Fingerprint Cards (Fingerprints™) today launched its Touchless 2.0 platform, combining the convenience of face recognition with the security of iris, to meet demand from smartphone and emerging IoT OEMs.

The new platform – which can be leveraged independently or as part of a multimodal biometric authentication solution together with fingerprint touch sensors – enables an improved user experience that works indoors or outside, in daylight or in rain. Fingerprints’ touchless solution is beneficial for multiple use cases including mobile devices, payments, automotive and access.

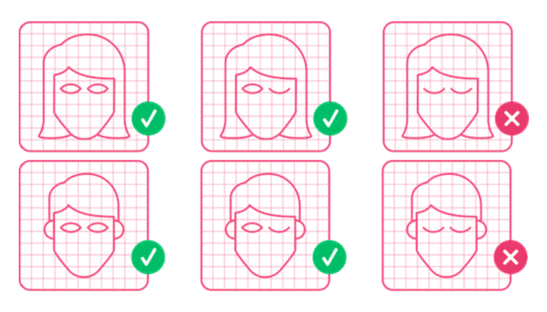

By combining iris and face recognition, Fingerprints’ Touchless 2.0 solution grants end users the dual benefits of proven security and greater convenience. The new software platform has three times better FRR* than the previous generation and works from a comfortable distance of up to 50cm without the need for visual feedback (i.e. no guide that face and eyes need to be placed within).

“As a company at the forefront of biometric innovation, we are constantly looking to develop and improve our products,” says Pontus Jägemalm, CTO at Fingerprints. “Iris recognition is a proven way to securely authenticate a user and by combining it with face recognition, our improved touchless portfolio now seamlessly balances trust with convenience, regardless of the form factor it’s deployed in.”

For more information about Fingerprints’ touchless platform, visit the website.

*FRR = measures how often the biometrics will wrongfully reject the valid biometric in the matching algorithm

About Fingerprints

Fingerprint Cards AB (Fingerprints) – the world’s leading biometrics company, with its roots in Sweden.

We believe in a secure and seamless universe, where you are the key to everything. Our solutions are found in hundreds of millions of devices and applications, and are used billions of times every day, providing safe and convenient identification and authentication with a human touch. For more information visit our website, read our blog, and follow us on Twitter. Fingerprints is listed on Nasdaq Stockholm (FING B).