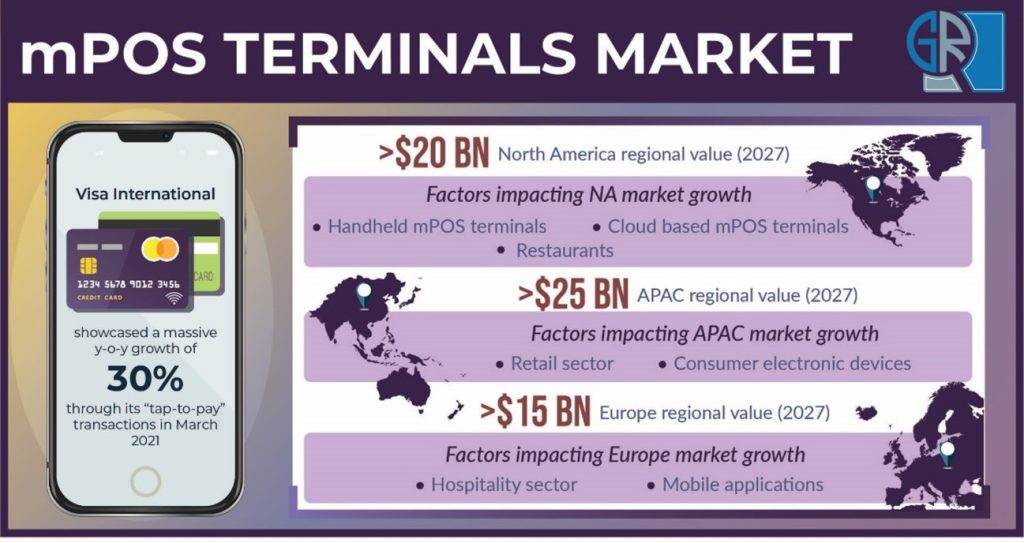

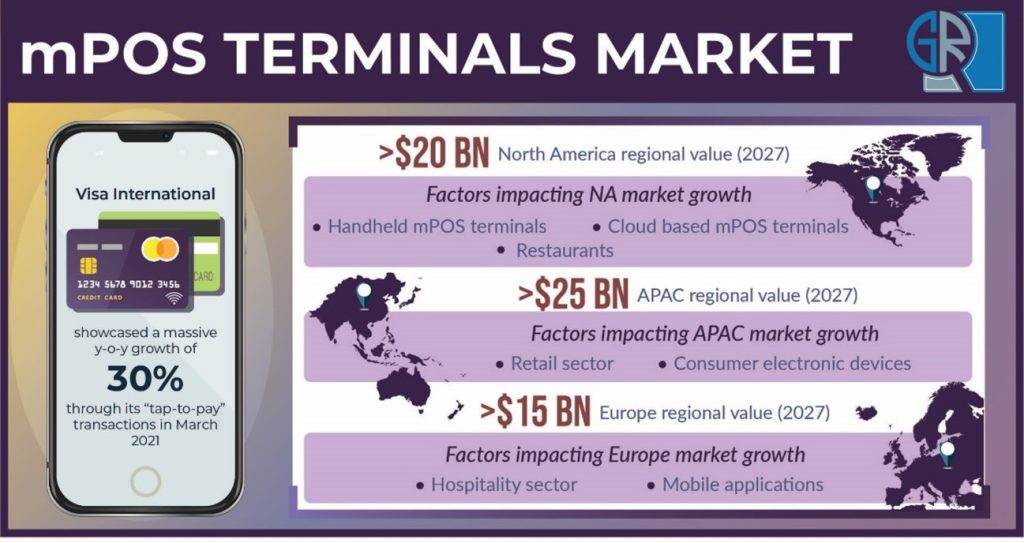

According to a recent study from market research firm Graphical Research, the global mPOS terminals market size is set to register a significant growth during the forecast timeframe, propelled by rising demand for digital payment solutions. Many countries in the developed regions are deploying advanced systems to enable customers to make online payments. The growing smartphone penetration has played an important role in increasing the number of cashless transactions. Below is a detailed list of the region-wise trends that may positively impact the industry forecast:

Europe (regional valuation likely to exceed $15 billion)

Hospitality sector to heavily use mPOS terminals:

The Europe mPOS terminals market size from the hospitality sector is set to witness a strong CAGR through 2027. One of the major reasons behind this is the initiatives taken by reputed organizations to offer reliable payment options to customers at restaurants. They are entering into various strategic partnerships and agreements to combine advanced technologies with the mPOS terminals and help hoteliers and other staff members give a unique and pleasant experience to their clients. Moreover, with the help of these technologies, it is easier to pay online due to the availability of handheld systems and a seamless checkout process, which will boost the use of mPOS terminals in the sector.

Mobile applications gain momentum among end-users:

Mobile applications are commonly found in every person’s smartphone due to the convenience they offer while carrying out any activity. Online shopping has become much easier as several companies are introducing small window-sized versions of their massive physical stores.

This scenario has notably increased the demand for mPOS terminals that are compatible with various mobile payment applications like ApplePay and Google Pay. Linking mobile apps with mPOS terminals not only fastens the entire payment process, but also reduces the burden of managing paper currencies, thereby increasing the demand for mPOS terminals.

North America (regional valuation may cross $20 billion)

Demand for handheld mPOS terminals grows:

Handheld mPOS terminals are expected to hold a significant share of the North America industry by 2027 due to the introduction of advanced software that facilitate quick and reliable payment transactions. Several organizations are planning to extend their product & service portfolios by launching the latest versions of their devices with enhanced operational capabilities.

In January 2022, Ayden N.V. unveiled an all-in-one mobile POS terminal containing the Android OS in the U.K., the U.S., and the E.U. One of the main advantages of using this device is that it does not need barcodes or separate cash registers to conduct financial transactions, which can increase the efficiency of a company. These initiatives will propel the use of handheld mPOS machines.

Cloud-based mPOS terminals gain traction:

The regional market size from cloud-based mPOS terminals will showcase an appreciable CAGR through 2027. Cloud mPOS terminals can create a safe, seamless, and secure access to tons of digital data records, which can greatly improve a customer’s experience.

Many businesses are adopting cloud mPOS terminals to help them keep a safe and accurate track of all their data files and elevate their customer’s experience by offering seamless online payment platforms, which will augment the deployment of this technology.

Restaurants may increase the use of mPOS terminals:

The restaurant application will observe a steady CAGR in the North America mPOS terminals market through 2027. A growing number of restaurant owners are using POS devices that have innovative technologies; these systems can play a key role in enhancing the productivity of restaurants and help them efficiently manage their time. With the help of smart POS devices, restaurants can track the number of orders, time taken to fulfill these orders, and the total number of transactions carried out through the day.

Asia Pacific (regional valuation likely to surpass $25 billion)

The retail sector witnesses promising growth:

The region’s retail sector is growing at a strong rate due to the rising urbanization. This has positively impacted the demand for mobile POS systems with advanced technologies. It can also have a positive influence on their customers’ shopping experience as these systems offer a quick checkout and a safe gateway for all online transactions.

Consumer electronic device sales shoot up:

The internet penetration has increased by many folds across the Asia Pacific mPOS terminals market in recent years. The number of people using online payment platforms to pay for their purchases has also tremendously grown. The high demand for an easier access to these platforms has also positively affected the sale of consumer electronic devices.

The mPOS software is being optimized for all devices to enable smoother payment transactions. Moreover, the main advantage of installing this software is that it works offline too, which makes it much easier for retailers to continue with their daily activities even if they don’t have a stable internet connection.