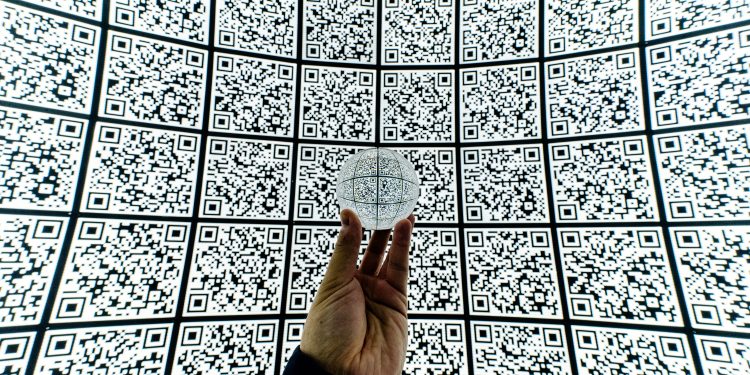

QR codes provide a radical change to payment acceptance, particularly in developing economies. Countries such as China and India embrace them as a low-cost tool towards financial inclusion. Instead of the typical payment acceptance device, merchants and consumers can trade on an inexpensive mobile phone.

Several central banks applaud the use of QR codes, and Indonesia is the latest to standardize QR code acceptance. Mobile World reports today:

- Indonesia’s central bank approved a standard QR code system, with mobile payment providers given until the end of the year to upgrade platforms to accept the new protocols.

- In a statement, Bank Indonesia said the introduction of a national standard for mobile payments would improve transactional efficiency and accelerate financial inclusion efforts in the country.

- Once rolled out, the QR code system will be used for transactions through mobile payment providers, electronic wallets, and mobile banking applications.

Here in the United States, QR codes gain traction with some top retailers. QR codes are less relevant as credit card issuers move towards contactless NFC, a competing technology, though several significant retailers built them into their mobile wallet or POS systems. You can find them at Walmart Pay, Target, Starbucks, Macy’s, Amazon/Whole Foods, 7-Eleven, and Dunkin Doughnuts, to name a few.

The current edition of Chain Store Age, a trade magazine, talks about 7-Eleven’s U.S. integration, which will link into the retailer’s loyalty system:

- To use mobile checkout, customers update or download the latest version of the 7-Eleven app, open the app in a participating store and tap “Get Started” on the home page, scan the product barcode to add it to their basket with automatically applied discounts or promotions, and pay for purchases using Apple Pay,

- A QR code appears in the app once payment tenders

- Customers then scan the QR code at the confirmation station to confirm your purchase. A tone lets the cashier know a customer has used the mobile checkout feature to make a purchase.

But everything is not wine and roses. Networks wonder if there is a power shift. Instead of a secure, controlled approach as found with NFC, QR codes shift control away from the payment networks. India is a perfect example of how the Indian Postal Bank might disrupt traditional banking with QR codes. FinTech News Singapore reports as part of the inclusion strategy, India is rolling out “doorstep financial services” in the remotest part of India. QR codes are a keystone of the process:

- This innovative model was made possible by the India Post Payment Bank (IPPB), a 100% government-owned public limited company under the Department of Post and was launched by India’s prime minister, Narendra Modi

- across the country, over 350,000 postmen are offering doorstep financial services to people in even the remotest parts of India.

- They are equipped with a mobile phone and a hand-held biometric scanner to perform tasks of bankers including opening savings accounts, transferring money, paying utility bills, top-up mobile phone, accepting cash deposits, and facilitating withdrawals.

- These have been trained and certified to provide banking services as well as to promote financial literacy in rural areas and are being given monetary incentives for both assisted and self-service transactions.

But the payments industry should watch out! India is also attempting to eliminate the merchant-side discount rate (MDR) at the point of sale, which India Times reported today. If this is the case, the payment card industry may have created a monster.

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group