The pandemic has impacted nearly every aspect of people’s lives. Employees are working at home, mental health is becoming top of mind as widespread isolation continues, another round of stimulus payments is being discussed, and shoppers are choosing e-commerce sites over physical brick & mortar stores.

Additionally, as many know, it has had a dramatic impact on the payments industry, shifting consumer preferences for payment methods evolving from traditional modes of payment to ecommerce payment methods. This has accelerated the need for financial organizations to adapt to new consumer demands and accelerate payments innovation.

These topics and many more were discussed in-depth in a recent webinar hosted by PaymentsJournal, titled “How Digital Acceleration Will Affect the Payment Industry?” The webinar featured three guest speakers: Sankar Krishnan, Executive VP of Strategy and Corporate Development at Capgemini Financial Services, Abdeslam Alaoui, CEO at Hightech Payment Systems (HPS), and Tim Sloane, VP of Payments Innovation at Mercator Advisory.

Lessons learned from the pandemic

When asked about the lessons learned during 2020, Alaoui listed three key takeaways:

- The customer relationship has become virtual.

- Now more than ever, cash is the enemy.

- There is more flexibility with national digital sovereignty, as new organizations and geographies open themselves up to cloud usage.

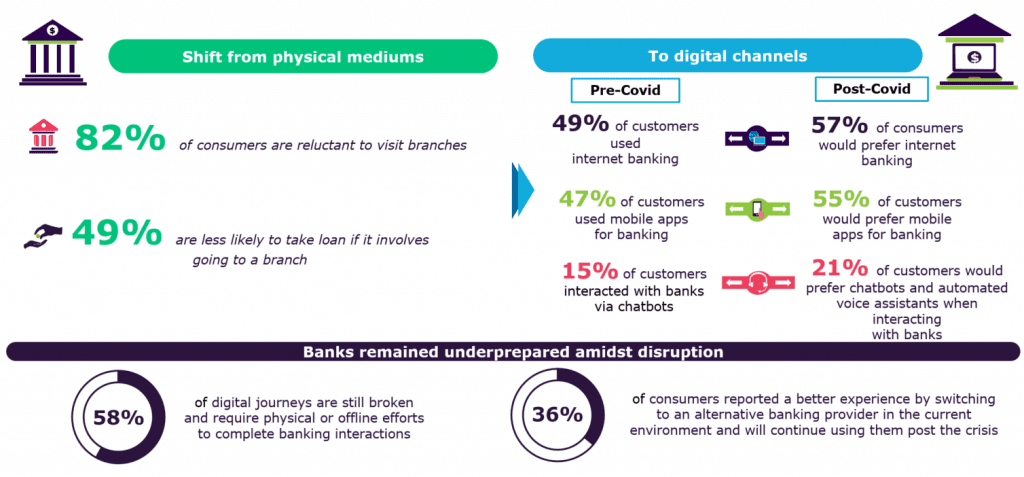

The chart below, provided by Capgemini, highlights just how much consumer behavior changed due to the pandemic. Broadly, consumers are wary of physical mediums and have largely migrated to digital channels like internet banking, mobile apps, and chatbots:

Even so, many banks remain underprepared for this disruption, with over half of banking digital journeys requiring physical or offline efforts to complete. In other words, it’s time to modernize payment systems to meet the demands of the new normal.

Banks recognize the need to prioritize modernization

COVID-19 has impacted every player in the payments ecosystem. “The entire ecosystem has really paved the way for a lot of modernization… [we’re] definitely going to see a more evolved payments ecosystem or more transformed ecosystem,” said Krishnan.

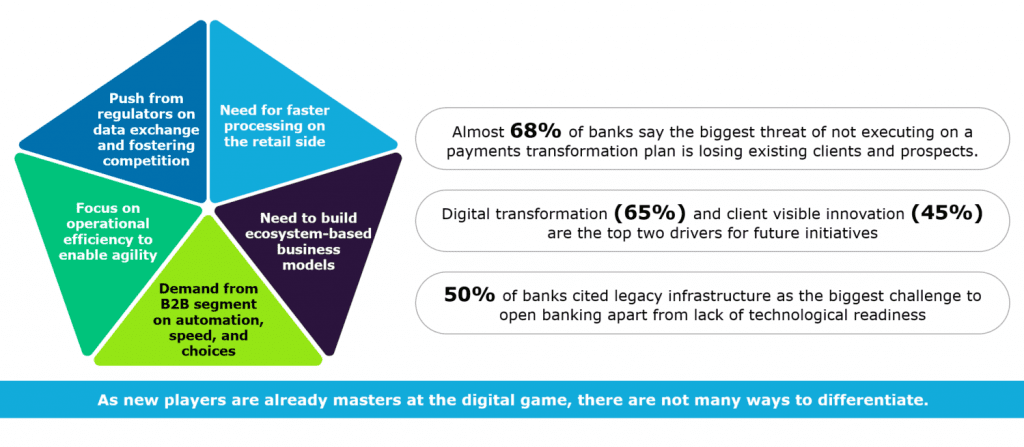

Financial institutions understand the need for digital transformation, with nearly seven in 10 banks saying the biggest threat of not executing a payments transformation plan is losing existing clients and prospects. Digital transformation is a top driver for future initiatives, and half of banks see legacy infrastructure as one of the biggest challenges to open banking:

“The main lesson that we learned, like everybody else, [is] we are here to serve our customers,” Krishnan added. Oftentimes, modernization efforts are necessary to best serve them.

Focal points when modernizing payments ecosystem

Adapting to the new normal will require implementing a digital transformation strategy to keep up. There are a few focal points organizations should keep in mind when planning modernization efforts.

Above all, the user experience should remain in the center. This means implementing simple, seamless, and secure features that consumers want, such as contactless and electronic payments.

Simplicity can be achieved either with system consolidation or the usage of stackable technologies, which improve business agility by increasing speed to market. “So, [with] the simplicity in this business, you continue to have a big waterfall and enable multiple iterations of that product to reach the customer,” said Alaoui.

Ultimately, successful modernization begins with a holistic look at the end-to-end payments value chain, from client initiation to clearing and settlement. Determining the technology stack is extremely important to ensuring technology platform uniformity and achieve cost efficiency.

The takeaway

2020 brought the world into a new era, and modernization is now table stakes for banks. In Sloane’s words, “the world is changing. There are huge opportunities if you change with it, and it’s probably going to eliminate your business if you don’t.”

In the webinar, Krishnan, Alaoui, and Sloane provided insight into several additional questions surrounding digital transformation and modernization efforts, including:

- What are the focal points when modernizing payments ecosystems?

- What are some “quick wins” to modernize legacy systems without disrupting related operations?

- How can firms accelerate payments innovation while maintaining profitability in the longer run?

- How can an open platform help all payment stake holders come together to deliver the best experiences to their customers?

Fill out the form below to access the complimentary webinar: “How Digital Acceleration Will Affect the Payment Industry?”