In this release at Finextra we see that the Fed is now finally moving on its previously announced intention to adapt to ISO 20022 as the messaging format for Fedwire. COVID-19 related delays have slowed down this effort since it was announced in 2018. This would typically mean that the switchover might perhaps be in the 2023 range, although rather than occurring in stages, it would be a ‘big bang’ event, and possibly connected to the initial launch of FedNow. We have been tracking the need for banks to modernize their infrastructure, advising members through research, and this transition is one of the catalysts for such re-thinking of basic approaches to payments for many institutions.

‘The change will allow for enhanced efficiency of both domestic and cross-border payments, and a richer set of payment data that may help banks and other entities comply with sanctions and anti-money laundering requirements….The Board also invited public comment on a revised plan for migrating the Fedwire Funds Service to the new message format. Specifically, the Board is proposing that the Reserve Banks adopt the new message format on a single day, rather than in three separate phases as previously proposed.’

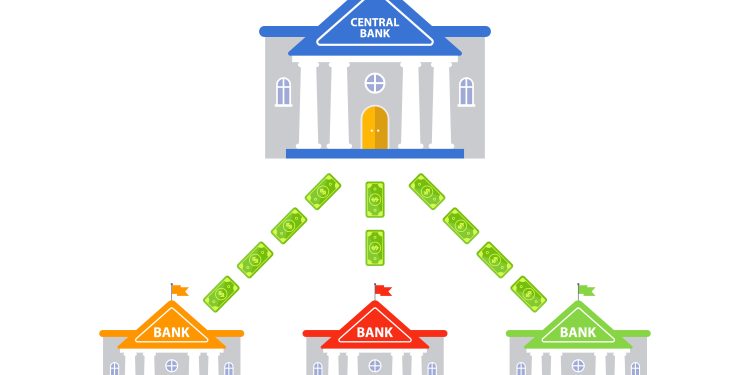

It was also previously announced that TCH (CHIPS) and the Fed were working together on the transition, which makes sense given the settlement accounts involved. Therefore, all users of these rails (which is any bank initiating a wire transfer, either directly or through a correspondent bank or other service) will need to start serious prep for the event.

‘The Fedwire Funds Service is a real-time gross settlement system owned and operated by the Federal Reserve Banks. It enables businesses and financial institutions to transfer funds quickly and securely….The ISO 20022 format was developed by the International Organization for Standardization, which is an independent, non-governmental organization that publishes standards for a broad range of industries….Comments are due 90 days after publication in the Federal Register, which is expected shortly. ‘

Overview by Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group