Fraud prevention and management is a key area of focus in the constantly evolving payments industry, as consumers demand personalized, tech-enabled payments experiences and fraudsters become increasingly sophisticated. To combat these sophisticated attacks, the fraud prevention industry has been forced to continuously develop advanced solutions.

Kount has emerged as a leader in the space for its artificial intelligence (AI) driven fraud prevention solutions, which protect the digital innovations of over 6,500 brands across the globe. The company’s solutions come with the tools needed to address both the common and emerging challenges brands face when it comes to fraud.

Here are just a few examples of what Kount’s solutions can help brands do to get the most out of fraud prevention:

1. Prevent account takeover fraud

Successful account takeover (ATO) fraud attacks lead to billions of dollars in losses and irreversible brand reputation damage each year as fraudsters find new ways to exploit vulnerabilities across the transaction process. For that reason, it is critically important that security measures are put in place to identify and prevent ATO fraud.

At the same time, stringent security measures and cumbersome step-up authentication processes can lower the quality of user experiences and drive customers to competitors. Therefore, companies must strike a balance between identifying and preventing ATOs and providing customers with the personalized, seamless experiences they demand.

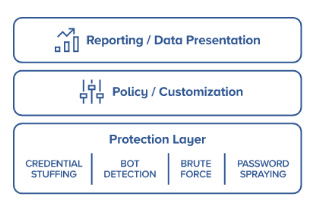

With that task in mind, Kount recently announced the industry’s first adaptive protection solution to stop account takeover fraud, Kount Control. Kount Control is a three layered solution consisting of protection, policy and customization, and reporting and data presentation.

Here’s an overview of what each layer does:

- Protection layer detects high-risk login activity such as bots, credential stuffing, and brute force attacks, which helps determine whether a login should be allowed, declined, or challenged with step-up authentication methods

- Policy/customization layer enables customizable user experiences by categorizing groups based on shared characteristics (for example, VIP users vs. free trial users)

- Reporting/data presentation layer provides login trend data not typically available to fraud teams, including device and IP information, that can serve as the basis for future fraud prevention policies

2. Establish identity trust levels

Kount Control is the only ATO solution built on Kount’s Identity Trust Global Network, which was unveiled in February 2020. The Identity Trust Global Network is a platform enabled with technological capabilities that determine identity trust.

Identity trust is the ability to establish the level of trust for each identity behind interactions including payments, account creations, and login events. Each of these interactions has an identity behind it, and each identity has a trust level that can be determined. A very high trust level indicates that the interaction is legitimate, while a very low identity trust level is a strong indicator of fraud.

By employing an identity trust platform, businesses can not only accurately flag instances of fraud, but also provide personalized, frictionless VIP experiences to consumers with high identity trust levels. Further, identity trust levels that fall between low and high can be subjected to enhanced authentication that is later reduced after a pattern of trustworthy user behavior.

The Identity Trust Global Network is a unique identity trust platform because of its sheer depth and richness of data. The platform reviews over 32 billion interactions every year, preventing fraud at every step of the customer journey. It spans across 75 industries and includes over 6,500 payment providers and customers.

3. Reduce instances of friendly fraud

Friendly fraud occurs when a customer disputes a legitimate purchase with their bank instead of requesting an exchange or return from a merchant. While friendly fraud can be done intentionally, it is more often caused by a misunderstanding, such as a consumer not realizing that a family member made a purchase on a shared card.

Though friendly fraud isn’t usually as malicious as criminal fraud, it still results in massive losses for businesses. Chargebacks and fees, double refunds, the cost of lost goods, and placement in chargeback monitoring programs can all result from instances of friendly fraud.

Friendly fraud prevention solutions are needed to reduce the number of unnecessary payment disputes and associated losses. Kount’s Friendly Fraud Prevention Solution, which features Visa’s Merchant Purchase Inquiry (VMPI) plug-in, does just that.

It allows issuing banks to request information from businesses to help cardholders recognize transactions at the time of the inquiry, preventing chargeback disputes before they happen. On average, the solution delivers a 5x return on investment.

Kount’s Digital Protection Summit

Kount will be discussing these topics and others related to payments fraud at its annual Digital Protection Summit (DPS) 2020.

In light of concerns associated with the COVID-19 pandemic, the annual event has moved virtual. The one day event will feature prominent industry leaders from companies such as GNC, Dunkin’, FraudPVP, Entertainment Benefits Group, and Kount.

Virtual sessions hosted by these leaders will provide participants with valuable information regarding the trends and best practices in the digital innovation and fraud prevention space. Topics to be covered include:

- Identity Trust Global Network, Emerging Fraud, and Security Trends

- How to Identify and Prevent Friendly Fraud

- Enabling New Revenue Channels: Omnichannel, Cross-border, and Loyalty

- Choosing your fraud prevention deployment method

Those interested in registering for the free Digital Protection Summit 2020, which will take place on Thursday, April 16, 2020, can reserve their virtual seat by filling out the sign-up sheet at https://digitalprotectionsummit.com/register.