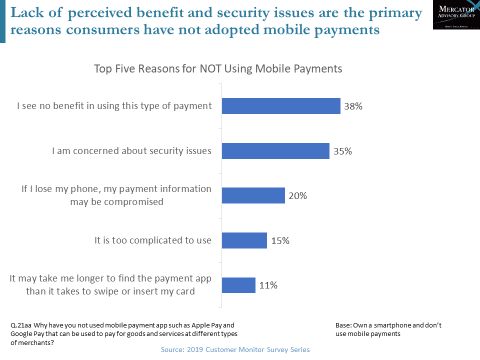

Are mobile payments a solution in search of a problem? One could argue that many consumers in the U.S. believe this. In a recent survey of 3,000 consumers conducted by Mercator, nearly four in 10 (38%) reported that they see no benefit in using mobile payments. A similar proportion had security concerns.

Despite the perceived convenience among the digirati and, claims of increased security via tokenization (in some apps) a sizable proportion of the U.S. population “ain’t buying it.”

There finding are confirmed in a recent report from the Pew Charitable Trust Are Americans Embracing Mobile Payments? In this excellent report, their finding also point to consumers not seeing any persuasive value in switching from the current way they pay for things compounded by security worries.

In part because of this lack of confidence—and the established history of positive experiences with traditional cards—mobile payment adoption has not met industry projections, even as e-commerce in general has seen strong growth in recent decades. Another possible factor is that mobile payments rely on the same underlying financial systems as traditional methods, which as some industry analysts have noted, means they are not yet able to offer consumers a meaningfully faster or more seamless transaction experience.

The slow adoption of mobile payments has been well documented. If those who are involved in mobile payments want to increase adoption they are going to have to create a more compelling value proposition for consumers.

If that weren’t a difficult task enough, they also have to battle the changes and confusion consumers have faced as they have been forced, in recent years, to move away from the tried and true “swipe” method of paying at the POS, to the “dip” and “wave” technologies that, again, have no discernable value to the consumer.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group