Many businesses dedicate significant time and effort to fighting fraud prior to a transaction being authorized. To keep fraudsters at bay, many businesses have fraud mitigation in place that checks email addresses with IP addresses and analyzes a breadth of data. When sales go through, and businesses believe the money is in their pocket, they often assume they will get to keep that money, without considering the possibility of post-authorization disputes.

What some businesses do not realize is that a customer account could have been fraudulently taken over, or there could be an issue with the order that was never intended. Businesses without post-authorization processes that manage transaction disputes could lose a lot of money. With the correct controls in place, these costs can be avoided.

To talk about the importance of post-authorization dispute management, PaymentsJournal sat down with Scott Adams, VP of Friendly Fraud at Kount, an Equifax Company, and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

Opinions expressed are those of Brian Riley are from Mercator/his expert opinion and not necessarily those of Kount, an Equifax company

The true cost of transaction disputes

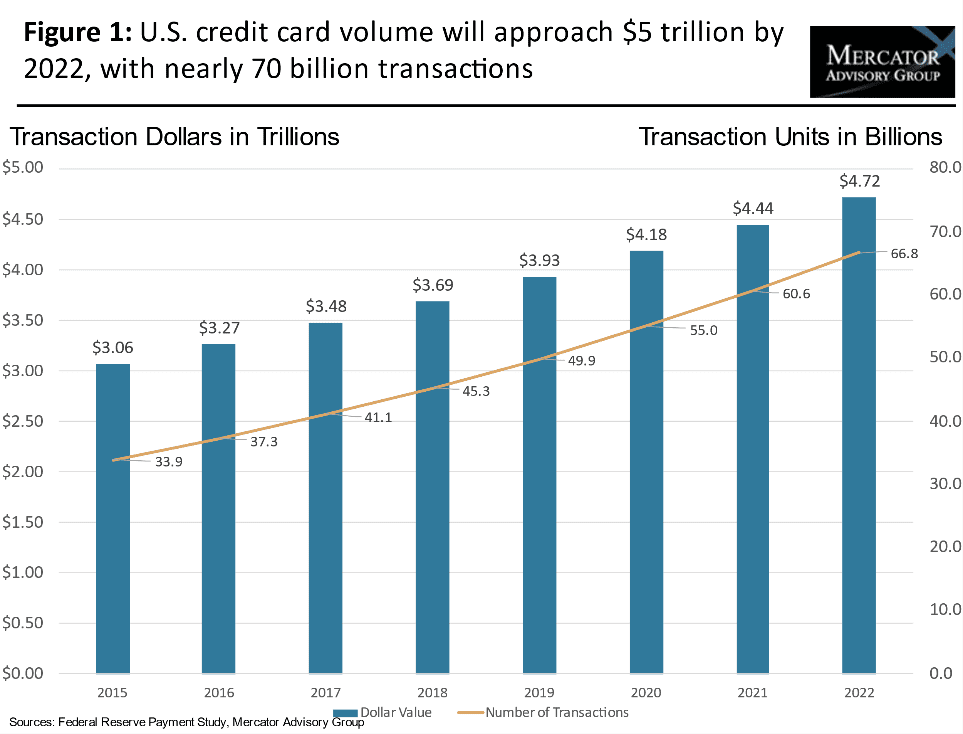

According to a Mercator Advisory Group study, the United States had 25 million disputed transactions in 2019. By 2022, this volume is estimated to grow to over 33 million. The rise in chargebacks is linear to the number of accounts conducting card transactions, which is shown in the chart below:

The fact that improvements in online and mobile banking have made it easier for cardholders to dispute transactions has accelerated the increased volume of transaction disputes. Further, as consumers switch from cash to cards for payments, the number of small transactions is increasing. These small transaction disputes can ultimately cost as much as larger transactions to resolve. As a result, disputed transactions are a growing problem for merchants and issuers.

These costs are often pushed onto merchants themselves. “The bank side [of a transaction] is very sophisticated in how they [manage disputes]. They want to review these and reconcile them and push them back into the merchant area,” explained Riley.

Merchants without adequate chargeback management solutions in place suffer the consequences of this pushback. “You’re [just] not adequately prepared to position yourself to reduce your chargebacks,” Riley added. “If you’re a merchant or an issuer, you need an automated process that takes you through this whole settlement of a transaction.”

With the correct controls in place, businesses can avoid dispute costs

Dispute management processes have historically been inefficient and costly. Traditionally, customers had to call their card issuer to report problems regarding transactions. A lack of access to information regarding transactions led issuers to default to issuing chargebacks. With modern controls in place, data can be used to prevent many disputes from turning into chargebacks.

Tools like Kount’s Dispute and Chargeback Management solution help businesses avoid chargebacks and revenue loss from friendly fraud, criminal fraud, and legitimate disputes.

For example, customers calling to dispute a transaction sometimes simply don’t recognize it as a purchase they legitimately made. With a little clarification, a chargeback can be avoided entirely. “Maybe the customer just didn’t recognize the name of the company. [Kount] can provide clarity around the purchase, whether that be the date, the time, whose name was on the purchase, or even deeper insights into what was purchased,” said Adams.

If the customer still does not recognize the charge, Kount can work with both the merchant and customer to resolve the issue, whether it be through a refund or other means that takes care of the customer’s needs without escalating the situation to a chargeback.

Kount provides issuers with information such as an itemized shopping cart, the recognizable name of the merchant, and other transaction data. The result is that consumers can have real conversations with well-informed issuers. “It gives [issuers] enough information to really collaborate with everybody in the mix and try to stop those chargebacks that do not make sense,” added Adams.

Chargeback tools make an immediate difference

By using dispute and chargeback management solutions like Kount’s, merchants can benefit almost immediately.

“In the past, the first thing [merchants] would set up is some sort of anti-fraud pre-authorization, and that’s great, but [it] doesn’t really affect [their] chargeback rate today; it affects it a month or so from now,” said Adams. With the use of insightful data, this no longer has to be the case. “The really cool thing is that with the speed of chargeback management, you are able to… prevent a chargeback today. It does not have to wait weeks and months.”

Features such as near real-time notifications that alert businesses of incoming chargebacks enable them to prevent further losses by halting shipments. Merchants can also use information about the incoming chargeback to adjust their fraud policies, preventing similar chargebacks in the future.

“This stuff is really a game changer. I think we are really at a turning point, and we can stop and lower the chargeback rates really fast. And that is really not something that we had in the past,” concluded Adams.