In their article on the a16z blog, “The CFO in Crisis Mode: Modern Times Call for New Tools,” Seema Amble and Angela Strange call for a new round of financial technology (fintech) innovation aimed at the corporate finance function. They envision a future in which fintechs deliver intelligent solutions that rely on data capture across the enterprise.

They also recommend ways that companies can make better financial decisions. It sounds like a worthy effort. As they point out, today’s CFO is expected to be highly strategic. But does that always have to mean undertaking Transformation with a capital “T?” Right now, it might be better to focus on opportunities for incremental change.

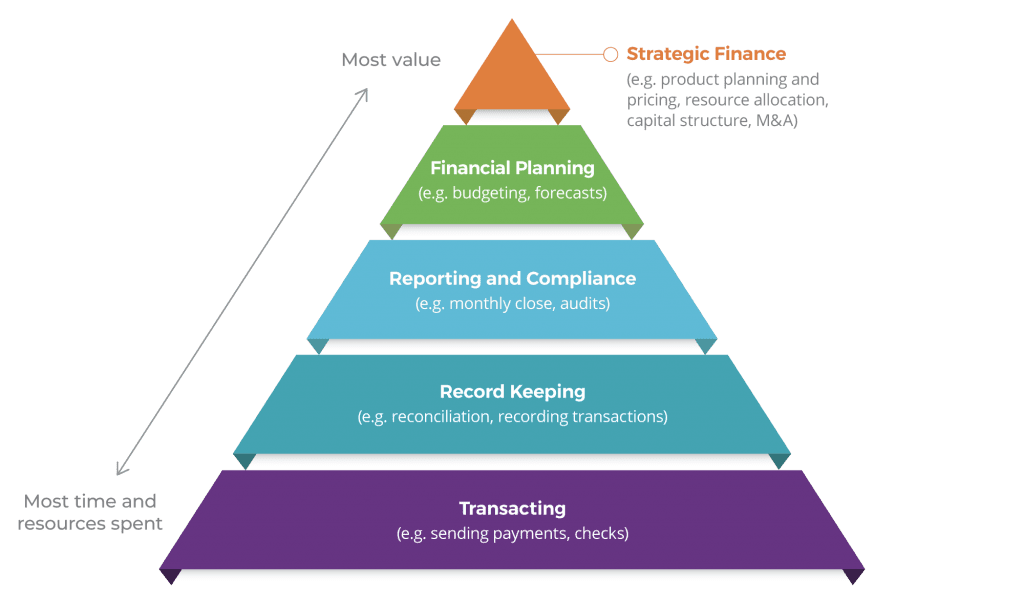

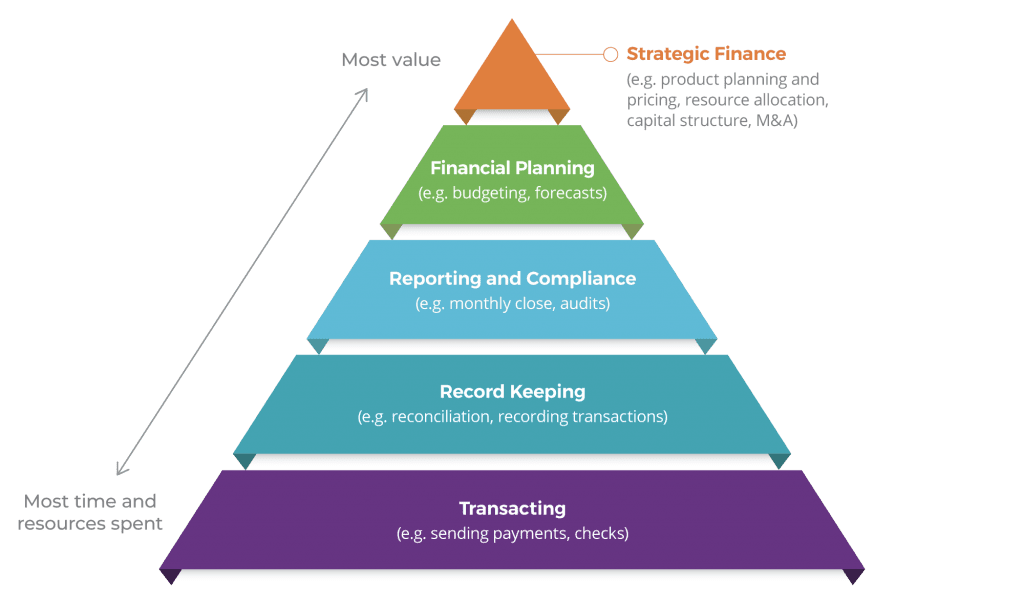

A recent survey of 225 CFOs at global companies found that nearly half have not completed any digital transformations. There are still significant efforts devoted to manual transactions in most finance departments—such as sending payments. Only a relatively small effort is going towards strategy, as Amble and Strange perfectly illustrate with the above image.

It’s not for lack of budget. According to the survey, the two greatest challenges to digital transformation are a lack of technological skills and internal resistance to change. Budget issues were the lowest-rated challenge.

To overcome those challenges, companies create titles like Director of Finance Transformation, Global Finance Digital Transformation, and Senior Program Manager for Finance Transformation. The people in these roles specialize in upgrading their businesses as simply and non-invasively as possible.

The Meaning of Transformation

If you look up synonyms for the word’ transformation,’ they include ‘metamorphosis,’ ‘revolution,’ and ‘radical change.’ The problem is that when people think about introducing new technology to finance this way, they tend to think about solving big problems at the top of the pyramid—for example, their ERP solution. When they’ve exploited that as much as they can, they move down the pyramid. They’re primed for Transformation (with a capital ‘T’) to be massive and arduous and disruptive, that they’ve missed the smaller, transformative opportunities that aren’t nearly as disruptive. I have yet to see a title like Senior Director of Incremental Change on LinkedIn, but maybe there should be. Incremental change is a lot easier, and it can have an outsized impact.

Those opportunities are found at the bottom of the pyramid, where people are mired in small, tedious problems that add up—especially as a company grows and adds headcount. Opportunities here tend not to attract the attention of the Transformation crowd because of their size. They’re not viewed as strategic. Automating payments is one such opportunity at this level, and fintechs are already on it.

