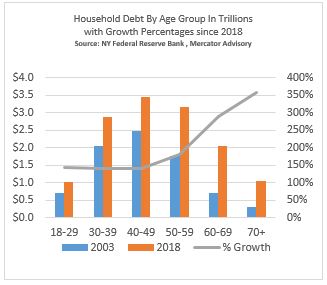

As a parent, you can look at the numbers and applaud millennials for their discipline in controlling debt, but it is best to be realistic and understand why. The reason for slow growth in the age group’s assumption of debt is more a result of their environmental factors as youngsters during the Great Recession than it is self-control. Using data from the NY Fed Study on Household Debt we see that household debt for the group aged between 18 and 29 years old grew from $700 billion to $1 trillion, a mere 42% increase during the 15 years between 2003 and 2018.

with Growth Percentages since 2018

Here is a good read from RetailDive, at trade rag that has some good thoughts about this age group.

- The demographic also has serious financial power. In the spring of 2018, omnichannel analytics firm Euclid released a report that revealed that millennials represent $200 billionin spending power and are soon projected to overtake Baby Boomers as the largest generation in the United States when it comes to purchasing.

- What millennials may not have, though, is a credit card. A 2016 survey by Bankrate.com revealed that only 33% of adults aged 18 to 29 own a card.

- Gaby Dunn, bestselling author and host of the “Bad with Money” podcast, explained that her generation is rejecting this form of payment because of what the group experienced at a young age. “I think we don’t understand them or we’re skeptical of them because we’ve seen our parents dealing with credit card debt and the economic recession in 2008 when we were impressionable

It is probably true that the shell-shock of unemployed family, foreclosed neighbors, or credit impaired parents left a mark on the 18-29 age group, but I’d say the CARD Act, also known as the Credit Card Accountability and Disclosure Act of 2009 probably had the most impact to this age group.

Gone are the days of the student market, which funded countless Domino’s Pizza and Budweiser parties. Parental sign-off on the child’s ability to repay is a buzz-kill.

With my parent-hat on, this is great news, or as Roger Daltrey said, the Kids are Alright, but my credit policy hat, it makes me wonder how our consumer-driven economy will look in 15 years when they are still paying off their student loans. This article at CNBC suggests that “60 percent of student debt borrowers expect to pay off their loans in their 40s.”

Talk about an early mid-life crisis.

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group