It has been said many times before, but it continues to ring true: the unprecedented COVID-19 pandemic has fundamentally changed consumer behavior. Accurate, timely payments and transaction data is the best mechanism to track these changes in real time to understand how consumers are reacting to the pandemic.

Companies across a number of verticals, including banks, fintechs, retail, investment, government, academia, and consultancy, can use this data to unlock valuable, actionable insights into consumer behavior to enable better organizational decision-making. Payments companies and financial institutions with access to transaction data are understandably hesitant to share data due to concerns surrounding compliance, consumer privacy, and security risks, but are losing out on a valuable source of revenue by not doing so.

Sharing data does not have to come at the expense of security. Rather, there is a way to leverage the valuable insights found within typically highly confidential transaction data while protecting the privacy of consumers and meeting regulatory requirements.

To further discuss the value of transaction data and how it can be securely monetized and leveraged to amplify organizational decision-making, Facteus and Mercator Advisory Group partnered up to host a webinar, Payments & COVID-19: How Transaction Data is Leading the Way Through the Pandemic and Beyond. The presenters were Randy Koch, CEO at Facteus, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

The data types traditionally used to understand market trends aren’t cutting it

While public data released by the government does have value, it’s often insufficient in helping businesses understand what their next steps should be. This is largely because there are significant delays in releasing the data; for example, the U.S. Census Bureau released data for April 2020 at the end of May. Other types of data lag behind even further, with GDP monitoring being released just once per quarter.

Further, much of the data made available to the public centers around the stock market, which means there is an emphasis on investor behavior—not the consumer behavior that directly impacts merchants and businesses on a daily basis.

Government agency data tends to lack granularity, too. The U.S. Census Bureau has released overall consumer spend data on “retail and food services,” but as Koch put it, “retail and food services is an extremely large territory—too large to identity [COVID-19’s] impact on specific trends, like fast food versus restaurant spend.”

Additionally, data from government agencies is generally collected by surveys, which are less accurate, more biased, and riddled with additional delays. Understanding payments in real-time can be a game changer for businesses looking to thrive amid the pandemic and beyond, making the current system of providing data ineffective.

Access to improved financial data delivers actionable insights to businesses

Shifting towards the use of accurate, timely data enables businesses to make better decisions based on what’s going on in the market.

“Payments and financial data is by far the most valuable data in the U.S. economy.”

Randy Koch

For example, the data company Facteus has data from over 50 million transactions per day. This data reveals trends and inflection points that businesses can use to target consumer demographics, improve online offerings, and choose appropriate partnerships, among other benefits. Some of the most prevalent trends Facteus has observed throughout COVID-19 are the growth of e-commerce, changing generational behaviors, specific vertical and industry growth and decline, and inflection points in consumer spending activity. The webinar includes several additional examples, specific data, and graphs to explore the trends further.

Synthetic data: A solution to data sharing that doesn’t compromise security

Despite the clear value that timely consumer transaction data offers, financial services and payments industry participants are nervous to utilize it due to concerns over data privacy regulations like the General Data Protection Regulation (GDPR). Compliance teams are quick to shut down any opportunity that involves sharing data because of these concerns, but that doesn’t have to be the case.

