No doubt that m-commerce represents a growing share of consumer spend. Business Insider Intelligence projects m-commerce will account for nearly 40% of US online sales by 2023, totaling $447 billion. And, Adobe estimated that 49% of holiday shopping traffic in November 2018 (including Cyber Monday) went through smartphones. Yet, conversion rates on desktop shoppers are twice that of smartphone shoppers, according to Qubit, who suggests that e-retailers need to facilitate their mobile checkout experience. The Business Insider Intelligence’s report on mobile checkout compares consumer experiences with popular e-commerce marketplaces. Surprisingly, Amazon underperformed in mobile checkout in efficiency ratings given its focus on Prime membership and consumer data, while Target ranked first in efficiency, particularly at the updating cart stage.

“So, although consumers spend more time accessing the internet on smartphones than any other device, e-tailers aren’t able to maximize that value. And considering mobile shoppers have a similar engagement rate as desktop shoppers, but the rates at which they select products and transact are lower, according to Qubit, mobile sites clearly need to improve their ability to convert — and top e-tailers have work to do.”

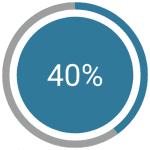

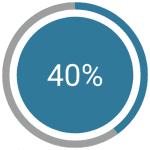

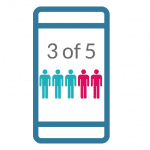

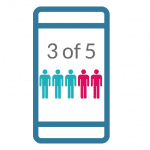

Given the nature of m-commerce and on a smaller screen, consumers welcome an easy-to-use checkout platform with shortcuts whenever possible. According to Mercator Advisory Group’s CustomerMonitor Survey Series Payments survey of June 2018, consumers, especially young adults are more likely than average to take advantage of online payment services, use merchants who keeps their cards on file when using their mobile device to pay. And, while using a Payment button with one-click checkout using payment data stored at that merchant may be near nirvana, fewer use this method. However, when they do, they are just as likely to use it by mobile as by desktop, suggesting it helps considerably in conversion. Virtual assistants also help facilitate the mobile checkout experience. In fact, our 2018 Customer Merchant Experience survey finds that half of consumers surveyed say they use virtual assistants on their smartphone and 3 in 4 of respondents who ever used virtual assistants have used them to purchase goods or services online. This study also finds nearly 3 in 5 smartphone owners reported shopping for products on their mobile device within the previous 30 days, but only 2 in 5 of them made the purchase on their phone.

The mobile checkout experience will be a topic we will explore further in our 2019 Customer Merchant Experience Survey Series

Overview by Karen Augustine, Manager, Primary Data Services