There’s a huge amount of manual effort that goes into making payments. It’s not just the writing of checks; it’s enabling suppliers, making supplier data changes, reconciling, and resolving payment errors. Taking advantage of the right fintech software can reduce the effort it takes to maintain these projects—and with just a few hours of IT time.

There’s little or no integration required—all you need is a payment file from your ERP or accounting system to map to. The right fintech partner will do that mapping, as well as most of the project’s heavy lifting.

By adopting this technology, companies go a long way toward shrinking the heavy foundation at the bottom of the pyramid and redirecting that effort toward more strategic initiatives.

Regaining Control

It’s not just about reducing or eliminating manual transactions. It’s also about visibility and control.

Every finance leader is hyper-focused on cash management. Cloud-based payment automation shows you where your liabilities are and simplifies the payment process—one that only requires a few clicks of the mouse. You have full visibility into the entire payment flow, regardless of payment type, at all times. Payment data is consolidated into an electronic format, so it’s easier to present the information to company leadership, FP&A, and auditors.

It’s time to think smaller and start at the bottom of the pyramid. We don’t have to wait for the next wave of fintech innovation. Companies can cut the time and cost of making payments by about 70 percent by chipping away at the pyramid’s lower sections. There are also opportunities to relieve your team from the worry of payment fraud while turning accounts payable into a revenue generator.

Understanding What’s Available

Very few people know about fintech payment automation or really understand what it does for their back-office operations. Market penetration is still in the single digits, and most companies make payments the old-fashioned way—by sending payments directly through their banks.

It’s hard to believe change can be so easy. Perhaps it’s because we associate change with a need for a seven-figure budget, an army and consultants, and a year of dedicated time. But that’s not necessarily the case anymore. If I could sidle up to these Directors of Finance Transformation, I’d ask them: “Are you looking for ways to increase throughput and reduce risk without upending everyone’s current processes? Have I got a project for you.”