We live in a world full of possibilities, but they’re not always open to everyone. While the number of women entrepreneurs worldwide has grown over time[1], women looking to start businesses still struggle to obtain adequate resourcing – funding, logistics and industry knowledge. According to the World Bank, 45 percent of the world’s economies have laws constraining women’s ability to join and remain in the labor force. So, what sets the more supportive economies apart, and where do women entrepreneurs thrive? Better understanding how to close the gender equality gap between markets will move us all forward.

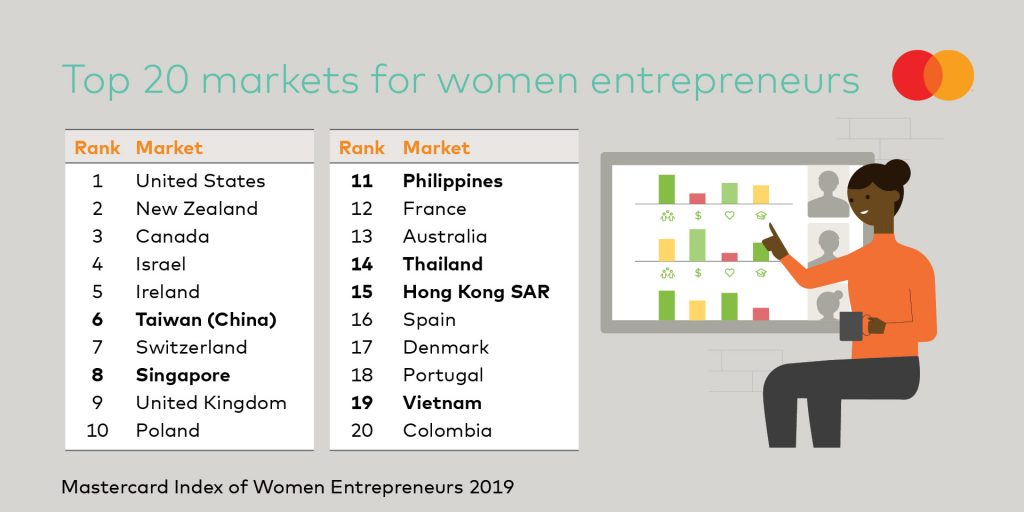

The recently launched Mastercard Index of Women Entrepreneurs[2] (MIWE) delves into publicly available data[3] to track the progress and achievement of women entrepreneurs and business owners in 58 societies around the world which represent 80 percent of the global female workforce. To devise the rankings, markets are assigned scores based on multiple indicators covering Women’s Advancement Outcomes (such as labor force participation rates), Knowledge Assets & Financial Access (i.e. tertiary education enrollment, inclination to borrow or save money for business, support for SMEs) and Supporting Entrepreneurial Conditions (such as ease of doing business, cultural norms and governance, etc).

Critically, what the Mastercard Index reveals is that gender inequalities related to wealth, entrepreneurship, society and culture are often expressed differently in each market – and it’s important to know what those differences are in order to help close the gender gap effectively. Therefore, the challenge for companies, governments and partner institutions lies in how we can work together to balance these factors to create conducive environments that enable women entrepreneurs to grow and thrive, advancing entire economies in the process.

Money isn’t everything

When viewed from a regional perspective, the results indicate that worldwide, the Middle East & Africa, followed by Asia, provide women entrepreneurs with the least amount of support as compared to other regions. However, six of the top 20 MIWE scores belong to Asian markets, pointing to diversity in conditions between them. That presents a great case study on the enabling factors that contribute to cultivating female entrepreneurship, and also highlights which factors have little to no effect.

For example, living in a place with a high-income economy certainly helps aspiring women entrepreneurs. One-third of the Asian markets that rank in the top 20 are high-income economies, including Taiwan, Singapore and Hong Kong SAR. These places offer access to better education, more financial assets and overall more conducive conditions to nurture a business.

However, income only tells part of the story. Though not designated as high-income economies, Thailand, the Philippines and Vietnam all exhibit high MIWE scores. Meanwhile, high-income markets South Korea (36th) and Japan (46th) are notably absent.

Distinguishing necessity from opportunity

Another key finding from the Index is that favorable entrepreneurial conditions and high income aren’t always necessary pre-conditions for female entrepreneurship. If participating in the traditional workforce can meet employees’ needs (with a decent salary and working conditions), they may not feel the need to start their own businesses, especially if starting that business involves barriers beyond their control, such as access to credit.

Women become entrepreneurs for many different reasons. One impetus is opportunity – they have ideas for how to improve an industry and have confidence in their ability to make an impact. Another motivator is necessity – for whatever reason, owning a business may be more practical in the long run, perhaps due to lack of support for women’s participation in the traditional workforce, or lack of access to the necessary education to join the labor force.

While MIWE shows that generally more women entrepreneurs start their own businesses due to perceived opportunity rather than out of necessity, a deeper dive into the results reveals that it is some of the lower income economies that exhibit some of the highest rates of female business ownership. For instance, Vietnam ranks 20th for female business ownership, while Singapore, which has the 8th best conditions in the world overall for female entrepreneurs to thrive, ranks only 24th on this specific metric.

Social values can make or break female entrepreneurship

While gender inequality persists across the world, it manifests in different ways – through restricted access to education, fewer financial options, less representation in the workforce and more. Notably, women living in places that provide easier access to resources like higher-level education and support for SMEs may still decline to start a business or assume a leadership role if cultural or societal norms discourage them from working, showing ambition or instil a greater fear of failure.

For example, while MIWE shows that India stands out as a prime market for business ownership, producing high proportions of innovative entrepreneurs, only seven out of every 100 business owners are women.

So how do we help? A key area for impact lies in financial resources, where improved access can help women regardless of where they live to start a business and gain more independence. Keeping women in mind when designing policies and solutions in formal finance can go a long way towards inclusive growth for women. That means making sure that women, regardless of income level or opportunity, can access formal financial resources like bank accounts, credit and insurance. We can also help to provide training around how to use these financial resources, and education on the benefits they provide to not only sustain livelihood, but also to build it.

Download

the Report: https://newsroom.mastercard.com/wp-content/uploads/2019/12/Mastercard-Index-of-Women-Entrepreneurs-2019.pdf

About the author

Julienne Loh, Executive Vice President, Enterprise Partnerships, Asia Pacific, Mastercard

Julienne Loh is Executive Vice President of Enterprise Partnerships for Asia Pacific. In this role, she drives partnerships across new industries with a focus on growing Mastercard’s global cities, travel and tourism, trade and business development initiatives across the region. Prior to this, she held various leadership roles in Core Products and Global Products & Solutions. Earlier, she was the Country Manager for Singapore. Julienne has been with Mastercard since 2005 and is a member of the Women’s Leadership Network at Mastercard.

[1] The World Bank, Female Entrepreneurship Resource Point

[2] MIWE defines an “entrepreneur” as someone who runs a business that employs at least one other person.

[3] Data comes from organizations including International Labour Organization, UNESCO, Global Entrepreneurship Monitor, World Bank and World Economic Forum.