Interchange, Interest, and Inflation are three factors that affect credit cards. Interchange typically generates 20% to 30% of credit card issuer revenue, and when purchasing habits shift from credit to debit cards, there is an industry loss. Interest, the lifeblood of credit revenue, has been held at historically low rates to protect the economy and the U.S. Household, but that is likely to rise soon. These issues will affect every cardholder in America, with higher minimum dues.

Now comes inflation. Rising prices will increase credit card spend. However, it will also diminish the consumer budget, stressing out credit policy managers who think about potential delinquency.

Today’s New York Times will make you wonder how fast prices will rise.

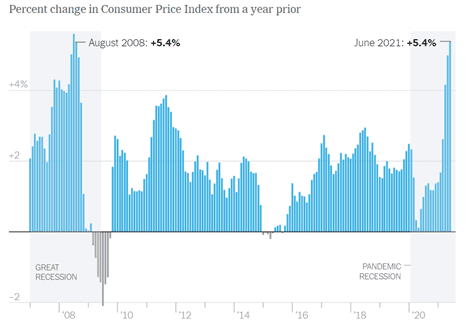

- In the United States, everyone is talking about inflation. The country’s reopening from the coronavirus pandemic has unleashed pent-up demand for everything from raw materials like lumber to secondhand goods like used cars, pushing up prices at the fastest clip in over a decade.

Follow that link, and read the first two sentences.

- A key measure of inflation spiked in June, climbing at the fastest pace in 13 years as prices for used cars, hotel stays, and restaurant meals surged while the economy reopens.

- The Consumer Price Index jumped by 5.4 percent in the year through June, the Labor Department said on Tuesday, the largest year-over-year gain since 2008 but one that is expected to fade as the economy moves past a volatile reopening period.

Hopefully inflation does fade, but don’t count on that in the short term. The following data, compiled by the NYT based on the Bureau of Labor Statistics, shows inflationary peaks and valleys. If 5.4% is indeed the peak, and things follow the course of the Great Recession, credit risk will probably not suffer.

However, if inflation continues, interest rates rise, and consumers do not have the confidence to spend again, 2022 will be a credit loss mess.

The risk is contained right now with low credit charge-offs, but there are indications that delinquency can rise. And as consumers pay more for milk, eggs, and gas, they will have less to pay their creditors. With that, they will revolve more debt, which will be subject to higher rates.

A risk manager can do little to change the “three ‘I’s” but be forewarned. As the industry tries to rebuild loan books, do not compromise credit quality. It can come back and bite you where it hurts- on operating expenses and credit losses.

Overview provided by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group