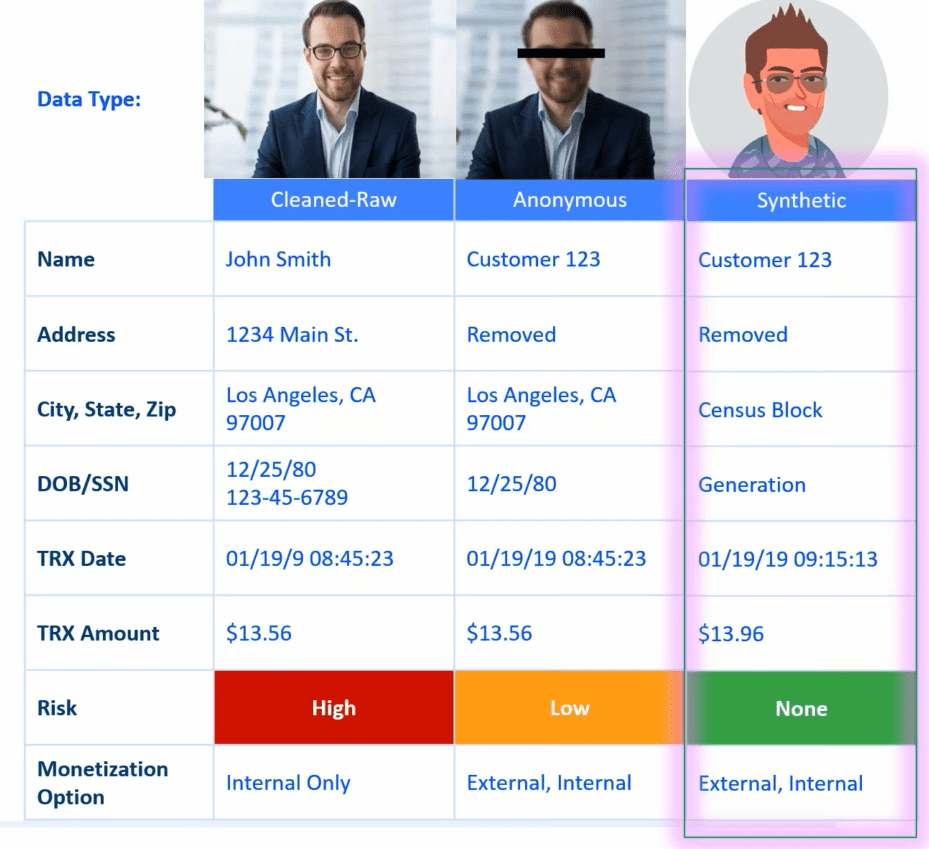

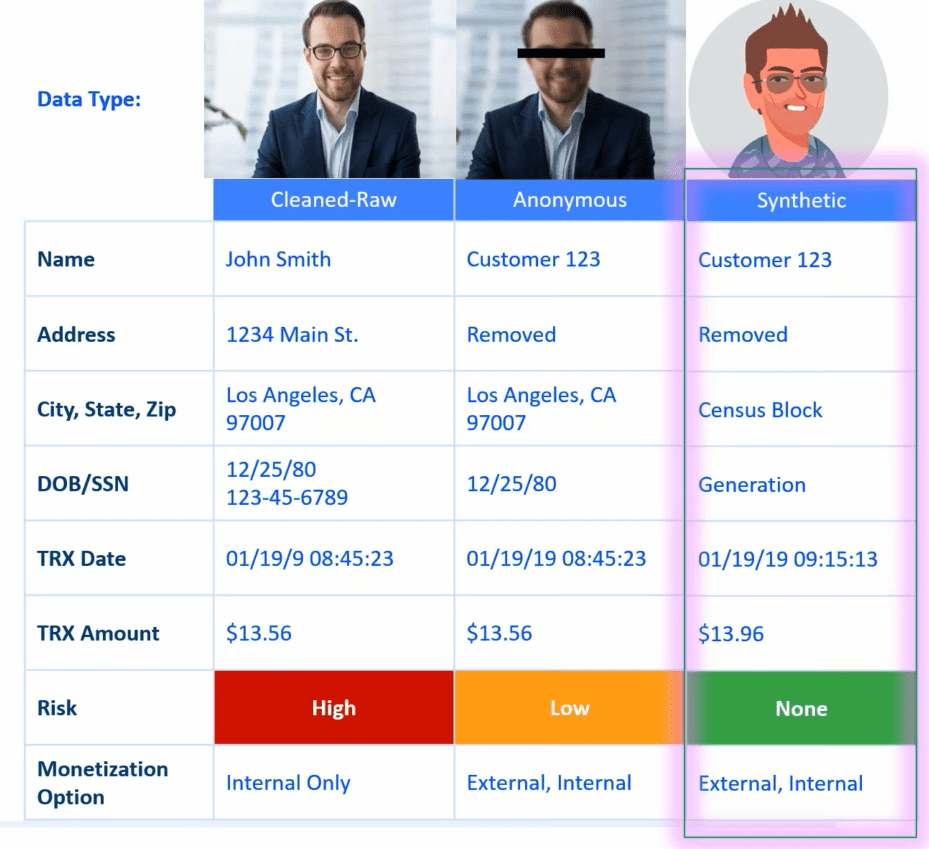

In fact, there is a solution that allows institutions to not only share, but monetize and generate revenue from data without compromising compliance, legality, or security: synthetic data. Synthetic data is a breakthrough data type that revolves around manipulating an authentic data set so all of the overall totals and values of the set are preserved, but are stripped of any personally identifiable information (PII) that can lead back to a particular individual or business:

In the webinar, Sloane and Koch dig deeper into what synthetic data is and how it works, and also provide numerous examples of how businesses can monetize data both internally—such as using data insights to improve the customer experience—and externally—such as selling data insights to external partners.

With synthetic data, “we have all the mechanisms to ensure that the data is secure and can be aggregated to protect both financial institutions and individuals themselves,” concluded Koch.

Conclusion

Ultimately, consumer transaction data can be used as a source of “truth” that is incorporated into business and investment strategies. In addition, securely sharing transaction data can be used as a revenue generating proposition and help inform the economy. Synthetic data is a way to do so securely.

For a significantly more in-depth dive into how COVID-19 has changed the consumer economy, the power of transaction data, and how financial data can be monetized securely, access the complimentary webinar, Payments & COVID-19: How Transaction Data is Leading the Way Through the Pandemic and Beyond, by clicking below.