Compliant Cash Discount Program

Despite the confusion, it’s fairly easy to spot non-compliant cash discount programs. They are identified by:

- Requiring that a merchant post “cash” prices on shelves and menus

- Adding a “service fee,” “non-cash discount” or other fee at the register

- Immediately removing that fee for cash-paying customers

Regardless of what a processor calls the program, if it meets the criteria above, it’s not a compliant cash discount program.

Ellen Cunningham is the Marketing Manager for CardFellow.com, independent experts in credit card processing dedicated to helping merchants find the right fit for their business. She is an authority on subsets of merchant services, including cash discounts and surcharges, chargebacks, B2B processing, and more. Her insight and articles can be found in the CardFellow blog as well as in publications across a variety of industries.