CNBC recently published an article with the headline: “Majority of Americans would try banking with big tech, Bain report says.” The article points to Americans’ willingness to buy “a financial product” from an established technology company.

According to the survey’s findings, 62% of Americans would buy a financial product from an established tech company and fully 75% of those aged 18-34 would do so.

Given recent announcements from Google and seemingly constant rumors of Facebook getting into the banking world, this Bain report provides a compelling argument for these companies to enter the complex world of banking.

Reading this article would lead one to believe that there is clear sailing into the banking world for these companies. However, we see some headwinds.

One of the critical factors in financial services is trust. Money is a subject near and dear to consumers, and they need to have trust in the institutions where they place their money. Trust is something that is earned and takes time to develop.

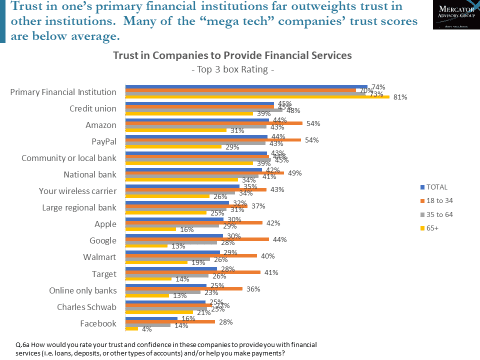

As part of our PaymentsInsights series, we ask 3,000 American consumers which brands they would trust to provide them with their financial services. As the graph below shows, consumers’ trust with their primary financial institution is significantly higher than any other company listed.

While Amazon and PayPal are above average—because consumers are already giving them money—Apple, Google and, particularly Facebook, are among the lowest rated brands. Younger adults are more trusting in these institutions, but they are more trusting in most institutions when compared to their older counterparts.

The lead sentence in the CNBC article reads “Most Americans are open to ditching traditional banks for big tech, according to a new report.” I think this might be a bit overly optimistic. The trust hurdle is a big one and often one that is the ultimate make or break when it comes to financial services.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group